Quick Summary:

An Aetna claim denial occurs when the payer determines that a submitted healthcare service fails to meet eligibility, prior authorization, coding, or medical necessity requirements defined within its clinical and administrative policies. In 2026, Aetna claim denial activity is increasingly driven by automated adjudication, Clinical Policy Bulletin enforcement, and AI-based claim scoring that flags inconsistencies before manual review. Healthcare organizations must implement payer-specific eligibility verification, authorization reconciliation, and documentation aligned with policy criteria. High-performing practices reduce denial risk by monitoring denial codes, analyzing provider-level patterns, auditing expected versus actual reimbursement, and applying structured, policy-aligned appeal strategies that accelerate overturns and protect revenue performance.

Healthcare practices across the United States are facing a measurable increase in payer scrutiny, and Aetna claim denial trends are among the most operationally disruptive. In 2026, Aetna’s integration into the CVS Health ecosystem has fully matured, resulting in a data-first adjudication model that reshapes how every Aetna claim denial is triggered, reviewed, and escalated.

Denials are no longer just administrative hiccups; they are leveraged as strategic cost-containment tools embedded directly into payer workflows.

For practice administrators, billing directors, and CFOs, understanding the Aetna claim denial process, including evolving clinical policy edits, automated claim scoring, and authorization enforcement, is no longer optional. It is the foundation of revenue protection and long-term payer contract stability.

Why Aetna Claim Denials Matter More Than Ever

In the current landscape, Aetna has transitioned to High-Velocity Adjudication. This model uses AI-driven smart edits to flag claims for medical necessity before they ever reach a human reviewer, significantly increasing the likelihood of an Aetna claim denial when documentation or coding elements are incomplete. A single missing data point can trigger a cascade of rejections across an entire patient’s episode of care, making the Aetna claim denial process faster and more automated than in previous years.

For a mid-sized practice, a mere 8% increase in Aetna denials can result in a 15% decrease in monthly liquid cash flow. This creates a resource trap where staff spend up to 40% of their time reworking old claims. Furthermore, Aetna now utilizes Provider Transparency Scorecards, which closely monitor every Aetna claim denial and measure clean claim performance against regional benchmarks.

These digital report cards track denial rates as a primary metric for contract renewals. If your clean claim rate (CCR) falls below specific thresholds, you lose leverage during rate negotiations, potentially locking your practice into lower-tier reimbursement schedules for years.

How Aetna Processes Claims Behind the Scenes

The Aetna adjudication engine, often referred to as their NextGen platform, uses a sophisticated multi-layered gatekeeping system designed to catch errors early, which significantly increases the likelihood of an Aetna claim denial when documentation, authorization, or coding elements do not meet payer criteria.

💡 Pro-Tip: Reverse-Engineer the CPB Scrubber

Aetna’s "NextGen" scrubber doesn't just look for a CPT/ICD-10 match; it checks for minimum documentation duration. For services like Behavioral Health or Physical Therapy, the AI extracts "Time In/Time Out" strings from your notes.

- Front-End Gateway: Coordination of Benefits (COB) logic is extremely aggressive in 2026. If Aetna’s database shows a patient had a secondary insurer years ago, they will auto-deny the claim (CO-16) until the patient updates their file.

- The Clinical Policy Engine (CPB): Aetna’s Clinical Policy Bulletins are the "bible" of their medical necessity. In 2026, these are integrated directly into the claims scrubber. If a CPT code for a specialty injection is submitted without the specific secondary ICD-10 code required by the CPB, the claim is diverted to a manual queue or auto-denied.

- Utilization Management Review: High-cost services now face "Site of Care" edits. Aetna may deny a hospital-based procedure if an independent diagnostic testing facility (IDTF) was available at a lower cost nearby.

- Automated Bundling: Aetna utilizes proprietary versions of NCCI edits, frequently applying "Black Box" logic where "Incident To" services are bundled even if Medicare would allow separate payment.

Most Common Aetna Denial Categories

Aetna’s application of standard codes is unique, and understanding the nuance behind each code is critical for resolving an Aetna claim denial effectively and building a reliable fix strategy.

| Denial Category | Example Code | 2026 Root Cause | Advanced Fix Strategy |

|---|---|---|---|

| Eligibility | CO-16 / CO-22 | COB mismatch or outdated patient data. | 24-hour "pre-flight" eligibility check via Availity. |

| Bundling | CO-45 / CO-97 | Proprietary edits or NCCI unbundling. | Modifier validation (e.g., -59 or -X{EPSU}). |

| Medical Necessity | CO-50 | Lack of "Step-Therapy" evidence in notes. | Attach a "Clinical Summary" to the initial claim. |

| Authorization | CO-197 | Coding variance from the original auth. | Post-op "auth-to-claim" reconciliation workflow. |

| Coding Mismatch | CO-11 | Diagnosis not supporting procedure intensity. | Scrub for Aetna-specific LCD/NCD rules. |

Aetna Denial Codes List Providers Must Monitor

Understanding Aetna denial codes is essential for identifying whether a claim failure is administrative, clinical, or policy-driven. High-performing revenue cycle teams maintain a mapped denial code library that connects each code to a specific correction workflow.

Key Aetna denial codes providers should monitor include:

- CO-16— Eligibility or coordination of benefits discrepancies that require patient data verification

- CO-22 — Duplicate or overlapping coverage conflicts that trigger payer coordination review

- CO-45 / CO-97 — Bundling edits related to proprietary or NCCI logic requiring modifier validation

- CO-50 — Medical necessity denials tied to insufficient clinical documentation

- CO-197 — Prior authorization mismatch between approved service and submitted claim

- CO-11 — Diagnosis and procedure intensity mismatch requiring documentation refinement

Tracking these denial codes at the provider, specialty, and location level helps identify systemic workflow gaps before denial volume escalates.

Aetna Medical Necessity Denial Examples

Aetna medical necessity denials typically occur when clinical documentation fails to demonstrate progression, treatment history, or alignment with Clinical Policy Bulletin criteria rather than incorrect coding alone.

Common medical necessity denial scenarios include:

- Therapy visits lacking measurable functional improvement documentation

• Imaging requests missing conservative care history

• Pain management procedures without step therapy evidence

• Behavioral health encounters lacking updated treatment plans

• Repeat procedures submitted without documented clinical change

Embedding payer language into provider templates ensures documentation reflects the decision logic used during Aetna review.

Aetna Prior Authorization Denial Workflow

Prior authorization denials frequently result from timing discrepancies, code variance, or site-of-care conflicts. Aetna systems compare authorization details directly with claim submission, meaning small differences can trigger denial.

An effective prior authorization denial workflow includes:

- Pre-service authorization verification and benefit confirmation

- Real-time monitoring of authorization status before service delivery

- Authorization-to-claim reconciliation after procedure completion

- Documentation updates when clinical circumstances change

- Escalation protocols for retro-authorization review when appropriate

Organizations that standardize this workflow significantly reduce preventable authorization denials.

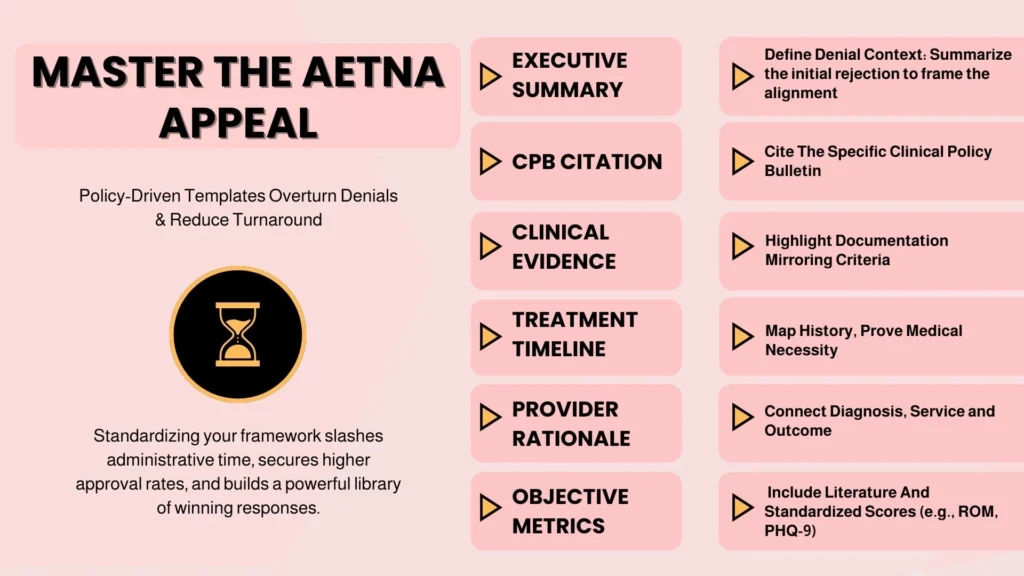

Aetna Claim Appeal Template Strategy

Appeals succeed when they demonstrate policy alignment rather than generalized justification. Structured appeal templates create consistency and improve overturn rates across denial categories.

A strong Aetna appeal template typically contains:

• Clear appeal summary explaining the denial context

• Citation of the relevant Clinical Policy Bulletin

• Highlighted clinical documentation supporting criteria

• Treatment timeline demonstrating medical necessity

• Provider rationale connecting diagnosis, service, and outcome

• Supporting literature or objective measures when required

Standardized appeal frameworks reduce turnaround time, improve approval consistency, and strengthen institutional payer intelligence.

What Aetna Denial Rates Reveal About Practice Revenue

A high denial rate is often a canary in the coal mine for clinical documentation gaps. If therapy departments see a spike in CO-119, Benefit maximum reached, it indicates that front-end teams are not tracking Aetna’s Benefit Periods, which often do not align with the calendar year. These patterns frequently surface through repeated Aetna claim denial activity tied to utilization limits rather than coding errors.

Furthermore, Aetna has introduced Predictive Claim Scoring. If your practice’s billing patterns deviate by more than 20% from your regional Peer Group, for example, billing more Level 4 E/M codes than other specialists in your zip code, Aetna’s AI triggers a Pre-Payment Audit that can significantly increase the volume of Aetna claim denial reviews for that provider.

This can hold all claims from that provider for 60 to 90 days. Tracking these metrics allows a CFO to identify whether recurring Aetna claim denial trends signal that the practice is being profiled by Aetna’s algorithms before a full-scale audit begins.

Eligibility Volatility & The 2026 Patient Responsibility Gap

As of 2026, eligibility denials have spiked due to ACA subsidy expirations and the continued "churn" of Medicaid redeterminations. This has moved the "denial" from the payer to the patient's wallet, creating a surge in bad debt.

- Real-Time Eligibility (RTE) 2.0: Simply checking if a patient is "active" is no longer enough. High-performing practices now use RTE tools to pull remaining deductible data in real-time. In 2026, individual plan deductibles of $2,000+ are the norm for 34% of the workforce.

- The "Credit Decisioning" Workflow: To prevent denials related to "non-covered services" or "terminated coverage," practices are adopting predictive analytics at the front desk. If a patient’s Aetna plan shows a history of COB issues, the system prompts the front desk to collect a pre-service deposit.

- Strategic Charity Care: Some CFOs are now using Charity Care Tradeoff Analysis. By identifying patients whose Aetna plans have extremely high deductibles that will likely result in an Aetna claim denial and subsequent bad debt, they proactively move them to charity programs to reduce the cost to collect, which can exceed $25 per denied claim.

The Aetna Claim Denial Process Explained Step-by-Step

When an Aetna claim denial appears on the ERA, Electronic Remittance Advice, a structured remediation pathway is required to identify the root cause, gather documentation, and initiate timely correction or appeal.

- Triage: Separate "Administrative" (missing info) from "Clinical" (medical necessity) denials.

- Evidence Gathering: For Aetna, a standard appeal letter is insufficient. High-performing teams use a "Clinical Packet" approach. This includes the Aetna CPB number on the cover sheet, with patient records highlighted where they meet the specific policy criteria.

- The Peer-to-Peer Bridge: If a clinical appeal is denied, request a Peer-to-Peer call within 5 business days. Success depends on the provider having both the patient's chart and the specific Aetna CPB on hand during the call.

- Escalation: If two internal appeals fail, move to an External Independent Review. Approximately 40% of external reviews result in an overturn because Aetna often prefers to settle rather than defend a denial against an independent medical body.

Root Causes Behind Recurring Aetna Claim Denials

The most toxic root cause in 2026 is "Authorization Lag." Aetna’s systems now time-stamp authorizations. If a surgery starts at 8:00 AM but the authorization wasn't secured until 2:00 PM, they will deny the claim and often refuse a retro-authorization.

Another hidden root cause is "Modifier Misalignment." Aetna is increasingly sensitive to Modifier -25. If a provider performs a procedure and an E/M on the same day, Aetna auto-denies the E/M unless there are two distinct notes in the EHR.

💡 Pro-Tip: The "Two-Header" Documentation Rule

Aetna’s 2026 AI scoring engine now automatically flags Modifier -25 claims for a "documentation mismatch" if they are uploaded as a single PDF.

High-performing practices fix this by templating their EHR to bifurcate the documentation automatically, ensuring a separate "Procedure Note" and "Progress Note" exist for every visit.

How High-Performing Practices Prevent Aetna Denials

Prevention has shifted toward "Payer-Specific Scrubbing." Standard software uses generic rules, but top-tier practices use custom edits for Aetna.

- Front-End Controls: Same-day eligibility verification and benefit category confirmation.

- Prospective Documentation Reviews: Auditors review 5–10 "Aetna-heavy" charts per week before claims are dropped. They look for "buzzwords" the AI searches for—terms like "functional improvement," "refractory to standard care," or "failure of conservative therapy."

- Claim Scrub Rules: Identifying missing elements like the specific GT vs. 95 modifiers for telehealth before submission.

Appeal Strategies That Work With Aetna

To win an appeal against Aetna in 2026, you must speak their language. The Policy Alignment Strategy is the gold standard for overturning an Aetna claim denial and demonstrating clear alignment with payer clinical policy requirements:

- Reference the CPB: Start every appeal with: "According to Aetna CPB #0XXX, this service is covered when criteria A, B, and C are met. Attached records demonstrate the patient met criteria A on [Date]..."

- Identify the "Fatal Flaw": If denied for "Experimental/Investigational," provide a one-page summary showing how the patient's specific history mirrors successful peer-reviewed studies.

- Adherence to Timelines: Aetna typically allows 180 days for a first-level appeal, but "Reconsiderations" often must be filed within 60 days to be effective.

Specialty-Specific Aetna Claim Denial Patterns

Aetna applies different scrutiny levels across specialties:

💡 Pro-Tip: Bypass the "IDTF Preference" Denial

Aetna’s 2026 "Site of Care" edits often auto-deny hospital-based imaging or surgery in favor of lower-cost settings.

- Orthopedics: Focus on "Viscosupplementation" frequency. Denials often trigger if injections are given 179 days apart instead of the required 181.

- Behavioral Health: Shift toward "Episode-Based Audits." Aetna searches for a "Treatment Plan" showing a decrease in acuity. Static documentation for long-term patients will trigger "Medical Necessity" denials.

- Radiology: Site-of-service edits are the main target. Hospital-based MRIs are frequently denied if an independent center was available nearby.

The "Silent" Denial: Aetna’s 2026 Level of Severity Policy

In January 2026, Aetna implemented a pivotal shift in inpatient reimbursement known as the "Level of Severity" Policy. This is often called a "silent denial" because the claim is technically approved, but the payment is downgraded to a lower-tier rate (comparable to observation) without a standard denial code.

- The Mechanism: Stays lasting between one and four midnights are now subject to severity reviews using Milliman Care Guidelines (MCG). If the clinical data doesn't meet Aetna’s proprietary "High Severity" threshold, the claim is downcoded automatically.

- The Operational Risk: Because these don't trigger traditional COB or medical necessity denial codes, they often bypass standard AR follow-up queues.

- The Fix: Practices must implement "Expected vs. Actual" payment auditing. If an inpatient DRG is paid at an observation rate, it must be flagged for a pre-claim challenge. Aetna now allows a 48-hour window to submit additional clinical evidence (like newly initiated mechanical ventilation or unexpected clinical complications) before the lower payment is finalized.

Metrics High-Performing Practices Track

CFO-level insight comes from correlating denial categories with revenue delay. Key metrics include:

- The "Hidden Denial Rate": Claims pended for "More Information" (these delay cash without being officially denied).

- Provider-Level Denial Mapping: Identifying which doctor causes the most documentation-related denials.

- The "Overturn Velocity": The number of days from denial to payment. If this exceeds 45 days, your appeal process is inefficient.

- Payer Yield: Actual vs. Expected reimbursement. This catches "silent" denials where Aetna pays a Level 4 E/M at a Level 3 rate.

How Pro-MBS Reduces Aetna Claim Denials

Pro-MBS approaches denial management as a payer behavior analysis function. We move beyond simple claim correction to provide:

- Denial Trend Dashboards: Identifying the specific root causes by provider and location.

- Appeal Template Libraries: Pre-aligned with Aetna’s 2026 Clinical Policy Bulletins.

- AR Escalation Protocols: Direct pathways to Payer Relations for systemic issues.

By shifting from reactive billing to intelligence-driven revenue cycle management, healthcare organizations can reduce revenue leakage and ensure long-term stability in an increasingly complex payer environment.

Frequently Asked Questions

What is an Aetna claim denial in medical billing?

An Aetna claim denial occurs when the payer determines that a submitted healthcare service does not meet eligibility, authorization, coding, or medical necessity requirements. These denials may be administrative or clinical and often require documentation review, claim correction, or a formal appeal before reimbursement can occur.

Why does Aetna deny claims so frequently?

Aetna claim denials commonly result from missing prior authorization, documentation gaps, diagnosis and procedure mismatches, and coordination of benefits issues. Aetna has expanded automated claim scoring and clinical policy enforcement, which increases denial frequency even when coding appears technically correct.

What are the most common Aetna denial codes providers see?

The most common Aetna denial codes include CO-16 for eligibility issues, CO-45 for bundling edits, CO-50 for medical necessity, CO-197 for authorization failures, and CO-11 for diagnosis and procedure mismatches. Each category requires a different correction workflow rather than simple resubmission.

How can practices prevent recurring Aetna claim denials?

Preventing an Aetna claim denial requires payer-specific workflows such as real-time eligibility verification, authorization tracking, documentation prompts aligned with clinical policy bulletins, and claim scrub rules that validate modifier usage before submission. Denial analytics help identify root causes early.

What is the Aetna claim denial appeal process?

The Aetna claim denial appeal process typically includes reconsideration, formal appeal submission, clinical documentation review, and peer-to-peer discussion when medical necessity is disputed. Referencing the relevant clinical policy bulletin and meeting deadlines improves overturn rates.

How long does Aetna take to overturn denied claims?

Aetna appeal timelines vary by denial category. Reconsiderations may resolve within 15 to 30 days, while clinical appeals can take 30 to 60 days or longer. Complex cases involving peer review or external independent review may extend beyond 90 days and affect cash flow.

What documentation supports Aetna medical necessity appeals?

Successful Aetna claim denial appeals require provider notes, diagnostic results, treatment history, conservative care attempts, and policy-aligned clinical rationale. Highlighting where documentation meets Aetna Clinical Policy Bulletin criteria improves approval probability.

How do Aetna denial patterns vary by specialty?

Aetna claim denial patterns differ across specialties. Therapy services face utilization limits, radiology encounters site-of-care edits, pain management requires stronger procedural justification, and behavioral health claims undergo episode-based review focused on measurable progress.

What is a silent denial from Aetna?

A silent denial occurs when Aetna approves a claim but reduces payment, such as downcoding inpatient severity or lowering evaluation and management levels. These payment variances do not always generate standard denial codes, making expected versus actual reimbursement tracking essential.

When should a practice outsource Aetna denial management?

Practices should consider external Aetna claim denial support when denial rates exceed benchmarks, appeals backlog increases, AR aging worsens, or documentation-related denials persist. Specialized teams provide payer intelligence, structured appeals, and workflow optimization to stabilize revenue.