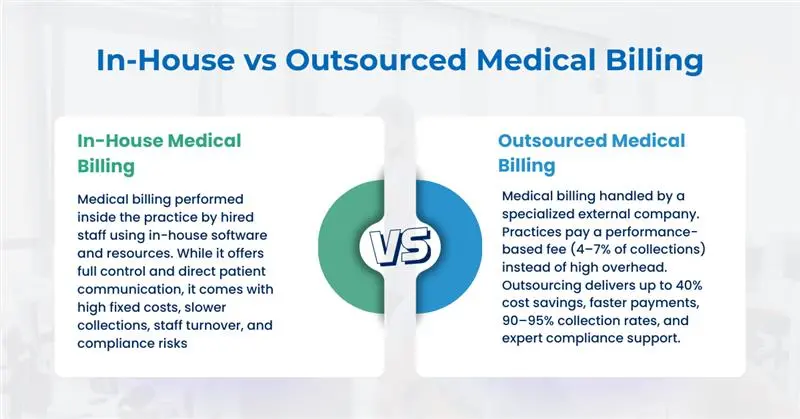

The debate around In-House vs. Outsourced Medical Billing has become one of the most pressing financial decisions for healthcare providers in 2025. With rising administrative costs, payer scrutiny, and complex compliance requirements, practices are under pressure to identify the most cost-effective and sustainable approach to medical billing.

This article provides an expert, data-backed comparison of In-House and Outsourced Medical Billing models, highlighting their financial, operational, and compliance impacts. Whether you are a solo provider, a specialty clinic, or a multi-location healthcare group, understanding the cost-benefit equation is critical to strengthening your revenue cycle management (RCM).

In-House vs. Outsourced Medical Billing: A Complete Comparison

1. Cost Savings & ROI: Crunching the Numbers

The central argument in the In-House vs. Outsourced Medical Billing debate comes down to cost efficiency.

- In-House Billing costs include staff salaries, benefits, training, billing software, clearinghouse fees, and compliance audits. The average U.S. medical biller’s salary ranges between $38,000 and $52,000 annually, with certified specialists often earning higher. These figures exclude recruitment and turnover costs. For smaller practices, these overheads significantly eat into margins.

- Outsourced Medical Billing fees are generally structured as a percentage of monthly collections (4–7% on average). Studies show outsourcing can reduce total billing costs by up to 40%, providing predictable, performance-based expenses instead of fixed overhead.

👉 According to Claimocity, the average cost-to-collect for In-House Billing is 13.7%, compared to just 5.4% for outsourced billing.

2 .Cash Flow & Revenue Cycle Efficiency

Beyond cost, cash flow determines practice sustainability. Outsourced Medical Billing firms typically offer:

- Faster Payments: Industry data shows that 88% of claims processed by outsourced firms are paid within 30 days, compared to 72% for In-House teams.

- Higher Collection Rates: Outsourcing often boosts collections into the 90–95% range, compared to 70–80% with internal staff.

- Stronger Denial Management: Professional billing teams track, appeal, and resubmit denied claims promptly, something many In-House teams struggle to prioritize.

By improving first-pass acceptance rates and aggressively following up on denials, outsourced billing directly strengthens a provider’s working capital.

3. Expertise, Compliance & Risk Mitigation

Compliance is another critical factor in the In-House vs. Outsourced Medical Billing debate.

- In-House risks: Internal staff often lack up-to-date knowledge of payer rules, ICD-10/CPT updates, and regulatory changes. Mistakes lead to increased denials, payer audits, or even fraud investigations.

- Outsourced expertise: Outsourcing to firms ensures access to certified coders and billing experts who are trained on the latest compliance standards (HIPAA, CMS guidelines, OIG audits). This minimizes errors and shields providers from costly penalties.

Outsourced Medical Billing firms also assume a portion of the liability for coding accuracy, reducing provider risk exposure.

4. Control, Customization & Patient Experience

One of the strongest arguments for In-House Billing is control:

- Practices maintain direct oversight of staff, workflows, and patient communication.

- In-House Billing staff can resolve disputes or clarify charges directly with patients, enhancing satisfaction.

- Internal teams can be more responsive to last-minute operational changes.

It’s also worth noting that many outsourced RCM firms now integrate patient support services, including call centers that handle statement clarification and balance inquiries, helping to preserve patient satisfaction even without direct in-house staff.

5. Scalability & Technology Integration

Scalability is where outsourcing truly excels:

- Flexible Costs: Outsourcing adjusts with claim volume. Practices avoid the costs of hiring, training, and scaling teams during growth or seasonal fluctuations.

- Advanced Technology: Outsourced Medical Billing providers bring access to enterprise-level RCM platforms, analytics, and denial tracking tools without requiring providers to invest in expensive systems.

- EHR Integration: Many vendors integrate directly with common EHRs, eliminating manual workflows.

👉 According to CPA Medical Billing, outsourced models not only scale faster but also integrate better with digital workflows, enhancing efficiency

In-House vs. Outsourced Billing: At-a-Glance Comparison

| Category | In-House Billing | Outsourced Medical Billing |

|---|---|---|

| Cost Savings & ROI | High fixed overhead from salaries, benefits, software, training, and compliance audits. Avg. cost-to-collect ~13.7%. | Fees based on % of collections (4–7%). Avg. cost-to-collect ~5.4%. Saves up to 40% in billing expenses. |

| Cash Flow & Collections | Payments slower. Avg. collections 70–80%. Only 72% of claims paid within 30 days. Denials often unresolved. | Faster cash flow. 90–95% collection rates. 88% of claims paid within 30 days. Strong denial management and follow-up. |

| Expertise & Compliance | Requires ongoing staff training to stay current with ICD-10, CPT, HIPAA, and CMS rules. High risk of errors and audits. | Certified coders trained on updates. Ensures HIPAA compliance, payer audit defense, and lowers provider liability. |

| Control & Patient Experience | Full oversight of workflows and patient communication. Staff resolve billing disputes directly. | Less direct control, but detailed reporting, transparency, and dedicated support offered externally. |

| Scalability | Scaling requires hiring, training, and software investment. Costly and slow to expand. | Costs adjust with volume. Scales easily without new hires or infrastructure. |

| Technology Integration | Practice must purchase and maintain billing software and clearinghouse tools. | Access to enterprise RCM platforms, analytics, denial tracking, and EHR integrations at no extra cost. |

How to Decide Between In-House and Outsourced Medical Billing

When evaluating In-House vs. Outsourced Medical Billing, practice leaders should follow a structured decision-making approach. The right choice depends on financial metrics, compliance needs, staffing capacity, and long-term growth objectives. Below are the most critical factors to analyze:

- Calculate the true cost-to-collect, including salaries, benefits, training, billing software, clearinghouse fees, compliance audits, and staff turnover. Compare this to outsourcing fees (typically 4–7% of collections) to determine cost efficiency and ROI.

- Review denial trends in your practice. High denial rates or poor follow-up can signal the need for outsourced billing, which often improves first-pass acceptance rates to 90–95%.

- Assess staffing capacity and expertise. In-House Billing requires continuous training on ICD-10, CPT, HIPAA, and payer rules. Outsourcing provides access to certified coders without ongoing internal training costs.

- Consider the impact on patient experience. In-House Billing staff can resolve disputes directly, while outsourcing shifts communication externally but provides transparency through reporting and support lines.

- Evaluate scalability and growth potential. In-House models demand hiring and new technology investments when patient volumes increase, while outsourcing scales seamlessly as costs adjust with claim volume.

Which Saves More Money: In-House or Outsourced Medical Billing?

When analyzing In-House vs. Outsourced Medical Billing, the numbers reveal a clear financial advantage for outsourcing. In-House Billing teams require fixed overhead for salaries, benefits, training, billing software, compliance audits, and staff turnover management. These factors drive the average cost-to-collect to 13.7%, meaning a significant portion of revenue is lost to administrative expenses.

By comparison, Outsourced Medical Billing operates on a performance-based fee model, typically 4–7% of monthly collections. According to industry data, outsourcing reduces the cost-to-collect to just 5.4%, generating cost savings of up to 40% for many practices. Beyond direct cost reduction, outsourcing also improves cash flow stability with faster claim payments (88% paid within 30 days vs. 72% in-house), higher collection rates (95% vs. 70–80%), and stronger denial management.

In short, while In-House Billing offers more control and direct patient interaction, outsourcing consistently saves more money by lowering administrative overhead, boosting claim acceptance, and scaling efficiently with practice growth. For most small to mid-sized providers, Outsourced Medical Billing is the more cost-effective model in 2025.

Conclusion

The evaluation of In-House vs. Outsourced Medical Billing demonstrates that while internal models provide direct control and closer patient interaction, they also come with high fixed costs, increased compliance risks, and scalability limitations. In contrast, outsourcing offers a performance-based structure with measurable improvements in cost-to-collect, denial reduction, and cash flow acceleration. By leveraging specialized billing expertise, advanced RCM platforms, and payer-specific compliance protocols, outsourced models create a stronger financial foundation for healthcare practices in 2025.

Ultimately, the decision rests on a practice’s size, growth objectives, and operational capacity. However, the data consistently shows that outsourcing maximizes efficiency and reduces long-term financial risk, especially for small to mid-sized groups. Practices that partner with an experienced billing company that not only reduce overhead but also achieve higher first-pass claim acceptance, improved compliance, and predictable revenue performance, critical elements for sustaining profitability in today’s healthcare environment.