Introduction: Why Billing Errors Threaten Financial Viability

Medical billing mistakes are more than administrative oversights, they are systemic vulnerabilities that erode the financial integrity of healthcare organizations. Seemingly minor errors, such as demographic mismatches, outdated insurance information, or incorrect CPT/ICD-10 code assignments, can trigger cascading issues including claim rejections, reimbursement delays, audit flags, and ultimately lost revenue.

In today’s value-driven and compliance-intensive environment, providers cannot afford to treat billing as an afterthought. Every stakeholder from front-office staff to billing managers must operate within a tightly coordinated revenue cycle framework to avoid denials and ensure sustainable cash flow.

In this guide, you’ll learn:

- A detailed breakdown of the eight most frequent and costly billing mistakes

- An analysis of how these errors compromise practice performance, reimbursement rates, and audit risk

- Proven, scalable strategies to strengthen your revenue cycle and eliminate error-prone workflows

- Let’s explore how to transition from reactive billing correction to proactive revenue integrity.

The Most Common Medical Billing Mistakes

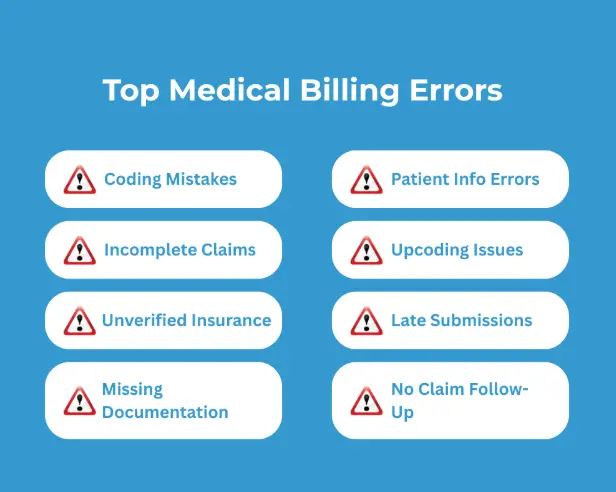

1. Patient Information Errors

The F90.2 ICD-10 code is used for ADHD, combined type, where the patient shows significant symptoms of both inattention and hyperactivity-impulsivity. This is the most common ADHD presentation and typically includes behaviors like difficulty staying seated, frequent interruptions, and a lack of impulse control.

Choosing between F90.0 and F90.2 requires clinical clarity. If both symptom clusters are present, F90.2 is the appropriate code. If only inattention is dominant, F90.0 should be used.

2. Coding Mistakes

3. Upcoding Issues

4. Incomplete Claims

5. Unverified Insurance

Failing to verify a patient’s insurance coverage before or during the appointment is a critical oversight that leads to high claim denial rates. Insurance status can change at any time, and assumptions based on past visits often result in billing the wrong plan or submitting claims for services not covered under the current policy. Without active eligibility verification, practices risk rendering services that are non-reimbursable, putting financial strain on both the provider and the patient.

6. Late Submissions

Every payer has a strict timeline within which claims must be submitted ranging from 30 to 365 days depending on the contract. When claims are delayed beyond these filing deadlines, they are automatically denied, with no option for resubmission or appeal. Late submissions are one of the most preventable causes of lost revenue, typically caused by disorganized workflows, bottlenecks in documentation, or lack of claim tracking systems. Missing these deadlines results in permanent revenue loss.

7. Missing Documentation

8. No Claim Follow-Up

The Real-World Impact of Medical Billing Mistakes on Healthcare Providers

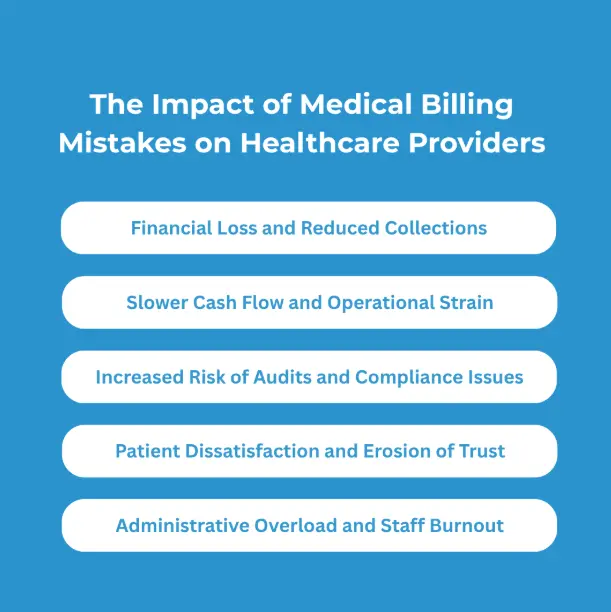

1. Financial Loss and Reduced Collections

When billing mistakes occur, they disrupt the flow of reimbursement, leading to immediate financial losses. Denied or rejected claims must be reworked, appealed, or in some cases, written off entirely. This delays revenue recognition and, over time, contributes to a significant shortfall in total collections. For practices operating on tight margins, the accumulation of small errors across hundreds of claims can have a major impact on annual revenue, affecting the ability to pay staff, invest in technology, or expand services.

2. Slower Cash Flow and Operational Strain

3. Increased Risk of Audits and Compliance Issues

4. Patient Dissatisfaction and Erosion of Trust

5. Administrative Overload and Staff Burnou

How to Avoid Medical Billing Mistakes – Expert Strategies for Long-Term Accuracy

Verify Patient Information at Every Encounter

Avoiding patient information errors starts with a standardized verification process at every point of contact. Practices should confirm the accuracy of all patient demographics and insurance details both at the time of scheduling and again during check-in. Relying solely on previously stored information or scanned ID cards increases the risk of submitting claims with outdated or mismatched data. Implementing a real-time verification system allows front-desk teams to catch and correct errors before they reach the billing stage, ensuring cleaner submissions and faster reimbursement.

Maintain Coding Accuracy with Training and Documentation Alignment

Prevent Upcoding Through Clinical Oversight

Verify Insurance Coverage in Real Time

Ensure Claims Are Complete Before Submission

Track Filing Deadlines to Avoid Late Submissions

Improve Documentation Practices Across the Team

Build a Structured Claim Follow-Up System

Following up on claims is a non-negotiable part of the revenue cycle. Practices must dedicate time and resources to track claim statuses, respond to payer inquiries, and appeal denials promptly. A defined process should be in place for reviewing remittance advice, identifying rejected or underpaid claims, and taking timely corrective action. Without active follow-up, even clean claims can fall through the cracks. A strong follow-up system ensures that every dollar earned is pursued and collected efficiently.

Eliminate Billing Errors with Proven Operational Control

Fixing denials isn't enough. Sustainable revenue performance starts with process architecture that prevents errors before they occur.

Our team embeds precision into every stage of your billing operation:

- Front-end eligibility checks that prevent coverage-related denials

- Code-to-documentation validation to ensure compliance and reduce audit risk

- Denial pattern analysis to correct systemic issues

Structured follow-up systems that recover every dollar left unpaid If you're managing high-volume claims, dealing with recurring denials, or struggling with fragmented workflows, this isn't just support, it’s infrastructure-level improvement built around your practice.