Introduction

Credentialing is not just a regulatory requirement, it’s the financial gateway between clinical services and payer reimbursement. In today’s payer-governed healthcare environment, providers cannot bill or receive payment until they are fully credentialed and enrolled with each payer. This process involves verifying licenses, certifications, malpractice history, exclusions, and submitting applications through platforms like CAQH, PECOS, and payer-specific portals. When mishandled, credentialing delays can freeze revenue, result in denied claims, and introduce compliance risk regardless of the provider’s qualifications or experience.

Yet many practices still treat credentialing as an afterthought. Without structured workflows, submission tracking, and a system for managing expiring documents or re-credentialing deadlines, even well-run organizations experience onboarding bottlenecks and cash flow disruptions. Whether you’re scaling to new states, adding specialists, or preparing to join Medicare Advantage networks, credentialing must be integrated into your operational and revenue cycle strategy from day one.

Credentialing vs. Enrollment: What’s the Difference?

Credentialing is the structured process of verifying a healthcare provider’s professional qualifications including medical education, postgraduate training, licensure, board certification, work history, malpractice coverage, and any sanctions or disciplinary actions. This validation ensures the provider meets clinical and regulatory standards required by accrediting bodies and payers.

Enrollment, on the other hand, is the administrative process of submitting approved credentialing data to insurance payers to establish the provider’s billing and reimbursement privileges. While many commercial insurers integrate credentialing and enrollment, government payers like Medicare and Medicaid maintain separate workflows requiring enrollment through systems such as PECOS (Provider Enrollment, Chain, and Ownership System) or state-specific portals. Commercial carriers may leverage CAQH ProView for credentialing, but still require direct contracting and payer-specific enrollment steps to finalize participation.

Why Credentialing Directly Impacts Reimbursement and Compliance

Credentialing is not merely administrative, it is a regulatory and financial prerequisite that directly affects a provider’s ability to generate revenue, maintain compliance, and operate efficiently.

- Reimbursement Eligibility

Uncredentialed providers cannot legally submit claims to payers. Most commercial and government payers reject claims submitted before formal enrollment, and retroactive billing if permitted requires prior authorization and strict adherence to deadlines. Delays in credentialing often result in revenue loss that cannot be recovered. - Regulatory and Legal Compliance

Billing for services under another provider’s NPI or submitting claims before enrollment constitutes a violation of CMS guidelines and payer contracts. Under Medicare’s program integrity rules, this is considered fraudulent billing and may trigger audits, recoupments, or civil penalties. - Network Participation and Patient Access

Credentialed providers are eligible for inclusion in payer networks. This status improves a provider’s visibility in insurer directories, increases patient access, and reduces out-of-network denials ultimately improving cash flow and patient retention. - Operational Efficiency and Revenue Predictability

Credentialing delays disrupt onboarding workflows, slow down revenue cycles, and create administrative bottlenecks. A structured credentialing process improves provider onboarding, shortens time-to-bill, and supports predictable revenue generation across the organization.

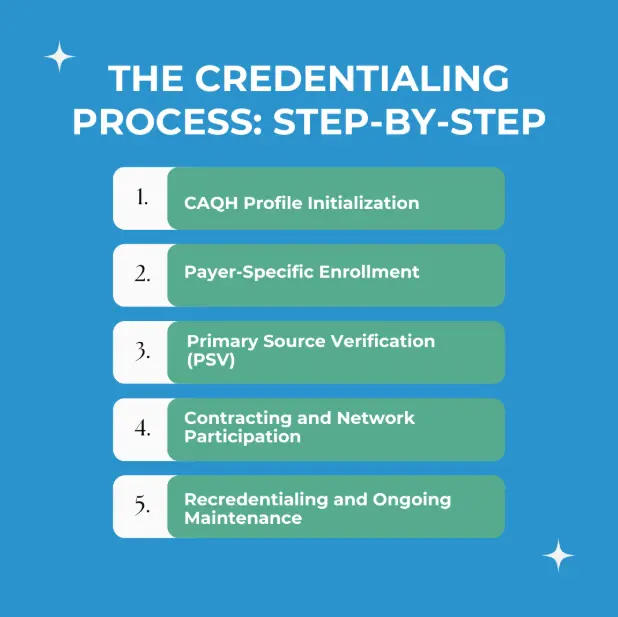

The Credentialing Process: Step-by-Step

Step 1: CAQH Profile Initialization

Most commercial insurers leverage the CAQH ProView system as the central repository for provider credentialing.

- Providers must complete their CAQH profile, upload all required documents (e.g., licenses, malpractice insurance, board certifications), and attest to data accuracy.

- Re-attestation is mandatory every 120 days, and failure to do so can suspend payer access to profile data, delaying credentialing.

Step 2: Primary Source Verification (PSV)

Payers are required to validate provider qualifications through direct source verification, as per NCQA and URAC standards. This includes:

- State medical licensing boards

- Medical schools and graduate training institutions

- DEA registration and controlled substance authority

- National Practitioner Data Bank (NPDB) for disciplinary actions or malpractice history

- OIG Exclusion List and System for Award Management (SAM) for federal sanctions

Primary Source Verification (PSV) timelines can range from 30 to 90 days, depending on the responsiveness of credentialing sources. Overall, Medicare PECOS enrollment typically takes 41–55 days, while commercial payer credentialing averages 60 to 180 days, influenced by application accuracy and insurer processing speed.

Step 3: Payer-Specific Enrollment

Credentialing alone does not authorize billing. Providers must separately enroll with each payer to gain reimbursement privileges:

- Medicare requires enrollment through PECOS, now using a consolidated CMS-855I form (for individual enrollment) and CMS-855R (for reassignment).

- Medicaid enrollment is state-specific, with variations in form type (electronic vs. paper), portal access, and required disclosures.

- Commercial carriers require distinct contracts and credentialing packets, often in tandem with CAQH data pulls.

Step 4: Contracting and Network Participation

Upon approval, payers issue a participation agreement outlining:

- Reimbursement terms (fee schedule, billing protocols)

- Network status (e.g., in-network effective date)

- Obligations related to coding, documentation, and audit compliance

A provider achieves “in-network” status only after executing and receiving countersigned agreements.

Step 5: Recredentialing and Ongoing Maintenance

- Commercial payers typically require recredentialing every 2–3 years.

- Medicare revalidation is mandated every 5 years (or every 3 for DMEPOS suppliers).

- Providers must proactively update:

- Licenses and DEA renewals

- Liability insurance certificates

- CAQH attestations and contact details

Failure to maintain an active credentialing file can result in claim denials, delisting from networks, or retroactive overpayment audits.

Common Credentialing Mistakes and Their Impact

| Mistake | Impact |

|---|---|

| Incomplete CAQH or expired documents | Application delays or denials |

| Submitting claims before credentialing is approved | Rejected claims and lost revenue |

| Missed recredentialing deadlines | Suspension from payer networks |

| Untracked license or malpractice renewals | Compliance violations and audit risks |

| Assuming retroactive billing is allowed | Financial loss due to denied claims |

How Credentialing Impacts the Revenue Cycle

Credentialing affects billing eligibility, payer reimbursements, and onboarding timelines. Without proper credentialing:

- Clean claims will still be denied

- New providers cannot generate revenue

- Practices may need to write off large volumes of unbillable care

- Cash flow becomes inconsistent

A reliable credentialing system supports a stronger, more predictable revenue cycle.

In-House vs. Outsourced Credentialing

In-House Credentialing

Some large practices manage credentialing internally through a dedicated team. This approach requires:

- Familiarity with CAQH, PECOS, and state-specific systems

- Deadline tracking

- Document management and recredentialing schedules

- Time to communicate with multiple payers

This method offers control but comes with administrative overhead and risk of human error.

Outsourced Credentialing

Outsourcing credentialing to an experienced team ensures:

- Faster processing due to payer familiarity

- Real-time updates on credentialing status

- Tracking of licenses, insurance, and CAQH attestations

- Fewer denials caused by credentialing errors

- Reduced administrative burden on your staff

For most growing or multi-state practices, outsourcing brings consistency and peace of mind.

What to Look for in a Credentialing Partner

A strong credentialing partner should offer:

- Experience with Medicare, Medicaid, and commercial payers

- CAQH, PECOS, and payer portal management

- Expiration tracking for licenses and malpractice insurance

- Automated recredentialing reminders

- Audit-ready documentation and reporting

- Integration with your EHR and billing system

Why Providers Choose Pro-MBS

At Pro-MBS, we manage credentialing as a core revenue function. We do not just process forms; we handle the entire lifecycle:

- New provider onboarding and payer enrollment

- Medicare and Medicaid credentialing via PECOS and state portals

- License and malpractice tracking

- CAQH profile maintenance and re attestation

- Recredentialing alerts and compliance reporting

We help you eliminate bottlenecks, reduce denials, and stay audit-ready.