If your home health agency (HHA) delivers excellent clinical care yet struggles with unpredictable cash flow, the culprit is often avoidable denials. Unlike office-based services, home health billing sits at the intersection of certification rules, clinical assessment instruments, payment groupers, and episode-based timelines. That complexity means home health denied claims rarely stem from a single coding mistake, they emerge where clinical, operational, and revenue-cycle processes fail to line up.

Three pressure points drive most denials in this space. First, timeliness and eligibility events, particularly the Notice of Admission (NOA), are unforgiving, Medicare explains in MLN Matters MM12256 that the NOA must be filed within five calendar days of start of care and that non-timely submissions trigger payment reductions. Second, clinical documentation is heavily regulated, the certifying physician’s face-to-face (F2F) encounter must meet strict timing and content requirements, which CMS outlines in its F2F policy presentation (90 days before or 30 days after start of care, with findings supporting homebound status and skilled need). Third, case-mix and assessment accuracy under the Patient-Driven Groupings Model (PDGM) determine payment classification, and CMS’s PDGM guidance makes clear that errors in OASIS and diagnosis coding can misgroup HIPPS and disrupt reimbursement.

This guide unpacks the causes behind home health denied claims and offers practical, evidence-based fixes. Where we reference policy, we point to CMS primary sources, where we translate rules into workflow, we connect to PROMBS resources like the Medical Billing Audit Checklist for Providers to reinforce staff education and day-to-day execution.

The Home Health Billing Landscape and Why Denials Happen So Often

Home health reimbursement is episode-based and assessment-driven. The bundle interacts with certification requirements, homebound criteria, and PDGM case-mix logic described in CMS’s Home Health manual portal (see Medicare Benefit Policy Manual, Chapter 7). Because payment is triggered and classified by upstream events, admission, OASIS, diagnosis grouping, and the NOA, small timing or content errors cascade into denials or payment reductions.

Two structural realities amplify risk. First, timing rules (for example, NOA in five calendar days and F2F within the allowed window) are binary, you’re either compliant or not, which is why prevention belongs in intake and scheduling. Second, data dependencies run across teams: clinical completes OASIS-E/E1, coding assigns principal and comorbidity diagnoses, intake verifies eligibility, and billing assembles the claim with the HIPPS code and occurrence codes. When those teams don’t share a single source of truth, denials multiply.

Did You Know? Improper payments across Medicare are materially driven by documentation and coding issues, and CMS’s Improper Payments portal repeatedly attributes a large share of errors to insufficient documentation. In home health specifically, HHS-OIG provider audits continue to find missing or non-specific F2F encounters that lead to recoupments, exactly the kind of preventable weakness that shows up later as a denial or overpayment.

Causes of Home Health Denials and Practical Fixes

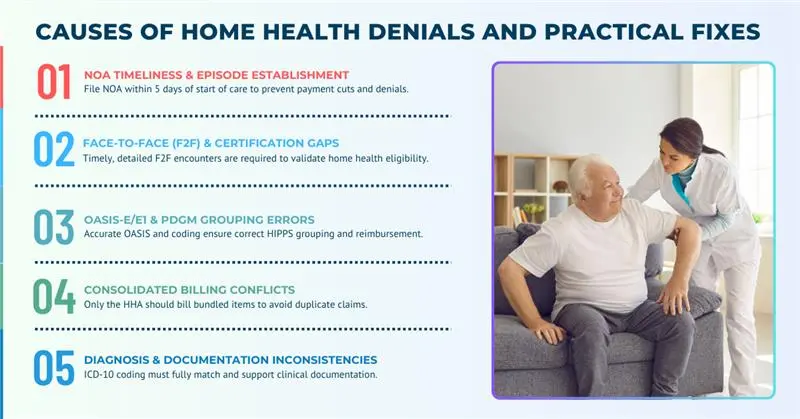

Denied claims in home health billing don’t usually come from a single mistake. Instead, they’re the result of small but critical breakdowns across intake, clinical documentation, coding, and billing workflows. Because home health billing is tied to strict regulatory events like the Notice of Admission (NOA), face-to-face (F2F) encounters, and OASIS assessments under PDGM, even a minor delay or inconsistency can jeopardize the entire episode’s reimbursement. Agencies that fail to recognize these weak points often see higher denial rates, delayed payments, and more administrative overhead.

The most frequent denial drivers in home health fall into a few well-defined categories: NOA timeliness, gaps in physician certification and F2F documentation, inaccuracies in OASIS-E/E1 assessments that disrupt PDGM grouping, consolidated billing conflicts, and insufficient diagnosis support. Each one has its own regulatory anchor and corresponding operational fix, which agencies must understand in order to protect revenue and remain compliant. Below, we look at these denial causes in detail and explain how to resolve them.

NOA Timeliness and Episode Establishment

Since January 2022, the one-time Notice of Admission (NOA) has replaced Requests for Anticipated Payment (RAPs). Under CMS guidance in MLN Matters MM12256, the NOA must be filed within five calendar days of the start of care. Missing this deadline doesn’t just reduce payment, it sets off denials that ripple through subsequent claims. Agencies that fail to integrate NOA submission into their intake process typically face chronic payment disruptions. The operational fix is to embed NOA submission into scheduling workflows and ensure acceptance is confirmed by the Medicare Administrative Contractor (MAC) before any visits are logged.

Face-to-Face and Certification Gaps

The physician’s face-to-face encounter is more than a box to check, it’s the legal backbone of home health eligibility. According to CMS’s F2F policy briefing, the F2F must occur within 90 days before or 30 days after the start of care, and its findings must explicitly support homebound status and skilled service need. Audits from the OIG show that missing or vague F2F narratives are one of the most common reasons for claim denials and recoupments. To resolve this, agencies should use structured F2F templates that prompt physicians to connect diagnoses with functional limitations, while also ensuring documentation is stored where billing staff can retrieve it during audits or Additional Documentation Requests (ADRs).

OASIS-E/E1 and PDGM Grouping Errors

Payment under PDGM is driven by case-mix classification, which relies heavily on OASIS-E/E1 assessments and diagnosis coding. Errors in these inputs can misclassify HIPPS codes and cause denials. CMS’s PDGM resources explain how functional impairment levels, comorbidities, and admission sources all determine payment. If OASIS responses don’t match therapy notes or physician evaluations, payers often flag the discrepancy. Agencies should conduct concurrent OASIS audits, reconciling functional scores with clinical notes before billing, and apply AHIMA’s CDI standards to ensure coding reflects documented patient conditions.

Consolidated Billing Conflicts

During a home health episode, bundled services and supplies must be billed by the HHA, not outside vendors. Errors here often lead to duplicate claims or improper denials. The CMS consolidated billing master list specifies which items are bundled, and contractors like Noridian publish operational billing examples. Agencies can prevent these denials by importing the CMS master list into their revenue cycle system and setting edits that flag bundled items before claims are submitted.

Diagnosis and Documentation Inconsistencies

Finally, diagnosis coding must be fully supported by clinical documentation. The CMS CERT program highlights insufficient documentation as one of the leading causes of improper Medicare payments, and in home health, this often surfaces as principal diagnoses not aligning with therapy or nursing notes. Implementing CDI reviews, modeled on AHIMA’s guidance, ensures that narrative records, OASIS assessments, and ICD-10 coding remain consistent and defensible under audit.

| Frequent Denial Cause | Why It Denies | Where to Fix It | Policy Anchor |

|---|---|---|---|

| NOA filed after day 5 | Medicare reduces payment for non-timely submissions | Place NOA in intake workflow and track accepted status before visits | CMS MLN Matters MM12256 explains the five-day rule and the reduction for late NOAs |

| Missing or weak F2F | Certification deemed invalid or non-supportive | Use a structured F2F template and secure signatures within allowed windows | CMS’s F2F briefing sets timing/content, OIG audits highlight F2F lapses |

| OASIS inconsistent with chart | PDGM misgrouping and HIPPS overrides | Audit OASIS vs. evals and early notes, correct before billing | OASIS-E manual and OASIS Data Sets guide items and updates |

| Consolidated items billed separately | Not separately payable during HH episode | Import CMS master list and pend conflicting HCPCS | CMS coding & billing hosts the master list, Noridian CB guidance explains vendor limits |

| Unsupported diagnoses/comorbidities | Documentation insufficiency and medical-necessity issues | Run CDI queries to align narrative and ICD-10 | CMS CERT data and AHIMA CDI show the standard |

How Denial Resolution Works in Practice

The fastest path to denial resolution is upstream. When you analyze a denial, start by classifying it as a timing, content, or classification failure. A timing defect like a late NOA is rarely curable on appeal, which is why CMS’s MM12256 matters most at intake. Content defects such as a thin F2F narrative may be remediable if the note exists but wasn’t submitted, if it never existed, adopt the CMS F2F elements as your template and train liaisons accordingly. Classification defects such as PDGM misgrouping can often be fixed by reconciling OASIS with the chart before final billing, CMS’s PDGM page is your technical map.

Pair denial categories with system checks. If consolidated-billing conflicts appear, refresh your item master from CMS’s HH consolidated billing master list so edits catch problems before submission. If MA/commercial payers require authorization evidence, ensure UM metadata lives in the EMR and is exportable for appeals, even though traditional Medicare home health often hinges on certification rather than prior auth.

Documenting The Denial Antidote

The single most powerful lever against home health denied claims is documentation built for audit. CMS’s Improper Payments overview underscores how often missing signatures, incomplete dates, or thin medical-necessity narratives drive errors. In practice, that means the F2F must explicitly support homebound status and skilled need, OASIS must echo the same functional and clinical story, and therapy/nursing evals must reinforce the diagnoses tied to HIPPS.

To make that stick, mirror CMS’s OASIS-E/E1 guidance in internal audits (review start-of-care OASIS against admission docs and early visit notes) and align your provider queries with AHIMA’s CDI best practices. If you need a ready operational sequence, adapt the PROMBS Medical Billing Audit Checklist for Providers to home health specifics so billing, coding, and clinical teams apply the same standards.

PDGM Nuances that Quietly Drive Denials

Two PDGM elements quietly shape outcomes. First, admission source and timing (community vs institutional, early vs late) directly affect case-mix, and CMS’s PDGM documentation explains how these variables flow into HIPPS. Second, functional impairment items on OASIS drive payment more than many teams expect, so inconsistencies between therapy notes and OASIS responses are red flags. Using CMS’s HIPPS code resource as a reference point, confirm that the system-calculated HIPPS aligns with the chart before final billing.

Consolidated Billing: Prevent Vendor and DME Conflicts

Denials often surface when a supplier bills a DME MAC for an item the HHA should include in its bundle. The cleanest fix is to have coordinators and billing staff check the Home Health Consolidated Billing Master Code List on CMS’s site before authorizing external supplies, and to orient vendors using Noridian’s consolidated billing guidance so expectations are set from day one.

Building a Denial-Resistant Workflow

A denial-resistant HHA relies on system design rather than heroics. Place the NOA in the intake path so scheduling can’t proceed without an accepted NOA (the standard set by MM12256). Use a structured F2F template that reflects CMS’s timing and content elements. Audit OASIS using OASIS-E/E1 guidance before billing. Import the CMS consolidated billing list into claim edits. Track first-pass rates, denial categories, and A/R days so leadership sees whether changes are working, the PROMBS audit is a practical way to structure those reviews.

Where Home Health Denials and Patient Protections Intersect

When patients are uninsured or choose to self-pay for services outside the benefit, the No Surprises Act’s good faith estimate expectations apply. Aligning financial communications to CMS’s NSA consumer guidance on “understanding costs in advance” reduces disputes and frees your denial-management bandwidth for genuine billing issues rather than preventable misunderstandings.

Preparing for Audits and Winning Them

When patients are uninsured or choose to self-pay for services outside the benefit, the No Surprises Act’s good faith estimate expectations apply. Aligning financial communications to CMS’s NSA consumer guidance on “understanding costs in advance” reduces disputes and frees your denial-management bandwidth for genuine billing issues rather than preventable misunderstandings.

Conclusion

Agencies that beat home health denied claims replace heroic appeals with predictable evidence chains. The NOA fires on day one because intake owns it and the scheduling system refuses to build visits without an accepted NOA, exactly as CMS requires in MM12256. The F2F is timely and specific because liaisons use a template that mirrors CMS’s documentation expectations. OASIS-E/E1 reflects the same functional realities therapists observe because clinicians and coders align on a single intake narrative and reconcile differences before the HIPPS code finalizes, following the grouping rules on CMS’s PDGM page and validating against HIPPS resources. The claim clears consolidated-billing screens because your rules engine consumes the CMS master code list and pends conflicts. And when denials do appear, your team answers quickly because documentation, assessments, and claim logic live together and are indexed to the episode.

That is the operational difference between firefighting and control. If you align workflows to CMS primary sources, NOA timeliness, F2F timing and content, PDGM/OASIS rules, and consolidated billing lists, you’ll see fewer adjustments, faster cash, and cleaner audits. Start with one episode: gate visits behind an accepted NOA, capture a CMS-compliant F2F, reconcile OASIS with early notes, screen supplies against the consolidated bill list, and confirm HIPPS before submission. Then make those steps non-negotiable for every patient. Within a few cycles, your first-pass rate will tell the story.