What is the CMS-1500 Claim Form?

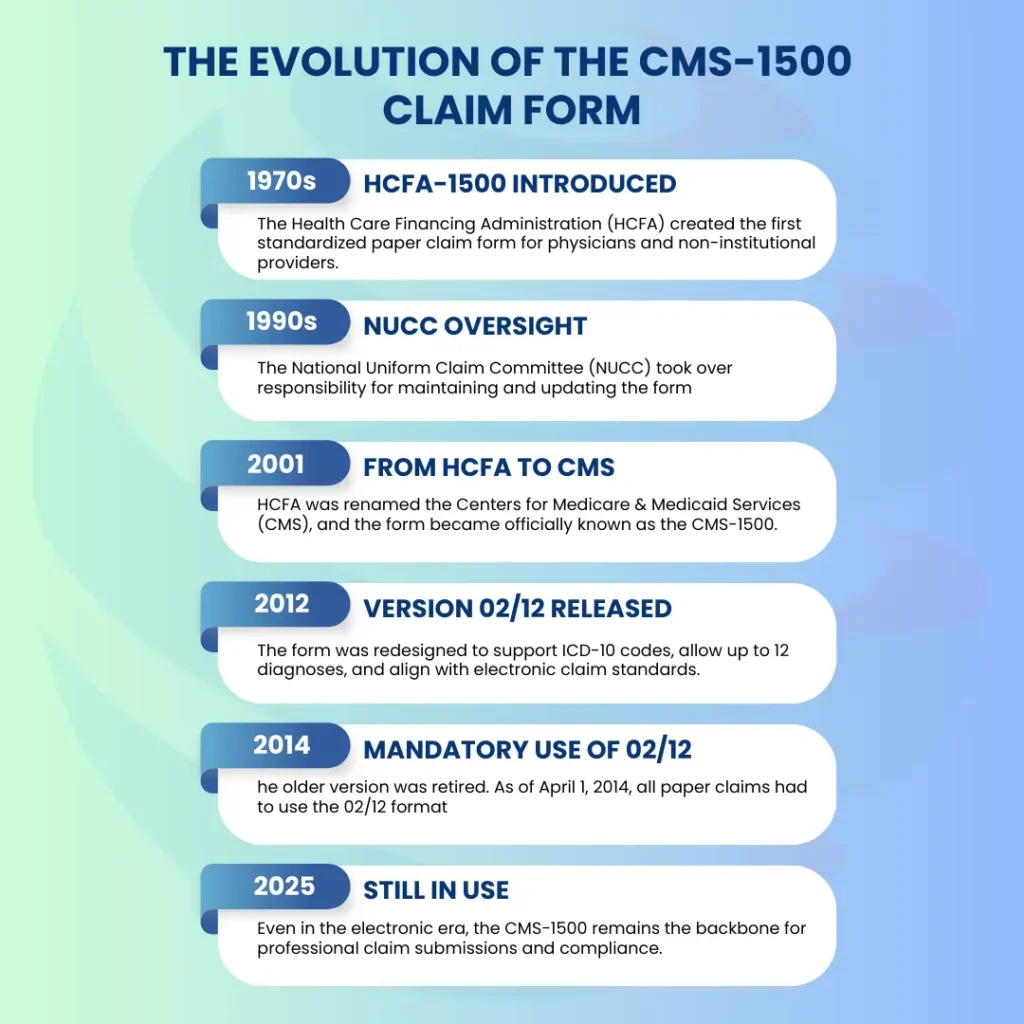

The CMS-1500 claim form (also known as the HCFA 1500 form) is the standard health insurance claim form used by physicians, suppliers, and other non-institutional providers to bill Medicare, Medicaid, and commercial insurers. Developed and maintained by the National Uniform Claim Committee (NUCC), it ensures a consistent reporting method for patient demographics, provider details, diagnoses, and procedures.

Even in 2025, with electronic claims dominating through the 837P format, the CMS-1500 form remains essential. It is required for certain paper claim submissions, used as the structural model for electronic billing, and still serves as a compliance benchmark for auditors, payers, and coding professionals.

Who Uses the CMS-1500 Claim Form

The CMS-1500 is used by non-institutional providers, including:

- Physicians and specialty practitioners

- Outpatient clinics not classified as hospitals

- Therapists, chiropractors, optometrists, and psychologists

- Durable Medical Equipment (DME) suppliers

- Ambulatory services that do not require institutional billing

By contrast, institutional providers such as hospitals, skilled nursing facilities, and inpatient rehab centers must use the UB-04 (CMS-1450) claim form.

CMS-1500 vs. UB-04: Key Differences

Understanding the difference between the two claim forms is critical for compliance:

| Feature | CMS-1500 (Professional Claim) | UB-04 (Institutional Claim) |

|---|---|---|

| Used By | Physicians, suppliers, therapists, DME, outpatient specialists | Hospitals, SNFs, inpatient rehab, institutional facilities |

| Number of Fields | 33 fields (Boxes 1–33) | 81 fields |

| Type of Services | Professional services, office-based care, outpatient therapy | Institutional services such as inpatient stays, facility-based care |

| Electronic Equivalent | 837P transactions | 837I transactions |

| Diagnosis Codes | Up to 12 ICD-10 codes (Box 21) | Expanded diagnostic and procedure reporting |

Submitting services on the wrong form (e.g., a hospital encounter on a CMS-1500 instead of UB-04) leads to immediate payer rejection.

What are the CMS-1500 Claim Form Fields? A Complete Reference Table

| Box No. | Field Name / Purpose | Required Information |

|---|---|---|

| 1 | What type of insurance is the patient using? | Select Medicare, Medicaid, TRICARE, Commercial, etc. |

| 1a | What is the insured’s ID number? | Policy/member ID from the insurance card. |

| 2 | What is the patient’s name? | Full legal name (last, first, MI). |

| 3 | What is the patient’s date of birth and sex? | DOB in MM/DD/YYYY format and M/F. |

| 4 | Whose name is listed as the insured? | Policyholder’s name, if not the patient. |

| 5 | What is the patient’s address? | Street, city, state, ZIP, phone. |

| 6 | What is the patient’s relationship to the insured? | Self, spouse, child, or other. |

| 7 | What is the insured’s address? | If different from the patient. |

| 8 | Is anything required in this field? | No – reserved for NUCC. |

| 9–9d | What if the patient has secondary insurance? | Enter other insured’s name, DOB, employer/plan, ID. |

| 10a–c | Is the condition related to work, auto, or other accidents? | Mark employment, auto accident, or other. |

| 10d | What are claim codes? | Situational; used for NUCC identifiers. |

| 11–11d | What policy details are required? | Group/policy number, DOB, plan name, COB status. |

| 12 | Has the patient authorized release of information? | Signature or “Signature on File.” |

| 13 | Has the insured authorized payment to the provider? | Signature or SOF. |

| 14 | What is the date of current illness, injury, or pregnancy? | Onset date in MM/DD/YYYY format. |

| 15 | What other date information is required? | Initial treatment or last seen date. |

| 16 | Was the patient unable to work? | Enter from/to dates if applicable. |

| 17–17b | Who is the referring or ordering provider? | Provider’s name and NPI (or legacy ID). |

| 18 | Were hospitalization dates involved? | Admission and discharge dates. |

| 19 | What additional claim information may be needed? | EPSDT, claim notes, resubmission info. |

| 20 | Were outside lab services used? | Check “Yes” and include charges. |

| 21 | What diagnosis codes are required? | Up to 12 ICD-10-CM codes (A–L). |

| 22 | Is this a resubmitted or corrected claim? | Use resubmission code and original claim number. |

| 23 | Was prior authorization obtained? | Enter the authorization number. |

| 24A–J | What service line details are required? | Dates of service, POS, CPT/HCPCS, modifiers, charges, units, rendering provider. |

| 25 | What is the provider’s federal tax ID? | SSN or EIN. |

| 26 | What is the patient’s account number? | Provider’s internal reference number. |

| 27 | Does the provider accept assignment? | Yes/No (assignment of benefits). |

| 28 | What is the total charge for services? | Sum of all service lines. |

| 29 | How much has already been paid? | Payments from patient or secondary payer. |

| 30 | Is this field required? | No – reserved for NUCC. |

| 31 | Has the provider signed the claim? | Provider’s signature and date. |

| 32–32b | Where were services rendered? | Service facility name, address, and NPI. |

| 33–33b | Who is the billing provider? | Billing entity’s name, address, phone, and NPI. |

How to Fill Out the CMS-1500 Claim Form Correctly

Boxes 1–13: Patient & Insurance Information

Boxes 14–20: Clinical Information

This section provides the clinical context of the claim. Box 14 captures the date of onset for illness, injury, or pregnancy, which payers use to evaluate medical necessity. Box 17 must include the referring or ordering provider’s name and NPI for services like imaging, labs, or therapy. Box 18 documents hospitalization dates if relevant, while Box 19 allows for additional payer notes (such as EPSDT or claim resubmission information). Errors in this section often delay claims requiring prior authorization or referral verification.

Box 21: Diagnosis Codes

Box 21 is reserved for ICD-10-CM diagnosis codes, with up to 12 codes (A–L) allowed. Codes must be sequenced according to medical priority primary diagnosis first, followed by secondary conditions. This section establishes medical necessity for services rendered, so vague or unspecified codes may result in denials. For example, “M25.561 – Pain in right knee” is more acceptable than “M25.569 – Pain in unspecified knee.” Billers should ensure documentation supports the highest level of coding specificity.

Boxes 22–23: Resubmission and Authorization

Box 22 is used when resubmitting corrected claims. It requires the resubmission code and the original claim reference number to prevent duplicate claim denials. Box 23 is reserved for prior authorization numbers, which are mandatory for many procedures and services. Claims missing authorization details are often denied automatically, regardless of medical necessity.

Box 24A–J: Service Line Information

This section contains the core billing details and is the most scrutinized by payers. Each service line must include:

- 24A: Date(s) of service

- 24B: Place of service (POS) code (e.g., 11 = office, 21 = inpatient hospital, 02/10 = telehealth)

- 24C: Emergency indicator (if applicable)

- 24D: CPT/HCPCS procedure codes with any modifiers

- 24E: Diagnosis pointer linking back to Box 21

- 24F: Charges for each service

- 24G: Number of units or services provided

- 24J: Rendering provider’s NPI

Errors in this section especially missing modifiers or incorrect POS codes are leading causes of denials.

Box 24E: Diagnosis Pointer

Although technically part of the service line, Box 24E deserves special mention because it connects procedures in Box 24D to diagnoses listed in Box 21. For example, if Box 21 includes “M54.2 – Cervicalgia” and Box 24D includes “97110 – Therapeutic exercises,” Box 24E should reference the correct pointer (e.g., “A”). Incorrect linkage results in denials for “service not medically necessary.”

Boxes 25–33: Provider Information

The final section identifies the billing provider and service facility. Box 25 must list the provider’s Tax ID or EIN, while Box 27 indicates whether the provider accepts assignment of benefits. Box 31 requires the provider’s signature and date, certifying the accuracy of the claim. Box 32 lists the facility where services were performed, along with its NPI, while Box 33 identifies the billing provider or group submitting the claim. Missing or mismatched NPIs here are common triggers for payer rejections.

Electronic vs Paper: Submitting CMS-1500 Claims

Yes. The CMS-1500 claim form can be submitted both on paper and electronically, but the industry standard in 2025 is the electronic 837P format, which directly mirrors the fields on the CMS-1500. Electronic claims are now required by Medicare, Medicaid, and most commercial payers, with very limited exceptions for paper submission.

Paper Claims

While paper claim submission is still technically accepted, it is usually limited to:

- Small or rural practices without access to clearinghouse software.

- Situations where a payer specifically requests a paper resubmission.

- Secondary or tertiary payers in rare cases.

Paper claims are prone to manual entry errors, mailing delays, and lost forms, which increase the risk of denials and delayed reimbursement.

Electronic Claims (837P Transactions)

Electronic claims are the preferred method for most payers because they:

- Mirror CMS-1500 fields while meeting HIPAA transaction standards.

- Allow real-time claim edits and error checks before submission.

- Provide faster adjudication often reducing payment cycles from weeks to days.

- Offer better tracking through clearinghouse and payer portals.

- Reduce clerical errors compared to manual paper claim entry.

In compliance audits, providers who rely heavily on paper claims may face additional scrutiny since electronic submissions are considered more accurate, secure, and audit-ready.

What are the most common errors on CMS-1500 claims?

Even though the CMS-1500 claim form is standardized, errors are still one of the leading causes of payer rejections, denials, and audits. Each mistake, no matter how minor, can delay reimbursement and increase administrative costs. Below are the most frequent compliance failures billing professionals must watch for:

1. Incorrect Patient Demographics (Boxes 1–5)

2. Wrong or Missing ICD-10/CPT Linkage (Box 24E Errors)

Box 24E is where the claim links each procedure code (CPT/HCPCS) to the relevant diagnosis code(s) from Box 21. If this linkage is missing, mismatched, or incorrect, payers will frequently deny the claim under “lack of medical necessity.” For example, billing a physical therapy session (CPT 97110) but linking it to “cough” instead of “knee pain” will result in non-payment. This error underscores why accurate diagnosis pointers are essential to demonstrate the clinical justification for services rendered.

3. Missing Prior Authorization Numbers (Box 23)

For procedures that require prior authorization or pre-certification, Box 23 must include the authorization number. Omitting this field is a common and costly mistake, leading to automatic denial regardless of the clinical documentation. Payers consider authorization compliance non-negotiable; even if the care was medically necessary, lack of an authorization number renders the claim unpayable. Billers should implement a pre-submission checklist to confirm prior authorizations are properly documented in Box 23.

4. Invalid Place of Service (POS) Codes

Place of Service (POS) codes in Box 24B are critical for payer adjudication. With the rise of telehealth, errors frequently occur when providers fail to use the updated codes 02 (telehealth outside home) or 10 (telehealth in home). In addition, payers often require modifier 95 for synchronous telehealth services. Using an incorrect POS code can result in either reduced reimbursement or outright denial. To stay compliant, billers must keep up to date with CMS guidance and payer bulletins on POS coding.

5. Using the Wrong Claim Form (CMS-1500 vs. UB-04)

Submitting the wrong type of claim form is a structural error that leads to rejection before the claim is even adjudicated. Professional providers (physicians, therapists, suppliers) must use the CMS-1500, while institutional providers (hospitals, SNFs, inpatient facilities) must use the UB-04 (CMS-1450). Submitting a hospital service on a CMS-1500 or vice versa results in an immediate denial. Staff should be trained to distinguish professional claims vs institutional claims to prevent this error.

6. Duplicate Claims

Resubmitting claims without using Box 22 (Resubmission Code and Original Reference Number) correctly often results in duplicate claim denials. Payers interpret duplicate claims as billing errors or attempts to double-bill. If a claim is rejected or needs correction, it must be marked as a resubmission with the original claim number. Proper use of Box 22 ensures the payer processes the claim as a corrected submission rather than a duplicate.

Why These Errors Matter

These errors not only delay reimbursement but can also trigger payer audits, compliance reviews, and loss of revenue due to timely filing limits. When errors are systemic, they increase the likelihood of post-payment reviews or recoupments. For this reason, billing teams must combine front-end verification, coding accuracy, and compliance checks to minimize errors on CMS-1500 claims.

Avoiding Denials on CMS-1500 Claims

How do you avoid denials when submitting CMS-1500 claims?

Denial prevention is one of the most critical aspects of medical billing. A single rejected claim can delay payment for weeks and increase administrative costs. The key to avoiding denials on the CMS-1500 claim form lies in accurate coding, precise documentation, and adherence to payer-specific requirements. Below are six strategies that billing professionals must prioritize.

1. Ensure Documentation Integrity

Every diagnosis listed in Box 21 must be supported by the provider’s medical record. Payers routinely deny claims when ICD-10 codes are assigned without clear documentation that establishes medical necessity. For example, submitting “unspecified hand pain” (M79.643) when the provider has documented “right hand pain” (M79.641) exposes the claim to denial for lack of specificity. Coders should always abstract directly from the provider’s notes and query physicians when documentation is incomplete or ambiguous.

Using nonspecific or outdated ICD-10 codes is a frequent mistake that leads to medical necessity denials. Payers expect the highest level of detail available, especially when coding conditions that have laterality, severity, or chronicity distinctions. Maintaining documentation integrity is the first line of defense against rejected CMS-1500 claims.

2. Follow Payer-Specific Claim Requirements

Each payer has its own requirements for modifiers, attachments, and claim edits. Medicare, Medicaid, and commercial carriers may implement Local Coverage Determinations (LCDs) or National Coverage Determinations (NCDs) that define which diagnoses support a given CPT/HCPCS code. Failing to align with these requirements can result in denials for “non-covered services.”

For example, a physical therapy CPT code may only be payable if linked to certain musculoskeletal diagnoses under a specific payer’s LCD. Similarly, many procedures require a prior authorization or medical necessity form attached to the CMS-1500. Billers must be familiar with these payer-specific nuances to ensure claims are submitted correctly the first time.

3. Correct Use of POS Codes and Modifiers

4. Double-Check Diagnosis/Procedure Linkage (Box 24E)

One of the most overlooked areas of the CMS-1500 form is Box 24E, where diagnosis pointers link procedures (Box 24D) to the ICD-10 codes listed in Box 21. If this linkage is incorrect, the payer may determine that the service was “not medically necessary” and deny payment.

For example, billing a knee MRI (CPT 73721) with a diagnosis pointer linked to “back pain” instead of “knee pain” results in immediate denial. Coders must carefully verify that every CPT/HCPCS code is linked to the correct diagnosis pointer(s). This simple step can prevent one of the most common and costly denial categories.

5. Staff Training on NUCC Guidelines

6. Use a Compliance Checklist Before Submission

Why the CMS-1500 Still Matters in 2025

Even though electronic claim submission is the industry norm, the CMS-1500 form continues to define how professional claims are structured, reviewed, and audited. It remains the compliance foundation for:

- Paper claim submission

- Electronic 837P field alignment

- Training new billers and coders

- Claim adjudication processes by payers and auditors

Conclusion

The CMS-1500 claim form remains the cornerstone of professional medical billing, bridging the gap between paper submission and electronic 837P transactions. Its structured fields capture essential patient demographics, provider information, diagnoses, and procedures, ensuring consistent claim reporting across Medicare, Medicaid, and commercial insurers. While institutional facilities rely on the UB-04, the CMS-1500 continues to serve non-institutional providers as the compliance template for claim adjudication, audit readiness, and reimbursement integrity.

In 2025, the significance of the CMS-1500 lies not just in its historical role but in its function as a compliance benchmark. Providers who master accurate completion of all 33 fields, apply correct POS codes and modifiers, and adhere to payer-specific requirements can prevent costly denials, accelerate reimbursement cycles, and maintain audit-proof documentation. As the healthcare industry advances toward greater digital standardization, the CMS-1500 persists as the technical backbone of professional claims, reinforcing the importance of precision, compliance, and operational efficiency in medical billing.