Introduction

In the complex world of medical Billing and Coding, understanding how to correctly assign the type 2 diabetes ICD 10 code E11.9 is essential for both compliance and revenue cycle success. This code, which denotes type 2 diabetes mellitus without complications, is among the most frequently used diabetes ICD 10 codes in primary care. Despite its routine use, many providers still face claim denials due to documentation gaps and misapplication.

This guide will help you understand what ICD 10 code E11.9 means, how to use it accurately, common payer pitfalls, and documentation strategies that ensure your claims are clean and audit-proof.

Understanding the type 2 diabetes ICD 10 Code Without Complications

The type 2 diabetes ICD 10 code E11.9 represents Type 2 Diabetes Mellitus Without Complications. It’s used when a patient has type 2 diabetes but does not have any documented complications such as retinopathy, neuropathy, nephropathy, or ketoacidosis.

Code Breakdown

- E11 refers to type 2 diabetes mellitus

- .9 means no complications are documented

The ICD 10 Code type 2 diabetes E11.9 is typically used for patients who are managing their diabetes through diet, oral medication, insulin, or a combination thereof but do not currently experience any adverse health effects related to their condition.

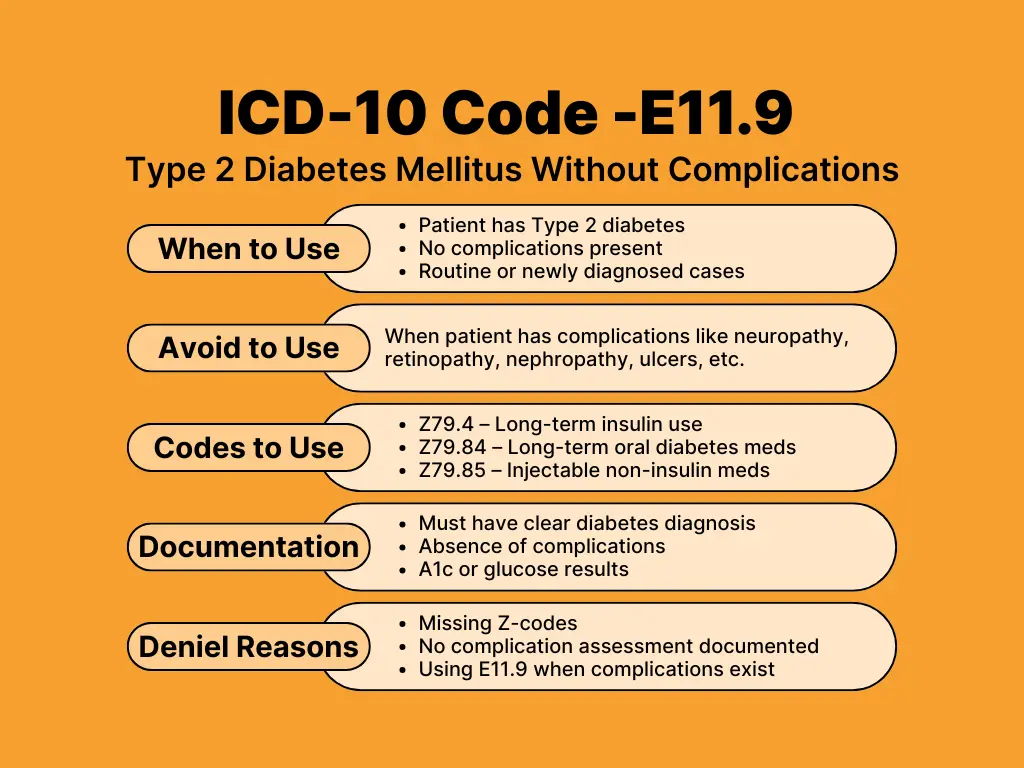

When to Use the type 2 diabetes ICD 10 Code E11.9

Use the type 2 diabetes ICD 10 code E11.9 only when the following are true:

- The patient has a diagnosed case of type 2 diabetes

- There is no evidence of complications (nephropathy, retinopathy, foot ulcers, etc.)

- The condition is either newly diagnosed or under stable, routine management

Example:

A 58-year-old patient returns for routine follow-up of type 2 diabetes. Their A1c is 6.9%, and they are currently taking metformin. No symptoms of complications are noted. This scenario supports using the ICD 10 code for type 2 diabetes E11.9.

Essential Supporting Codes for type 2 diabetes ICD 10 E11.9

To ensure your billing is complete, certain Z-codes should accompany the type 2 diabetes ICD 10 code E11.9, depending on the patient’s therapy:

- Z79.4 - Long-term (current) use of insulin

- Z79.84 - Long-term use of oral hypoglycemic drugs

- Z79.85 - Long-term use of injectable non-insulin diabetes medications

These Z-codes provide clarity on the patient’s treatment plan and often influence payer decisions for reimbursement.

Documentation Requirements for the type 2 diabetes ICD 10 Code E11.9

Proper documentation is the cornerstone of accurate coding. Incomplete or vague charting is a leading cause of claim denials for type 2 diabetes ICD 10 codes.

To justify the type 2 diabetes ICD 10 code E11.9:

- Clearly state the diagnosis: Type 2 diabetes mellitus

- Specify the absence of complications

- Include blood glucose or HbA1c test results if available

- Mention current treatment (e.g., diet, metformin, insulin)

Apply the MEAT Principle

For 2026 compliance, ensure your notes cover these four areas:

- Monitoring: A1c checks, glucose monitoring.

- Evaluating: Reviewing test results.

- Assessing: Clinical notes on stability.

- Treating: Lifestyle advice, prescriptions.

Sample Documentation Note:

Patient with type 2 diabetes ICD 10 (E11.9), well controlled with metformin 1000 mg BID. Most recent A1c is 6.7%. No signs of retinopathy, nephropathy, or neuropathy.

Avoiding Common Payer Mistakes for type 2 diabetes ICD 10 Claims

Even if your coding is technically correct, claims involving the type 2 diabetes ICD 10 code E11.9 can still be denied due to common payer pitfalls. Here are a few to watch for in 2026 and how to avoid them:

Missing Treatment Codes (Z-Codes)

When submitting a claim with a diagnosis like type 2 diabetes ICD 10 (E11.9), forgetting to include relevant Z-codes such as Z79.4 (long-term use of insulin) or Z79.84 (long-term use of oral hypoglycemic drugs) can result in the claim being flagged for incomplete treatment details. It’s crucial to always document and report applicable Z-codes that reflect the patient’s ongoing medication regimen.

Assumed Absence of Complications

Claims are sometimes denied because payers assume there are no complications if the documentation doesn’t clearly confirm that complications were evaluated. To avoid this, your clinical notes must explicitly show that you assessed for potential complications and either confirmed or ruled them out. Clear documentation is key to supporting your type 2 diabetes ICD 10 diagnosis and treatment plan.

Overuse of type 2 diabetes ICD 10 Code E11.9

Some providers default to using the type 2 diabetes ICD 10 code E11.9 even when the patient has documented complications. This can result in inaccurate coding and denied claims. If your documentation includes signs of complications such as diabetic foot ulcers or retinopathy noted during eye exams, then a more specific diabetes code must be used. Avoid using E11.9 in cases where complications are present.

No Clinical Justification for Continued Therapy

When patients are prescribed insulin or other diabetes medications, the claim must include documentation explaining why the therapy is necessary. If there's no supporting information, such as lab results or progress notes, the claim may be denied due to lack of medical necessity. Always document the rationale for continued treatment under the type 2 diabetes ICD 10 umbrella, including test results like A1c levels and other clinical indicators.

Optimizing the type 2 diabetes ICD 10 Workflow with EHR Systems

Electronic Health Records (EHRs) with coding assistance can minimize manual errors. These systems often flag missing Z-codes or alert providers when complications are mentioned elsewhere in the chart. In 2026, many advanced EHR platforms also include specific decision support for the new "remission" status (E11.A), helping you distinguish it from the standard type 2 diabetes ICD 10 code E11.9.

However, don’t rely solely on automation. Review your diagnosis codes regularly and educate your clinical team to ensure the documentation matches the high level of specificity required for modern compliance.

Stay Updated with type 2 diabetes ICD 10 Guidelines in 2026

Every year, ICD 10 codes are reviewed and updated to reflect changes in medical understanding and healthcare regulations. As of 2026, the E11.9 code remains a valid type 2 diabetes ICD 10 code for Type 2 diabetes mellitus without complications. However, healthcare providers and billers should always consult the most recent CMS ICD 10 updates to ensure compliance. Updated coding guidelines help maintain accuracy in claims submission and reduce the risk of denials.

Key Updates to Watch For

Some of the critical updates to monitor in 2026 include new documentation standards implemented by leading payers such as Medicare, UnitedHealthcare, and Aetna. These updates often affect how providers must record diagnosis and treatment details in their clinical notes.

A major shift for 2026 is the introduction of code E11.A, which specifically identifies Type 2 diabetes mellitus in remission. This requires clinical documentation of normal A1c levels (below 6.5%) for at least three months without glucose-lowering medication.

Additionally, changes to the ICD-10-CM Official Guidelines for Coding and Reporting may alter code selection or sequencing requirements. There is also a growing emphasis on documentation integrity under value-based care models, meaning payers will scrutinize how thoroughly complications are ruled out and treatment decisions are supported by clinical data.

Tips to Maximize Reimbursement for type 2 diabetes ICD 10

Properly billing the type 2 diabetes ICD 10 code E11.9 does more than prevent claim denials; it ensures full and timely reimbursement. Clinics that follow best practices when coding diabetes diagnoses tend to experience fewer rejections and smoother revenue cycles in 2026. Several steps can help providers consistently get paid for diabetes care services without unnecessary administrative delays.

Best Practices for 2026

- Chart Review: Start by carefully reviewing each patient’s chart to verify that there are no complications that would require a different code.

- Precise Z-Codes: When applicable, include precise Z-codes that indicate how the condition is being managed, such as with insulin (Z79.4) or oral medications (Z79.84).

- Staff Training: Training providers to meet 2026 documentation standards - including the new distinction for "remission" (E11.A) - is equally important and ensures consistency across the care team.

- Internal Audits: Internal chart audits can help identify common coding or documentation mistakes before they lead to payer audits.

- Workflow Integration: Lastly, make sure your coding process is well integrated with your clinical workflow to minimize errors and maintain efficiency.

Why Accurate type 2 diabetes ICD 10 Coding Matters

Using the correct type 2 diabetes ICD 10 code, especially E11.9, has implications that go beyond billing. Accurate coding directly affects patient care quality, health tracking across populations, and outcomes-based reimbursement. Many commercial and government payers, including Medicare Advantage plans, now require evidence such as A1c levels and treatment types to justify reimbursement in 2026.

When you code type 2 diabetes ICD 10 E11.9 correctly, your clinic benefits in multiple ways:

- Audit Risk Reduction: It reduces the chance of audits by providing a clear clinical picture.

- Patient Care: It ensures patients receive timely and appropriate care based on their specific health status.

- Healthcare Initiatives: It supports larger initiatives like value-based care and population health management.

- Payer Relationships: Consistently accurate coding fosters stronger relationships with payers by demonstrating compliance and clinical integrity.

Final Thoughts on Using the type 2 diabetes ICD 10 Code E11.9

On the surface, billing the type 2 diabetes ICD 10 code E11.9 may seem like a routine task, but in practice, it demands attention to detail and strict documentation. In 2026, many claim denials can still be traced back to errors such as assuming the absence of complications without evidence or neglecting to include essential Z-codes.

To ensure clean claims:

- Use the type 2 diabetes ICD 10 code E11.9 only when no complications are present.

- Support the diagnosis with treatment-related Z-codes (like Z79.4 or Z79.84).

- Stay current with annual ICD 10 updates, especially the new 2026 guidelines for remission.

- Apply the MEAT criteria for all clinical documentation.

- Perform regular audits to catch potential issues early.

When these best practices are followed, type 2 diabetes icd 10 billing becomes a reliable and efficient part of your revenue cycle. By taking a proactive approach, your practice can improve compliance, streamline payments, and ultimately enhance patient care.

Frequently Asked Questions

How do I document Type 2 diabetes without complications using E11.9?

To accurately use the type 2 diabetes icd 10 code E11.9, explicitly state the absence of complications like neuropathy or retinopathy. Use the MEAT principle - Monitoring, Evaluating, Assessing, and Treating - to show clinical depth. Payers require proof that you actively ruled out complications rather than just leaving the record blank.

Which Z-codes must accompany the E11.9 diagnosis for accurate billing?

Include specific Z-codes to justify the patient's treatment plan. Use Z79.4 for insulin, Z79.84 for oral hypoglycemics like metformin, or Z79.85 for injectable non-insulin medications. These codes provide the "medical necessity" required for 2026 reimbursement, ensuring the payer understands the full scope of the patient’s ongoing management.

Can I use E11.9 if a patient is in diabetes remission?

No. In 2026, you must use code E11.A for Type 2 diabetes in remission. This applies when a patient maintains an HbA1c below 6.5% for at least three months without glucose-lowering medication. Switching from the standard type 2 diabetes icd 10 code E11.9 to E11.A ensures clinical and regulatory accuracy.

What is the difference between E11.9 and E11.8 in ICD 10 coding?

Use type 2 diabetes icd 10 code E11.9 only when no complications exist. Code E11.8 denotes "unspecified complications," which often triggers payer audits due to lack of specificity. To ensure clean claims, always document specific complications or explicitly confirm their absence by using the more precise E11.9 code.

Why do payers deny claims for the E11.9 diabetes code?

Denials often occur when documentation fails to support the code. Common errors include omitting A1c results, failing to include medication Z-codes, or contradictory notes—such as mentioning a foot ulcer while using the type 2 diabetes icd 10 "no complications" code. Regular audits ensure your clinical findings and codes align perfectly.