Blue Cross Blue Shield (BCBS) is a federation of 33 independent and locally operated health insurance companies across the U.S. Each affiliate such as Anthem, Highmark, or Florida Blue sets its own fee schedules, billing rules, and reimbursement criteria. The diversity in plan design including PPO, HMO, and EPO models directly affects how therapy services are reimbursed. For billing teams and providers, this variation requires a state-specific and plan-specific approach to revenue cycle management.

Reimbursement Models for Therapy Services

When billing therapy services to Blue Cross Blue Shield (BCBS), there are two primary reimbursement models you need to understand: In-Network (INN) and Out-of-Network (OON). These models determine how claims are submitted, who gets paid, how much is paid, and how quickly the money arrives. Each model has its own rules, reimbursement logic, and patient financial responsibility. Understanding the difference is critical not just for getting paid correctly but for setting the right expectations with patients before services are even rendered.

In-Network (INN) Model

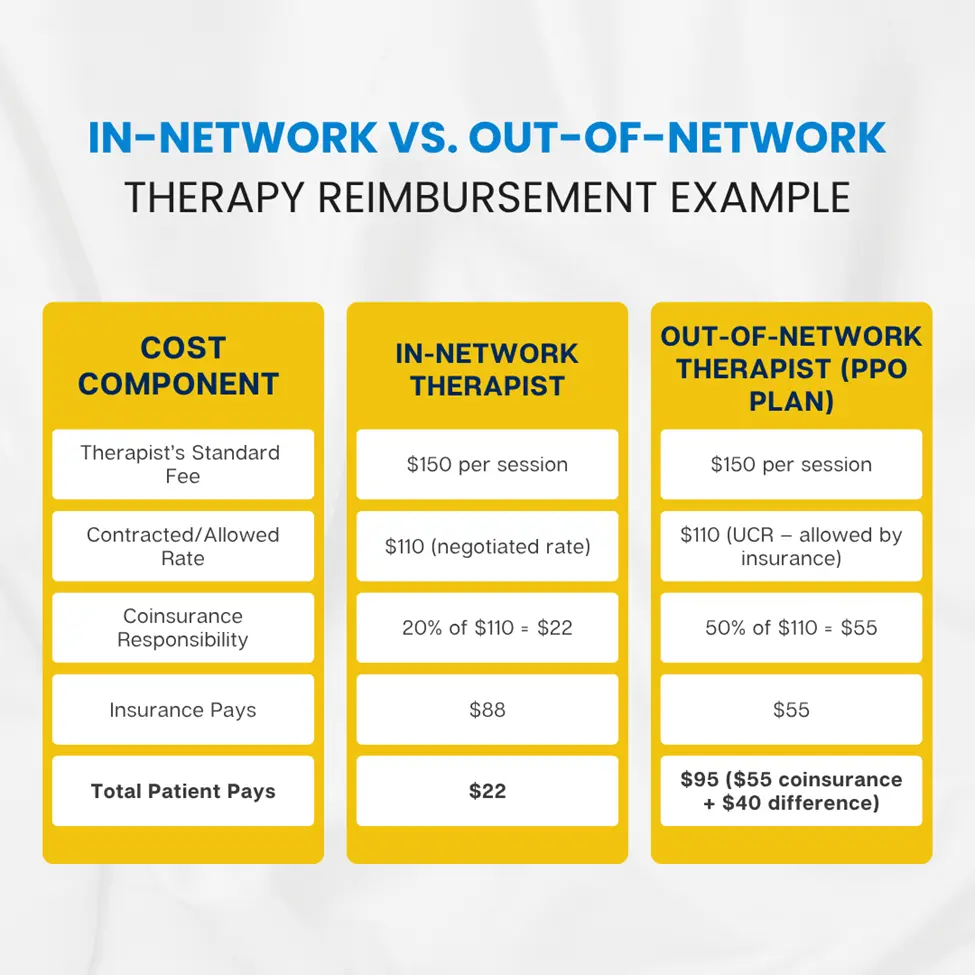

Being “in-network” means you’ve signed a contract with the local BCBS affiliate to be one of their approved providers. This contract sets a fixed price (called the contracted rate) for each therapy service you provide like $130 for a 60-minute psychotherapy session (CPT 90837), for example.

As an in-network provider:

- You send the claim directly to BCBS after each session.

- BCBS pays you based on the rate you agreed to in your contract.

- The patient may owe a small portion (like a $20 copay), but you don’t have to chase the full fee.

Out-of-Network (OON) Model – PPO Plans Only

If you’re not in-network, you haven’t signed a contract with BCBS. You’re considered “out-of-network.” Now, things change significantly especially how you get paid and how much you get paid.

Only PPO plans (Preferred Provider Organization) allow out-of-network claims. If the patient has an HMO or EPO plan, they typically won’t get reimbursed for seeing an out-of-network provider at all.

In the out-of-network model:

- The patient pays you directly at the time of service.

- You provide them with a superbill (an itemized receipt with CPT/ICD codes).

- The patient then sends this to BCBS.

- BCBS reviews the claim and reimburses the patient, not you based on their UCR (Usual, Customary, and Reasonable) rate.

Mental Health CPT Codes and Reimbursement Averages

Reimbursement for therapy sessions depends on the CPT code billed, session length, provider credential, and state regulations. Below are the most commonly billed psychotherapy codes and their average reimbursement ranges in 2025:

| CPT Code | Description | Avg In-Network Rate | Avg OON Rate (PPO) |

|---|---|---|---|

| 90834 | 45-min individual psychotherapy | $100–$130 | $50–$95 |

| 90837 | 60-min individual psychotherapy | $120–$160 | $60–$120 |

| 90791 | Diagnostic evaluation (no meds) | $130–$200 | $70–$150 |

| 90847 | Family psychotherapy (with patient) | $100–$140 | $55–$100 |

| 90846 | Family psychotherapy (without patient) | $95–$135 | $50–$90 |

Reimbursement is also influenced by proper use of modifiers, accurate ICD-10 diagnosis mapping, and documentation supporting medical necessity.

Factors That Influence BCBS Therapy Reimbursement

Several operational and clinical variables determine how much a provider will be reimbursed:

- Provider Credential: Psychiatrists generally receive the highest reimbursement, followed by psychologists, LCSWs, and MFTs.

- Network Participation: In-network status leads to consistent, faster reimbursements. OON providers face delays and reductions.

- CPT Code & Duration: Longer sessions like 90837 reimburse more but are more likely to trigger audits.

- Geographic Location: Plans use ZIP code adjustments to define fee schedules.

- Session Modality: Telehealth services may be paid at parity in some states but require exact coding compliance.

- Plan Type: PPOs offer OON benefits; HMOs and EPOs do not.

- Claim Documentation: Lack of time-stamped session notes or clinical justification reduces payment accuracy.

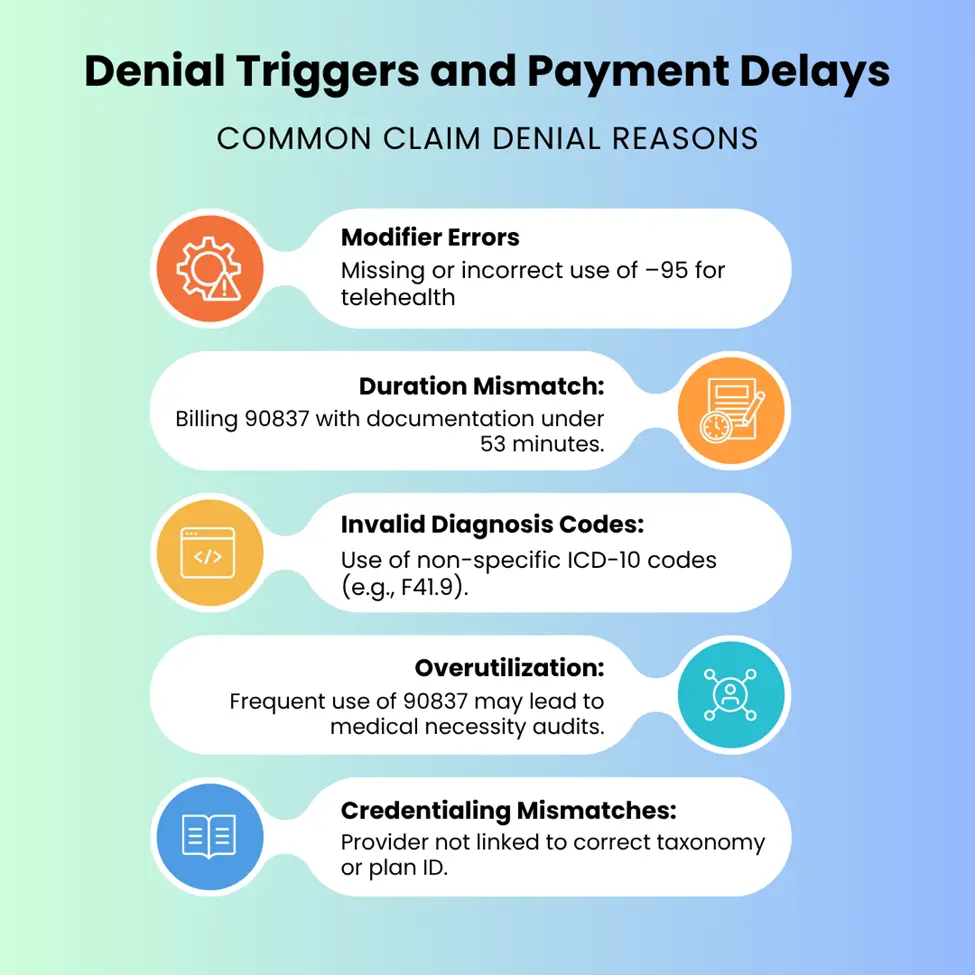

Denial Triggers and Payment Delay

BCBS Payment Timelines and Claims Processing

In-Network Providers:

- Payment timeline: 7–14 days from EDI submission

- Clearinghouses like Availity, Office Ally, or Waystar streamline claim status checks

- EFT and ERA setups are strongly encouraged

Out-of-Network Claims:

- Payment timeline: 30–60 days post-superbill

- Checks are mailed to patients unless provider has special arrangement (rare)

- Delays are common due to manual processing, missing info, or incorrect forms

Timely filing limits also vary by plan, generally ranging from 90 to 180 days post-date-of-service.

How to Maximize Reimbursement Efficiency

be both proactive and precise. Submitting claims on a daily basis and reconciling payments weekly ensures that revenue doesn’t sit idle or get lost in processing delays. Every session should include clear documentation of the service duration, modality used, and clinical justification to demonstrate medical necessity. It's essential to avoid overusing CPT code 90837 unless the full 60-minute session is justified and properly documented, as this code is often flagged for medical necessity reviews.

For teletherapy, the –95 modifier must be appended correctly, and the place of service (POS) 10 must be used to indicate services provided in the patient’s home. Understanding plan-specific fee schedules and recognizing payer flags such as code bundling or frequency limitations can help prevent denials before they occur. Finally, maintaining up-to-date provider information in CAQH, NPPES, and all payer directories is crucial to prevent claim rejections due to credentialing mismatches.

BCBS Reimbursement Audit Preparedness

When billing high-value or high-frequency codes like 90837 or 90791, it’s critical to stay audit-ready. Blue Cross Blue Shield payers routinely flag patterns that suggest overutilization or billing irregularities. To pass audits successfully, providers should maintain signed treatment plans, detailed progress notes, and diagnostic assessments that clearly justify medical necessity. Session documentation must include time logs verifying the duration of service, and therapy notes (formatted in SOAP or DAP) should reflect the clinical work done in the session.

For telehealth sessions, keep patient consents on file and ensure session summaries align with the billed codes and modifiers. Timely, structured documentation not only improves cash flow and reduces denial rates, it also provides legal and financial protection in the event of retroactive reviews or recoupment attempts by the payer.

Future Trends in Therapy Reimbursement (2025–2026)

- Value-Based Contracts: Plans are piloting models that reward clinical outcomes over session volume.

- Parity Enforcement: Expect increased scrutiny to ensure mental health receives equal reimbursement treatment.

- AI and NLP in Claims Scrubbing: Automated tools will flag CPT/ICD mismatches pre-submission.

- State-Level Fee Schedule Adjustments: Several states (e.g., CA, NY, MA) are pushing legislation to enforce minimum reimbursement rates for licensed therapists, particularly for Medicaid and ACA-compliant plans. Some BCBS affiliates have already adopted these floors as part of parity enforcement initiatives.

- Integrated Behavioral Health Billing: Bundled payments for behavioral health in primary care are gaining traction.

Conclusion

Understanding and navigating Blue Cross Blue Shield therapy reimbursement is a critical skill for behavioral health providers and billing teams in 2025. With rates and rules varying widely by plan and state, providers must maintain payer-specific workflows, accurate documentation, and compliance-driven claim submission. Mastery of these principles ensures sustainable revenue and minimal disruptions to practice operations.