In today’s healthcare landscape, transparency is no longer optional, it is a compliance requirement. One of the most significant changes driving this shift is the good faith estimate medical billing requirement introduced under the No Surprises Act (NSA). First implemented in 2022, the NSA was designed to shield patients from surprise billing, particularly when they unknowingly receive care from out-of-network providers. By 2025, updated rules have placed even greater emphasis on NSA estimates and the responsibility of providers to deliver accurate, timely cost projections.

The concept is simple: a Good Faith Estimate (GFE) is a written, itemized forecast of expected charges given to uninsured or self-pay patients before care is delivered. The requirement is legally enforced by the Centers for Medicare & Medicaid Services (CMS) and monitored by the U.S. Department of Health and Human Services (HHS). If the final bill exceeds the GFE by more than $400, patients have the right to initiate a formal payment dispute, making compliance not just a matter of patient courtesy but a regulatory necessity.

For patients, GFEs are a safeguard against unexpected costs. For providers, they represent both a compliance challenge and an opportunity. Implemented properly, GFEs reduce billing disputes, strengthen payer relationships, and minimize the risk of penalties or audits. PROMBS explains in its CMS-1500 claim form guide that upfront financial accuracy is directly tied to clean claim submission and reimbursement reliability. Failure to integrate GFEs into workflows, however, can expose practices to disputes, denials, and OIG oversight.

This blog explores how GFEs affect medical billing compliance in 2025, why they matter, and how providers can operationalize them effectively. By examining NSA requirements, payer expectations, and PROMBS’s practical billing strategies, we’ll highlight how GFE billing not only ensures regulatory compliance but also builds patient trust and financial stability.

What Is a Good Faith Estimate in Medical Billing?

At its core, a good faith estimate of medical billing is a written document that outlines the anticipated cost of services for a patient who is uninsured or chooses to self-pay. This estimate must include all reasonably expected charges for the primary service as well as related items or procedures, such as labs, anesthesia, or imaging.

Under the No Surprises Act, providers are legally obligated to provide these estimates in clear, itemized form. Patients must receive them within a specific timeframe, typically within three business days of scheduling a service. The purpose is to prevent situations where patients undergo care only to be surprised later by massive bills they were not expecting.

GFEs are not binding contracts, but they must be accurate within a reasonable margin. If the final bill exceeds the GFE by more than $400, patients have the right to initiate a payment dispute process through CMS. This makes GFEs both a compliance safeguard and a financial risk if providers fail to manage them properly.

Did You Know? The Kaiser Family Foundation (KFF) found that two-thirds of American adults worry about unexpected medical bills, ranking them above rent, food, and transportation as their greatest financial concern. GFEs are designed to directly address this issue by providing upfront cost transparency.

Why GFEs Matter for Compliance

Good Faith Estimates (GFEs) are far more than a courteous courtesy, they are a cornerstone regulatory requirement and a powerful risk management tool. Understanding their importance through key compliance lenses demonstrates why providers must prioritize them in billing workflows.

Legal Mandate Under the No Surprises Act

The NSA firmly established GFEs as a legal obligation, not just a best practice. Under CMS rules, any provider or facility scheduling non-emergency care for self-pay or uninsured patients must deliver an itemized GFE within strict deadlines. Failure to do so can trigger civil penalties enforced by the Department of Health and Human Services, as outlined in CMS’s Final Rule guidance on NSA compliance. Furthermore, patient rights under NSA include the ability to dispute charges if final costs exceed GFE totals by more than $400, placing providers at financial risk if GFEs are inaccurate or missing.

Alignment with CMS Medical Billing Integrity

GFEs also reinforce broader medical billing integrity standards. In its Fraud, Waste, and Abuse Resource Guide, CMS links accurate pre-service estimate delivery to pain points in improper payment detection and audit outcomes. GFEs can serve as a form of proactive documentation, verifying that billing intentions match expectations given to the patient. When claims later face audit scrutiny, the presence of a clear, dated estimate can demonstrate intent and compliance, reducing liability exposure.

Minimizing Dispute Volume and Denial Costs

From a financial perspective, accurate GFEs significantly reduce downstream disputes and appeals. Becker’s Hospital Review notes that organizations with structured GFE programs saw a 20% reduction in unexpected billing disputes, and a corresponding decline in administrative workload and collection delays. Given that HFMA estimates cost recovery for each denied claim ranges up to dozens of dollars, eliminating even a fraction of disputes translates to meaningful ROI.

Enhancing Patient Trust and Transparency

In today’s healthcare environment, transparency is a competitive advantage. Patients who receive clear cost estimates report higher satisfaction and are far less likely to abandon care or delay treatment due to cost concerns. The Kaiser Family Foundation (KFF) reports that upfront pricing clarity is the #1 factor patients cite in trusting a provider’s billing, underscoring how GFEs protect both reputation and revenue.

Integrating GFEs into Operational Workflows

Operationally, GFEs are a compliance trigger that intersects with patient registration, scheduling, clinical documentation, and billing submission. PROMBS emphasizes that GFEs should be baked into standard workflows alongside core billing tasks such as No Surprises Act compliance, accurate modifier usage, and POS code validation. Our No Surprises Act 2025 guide details how GFEs should integrate alongside these elements to create a seamless, compliant revenue cycle system.

Key Components of a Good Faith Estimate

A good faith estimate of medical billing must include very specific elements in order to meet NSA compliance requirements. These components are outlined in detail by the Centers for Medicare & Medicaid Services (CMS) and reinforced by compliance audits from the Office of Inspector General (OIG). Missing or incomplete elements can lead to disputes, denials, or even fines.

Patient and Provider Information

Every GFE must clearly identify both the patient receiving care and the provider or facility delivering the service. This includes legal names, contact information, and tax ID or NPI numbers for providers. Such identifiers ensure that if billing disputes arise, the estimate can be easily traced back to its origin. As PROMBS notes in its delegated credentialing guide, accurate provider identifiers also strengthen payer trust by proving that services are tied to authorized clinicians.

Comprehensive Itemized List of Services

One of the most critical elements is the itemized service list. This means that the estimate must not only include the primary service (e.g., surgery, imaging, consultation) but also all reasonably expected ancillary services such as lab tests, anesthesia, pathology, or follow-up visits. According to the American Medical Association (AMA), many billing disputes arise when providers omit secondary services, leading to “surprise” add-ons in the final bill. A proper GFE anticipates these charges, even if they are provided by other clinicians.

Expected Charges in Clear Dollar Amounts

GFEs must show specific dollar amounts rather than vague ranges or estimates. This ensures patients understand their exact financial exposure. CMS emphasizes that if actual charges exceed the GFE by more than $400, patients have the right to invoke the payment dispute resolution process. PROMBS’s CMS-1500 claim form guide similarly underscores that exact figures reduce payer disputes and speed up claim adjudication.

Provider Signatures and Dates of Service

Another compliance-critical element is proper documentation of provider signatures and dates of service. These demonstrate that the estimate was completed and reviewed before the service occurred. Missing signatures are a top reason GFEs are flagged during compliance audits, as noted in OIG compliance reports.

Disclaimers and Patient Rights

Every GFE must include specific disclaimers that notify patients of their rights under the No Surprises Act. This includes the right to dispute charges if the final bill exceeds the estimate, as well as instructions on how to initiate a dispute through CMS. PROMBS highlights in its No Surprises Act 2025 compliance guide that omitting disclaimers not only violates federal rules but also erodes patient trust.

Timeline for Delivering GFEs

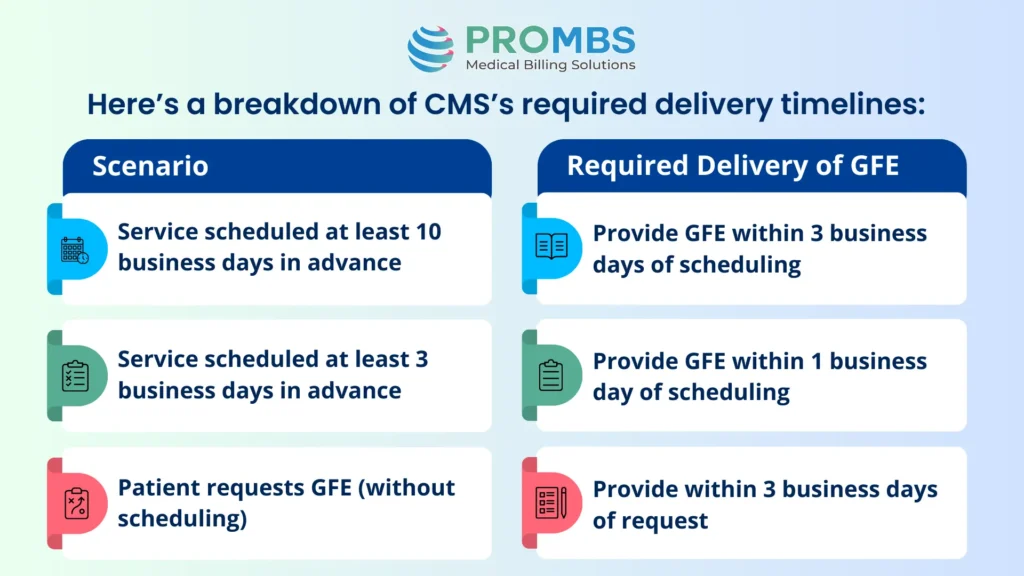

One of the most challenging aspects of good faith estimate medical billing is adhering to strict delivery timelines. The Centers for Medicare & Medicaid Services (CMS) requires providers to give patients a GFE within specific windows depending on when the service is scheduled or requested. Missing these deadlines is considered noncompliance and can trigger disputes, penalties, or additional oversight from regulators like the Office of Inspector General (OIG).

PROMBS emphasizes in its No Surprises Act compliance guide that timeliness is just as important as accuracy. Even a perfectly itemized estimate is invalid if delivered late, which is why billing teams must integrate GFE tracking into their scheduling and registration workflows.

The operational impact of these deadlines is significant. For example, if a pati ent calls to schedule an elective surgery 12 days ahead, the provider’s billing team has just three business days to generate a complete, signed, and itemized GFE. Failure to meet this deadline could mean the patient is eligible for CMS’s dispute resolution process, leaving the provider vulnerable to financial penalties and potential reputational harm.

This is why leading practices are adopting workflow automation tools that alert billing teams to pending GFE deadlines. PROMBS’s CMS-1500 claim form guide stresses that automating documentation deadlines is critical to maintaining a compliant revenue cycle and reducing administrative errors.

Operational Impacts of GFE Billing

Integrating GFE billing into medical practice workflows is not without challenges. Providers must adapt their scheduling, registration, and billing systems to ensure compliance.

Front-office staff need training to recognize when a patient qualifies for a GFE, and back-office billing teams must ensure estimates align with payer fee schedules and local market rates. EHR systems must be configured to capture GFE data, track delivery deadlines, and store signed copies in the patient record.

For practices already managing complex payer rules and modifier compliance, adding GFE requirements can feel like another burden. Yet, failure to integrate them seamlessly exposes providers to penalties and unnecessary disputes.

Compliance Risks of Poor GFE Management

Even though Good Faith Estimates are meant to improve transparency, poor management of GFE workflows can quickly expose providers to compliance failures. Regulators like the Office of Inspector General (OIG) have already emphasized that insufficient documentation and incomplete estimates are among the top reasons healthcare organizations face audits and penalties. For billing teams, this means GFEs are not just an administrative task, they are a compliance checkpoint that demands precision. Without strong internal processes, providers risk payment disputes, delayed reimbursements, and reputational damage.

Excessive Billing Variances

When actual charges exceed the GFE by more than $400, patients are legally entitled to dispute the bill through CMS’s dispute resolution process. Frequent overages suggest systemic issues in estimating practices and can trigger payer scrutiny.

Documentation Failures

A GFE without provider signatures, service dates, or detailed itemization is considered incomplete. Missing documentation not only creates audit risk but also undermines a provider’s ability to defend claims during disputes. PROMBS notes in its medical billing audit checklist that documentation accuracy is a recurring weak point in compliance reviews.

Training Gaps

Staff who lack proper training may skip delivering GFEs altogether or provide incomplete versions, exposing the organization to penalties. According to AHIMA, training gaps in compliance protocols remain a leading cause of billing errors across revenue cycle management.

Technology Solutions for GFE Billing

Implementing good faith estimate medical billing can feel overwhelming for providers, particularly smaller practices that lack large compliance departments. Technology offers one of the most effective ways to manage GFEs at scale while maintaining compliance. Automated platforms can generate estimates, track delivery timelines, and store signed GFEs within patient records, ensuring audit readiness.

The Centers for Medicare & Medicaid Services (CMS) has emphasized that providers are responsible for meeting both accuracy and timeliness requirements, and EHR integrations now make this far more feasible. By leveraging software that pulls CPT codes, payer-specific fee schedules, and ancillary service costs, billing teams can produce compliant GFEs in minutes rather than hours.

PROMBS highlights in its CMS-1500 claim form guide that automating documentation processes reduces administrative burden while supporting NSA compliance. Linking GFE workflows to claim preparation helps practices avoid mismatches between estimated and billed charges.

Industry associations echo this need for technology adoption. The Healthcare Financial Management Association (HFMA) reports that automation in billing workflows improves first-pass claim accuracy and significantly lowers denial rates. Meanwhile, AHIMA stresses the importance of data security in automated systems, ensuring PHI remains protected while estimates are shared electronically.

PROMBS also recommends connecting GFE automation with tools used for modifier compliance and place of service code accuracy. Since GFEs rely on precise coding, linking these workflows ensures patients receive accurate, dispute-free estimates.

In practice, technology is not a replacement for compliance staff, it is an essential partner. Automated alerts, integrated dashboards, and secure patient portals allow organizations to streamline GFE delivery while keeping focus on patient care. As Becker’s Hospital Review notes, organizations that adopted automated GFE solutions saw a 20% reduction in billing disputes compared to those relying on manual processes.

Specialty-Specific Challenges in GFE Billing

Different specialties face unique hurdles in implementing GFE billing:

- Surgical practices must account for bundled charges (surgeon, anesthesiologist, hospital fees) that can vary widely.

- Diagnostic labs often struggle with projecting charges when results lead to additional testing.

- Telehealth providers must ensure GFEs reflect different reimbursement structures for virtual visits, a challenge closely tied to evolving POS code compliance.

PROMBS provides guidance on tailoring billing workflows to each discipline, helping organizations avoid one-size-fits-all mistakes in GFE creation.

Did You Know? A Becker’s Hospital Review analysis found that billing disputes related to unexpected charges dropped by 20% in organizations that implemented structured GFE programs. This demonstrates that compliance isn’t just about avoiding penalties, it also drives better patient satisfaction.

Preparing for Audits

For providers, one of the most important realities of good faith estimate medical billing is that compliance will be subject to review. Both the Centers for Medicare & Medicaid Services (CMS) and the Office of Inspector General (OIG) have emphasized that GFEs will remain a focal point of audits throughout 2025 and beyond. That means practices must be able to show not just that they provided estimates, but that they met delivery deadlines, captured accurate itemizations, and documented every step of the process.

To prepare, billing teams should first ensure that delivery logs are audit-ready. Regulators will want proof of when the GFE was sent, whether it was tied to a scheduled service, and if it was signed and dated by the provider. These logs must match the dates of service and be stored in the patient record. Another critical factor is ensuring itemization accuracy. If the estimate lists only the primary service and leaves out related charges such as anesthesia, imaging, or lab tests, auditors may flag the GFE as incomplete.

Equally important is tracking how disputes are handled. Patients have the right to challenge final bills if they exceed the estimate by more than $400. Regulators will review whether those disputes were resolved according to CMS’s dispute resolution process and whether corrective action was taken to prevent similar issues in the future. As PROMBS explains in its medical billing audit checklist, audit readiness is not about reacting when regulators arrive, it is about embedding compliance practices into everyday billing workflows.

In practice, organizations that succeed in GFE compliance audits are those that approach them like internal quality checks. Regularly reviewing timelines, documentation completeness, and dispute management protocols ensures that when CMS or OIG arrives, providers can demonstrate compliance confidently. This proactive stance not only avoids penalties but also reassures patients and payers that the organization operates with transparency and accountability.

Conclusion

Good faith estimate medical billing is no longer a regulatory footnote, it is a central compliance requirement under the No Surprises Act. By mastering NSA estimates, providers not only avoid penalties but also protect their revenue cycle and strengthen patient trust.

The technical requirements are clear. GFEs must be itemized, accurate, and delivered within CMS deadlines. They must align with payer rules, be documented with signatures and dates, and stored as part of the patient’s record. Providers who implement technology solutions, invest in staff training, and tailor workflows by specialty will achieve compliance while improving efficiency.

In the era of GFE billing, compliance is not just about avoiding fines. It is about ensuring transparency, reducing disputes, and demonstrating that healthcare organizations can deliver care with both clinical and financial integrity.