What Are Offsets? (And Why Payers Use Them)

An offset is a financial action taken by the payer to withhold or deduct a portion of reimbursement from a current or future payment in order to recover a prior overpayment or resolve a contractual adjustment. Instead of requesting a traditional refund, payers often choose to apply offsets automatically.

Payers favor offsets because they bypass provider approval, require no additional processing time, and reduce their outstanding liabilities. Unfortunately, this approach leaves providers scrambling to match missing payments with unrelated claim lines on their remittance advice.

Where Offsets Show Up on Remits (And How to Spot Them)

Offsets are typically embedded within Electronic Remittance Advice (ERA) using specific CARC (Claim Adjustment Reason Codes) or RARC (Remittance Advice Remark Codes). Common examples include:

- CARC 45: Charges exceed fee schedule/maximum allowable.

- CARC 94: Processed in excess of charges submitted.

- RARC N620: Reimbursement adjusted due to prior overpayment.

These codes often appear without explanatory notes, making reconciliation more difficult, especially in high-volume billing operations.

How Offsets Disrupt AR Tracking

Offsets can significantly distort your AR (Accounts Receivable) tracking because they don’t reduce the charge in your billing system only the payment. This creates a mismatch: the system still shows a full charge with no payment against it, even though the payer applied an offset. As a result, these accounts appear unpaid even though they’ve already been partially or fully recouped.

This misalignment can lead to:

- False positives on aging reports, making it seem like claims are overdue.

- Unwarranted collections activity, where teams chase balances that aren’t actually due.

- Inflated AR values, which misrepresent your cash flow and financial performance.

- Misleading payer analytics, since true payment activity is hidden in offset adjustments.

The Connection Between Offsets and Denials

Offsets are not just financial deductions; they are operational triggers that introduce denial risk into unrelated claims. When an offset is applied to a current claim due to a past issue, the current claim may be underpaid or denied altogether.

These denial types are harder to appeal because they stem from past errors, such as:

- Unresolved recoupments.

- Coordination of benefits issues.

- Previously unrefunded overpayments.

AR and denial management teams must work together to spot these compound risks and assign root-cause ownership.

Common Payer Scenarios That Trigger Offsets

Offsets typically occur in response to:

- Medicare and Medicaid recoupment following post-payment reviews.

- Commercial plan adjustments after eligibility retro-terminations.

- Duplicate payments processed in error by the payer.

- COB errors when secondary insurers pay primary by mistake.

The challenge lies in linking the offset to the originating claim, especially if the original overpayment occurred months prior and is not clearly identified on the remit.

Offset vs Traditional Recoupment

| Feature | Offset | Refund/Recoupment |

|---|---|---|

| Initiated By | Payer | Payer or Provider |

| Processing Method | Deducted from current or future payments | Separate refund issued or requested |

| Notification Format | ERA line item or RARC/CARC codes | Letter of overpayment |

| Impact on Workflow | Inflates open AR until manually cleared | Less disruptive if proactively handled |

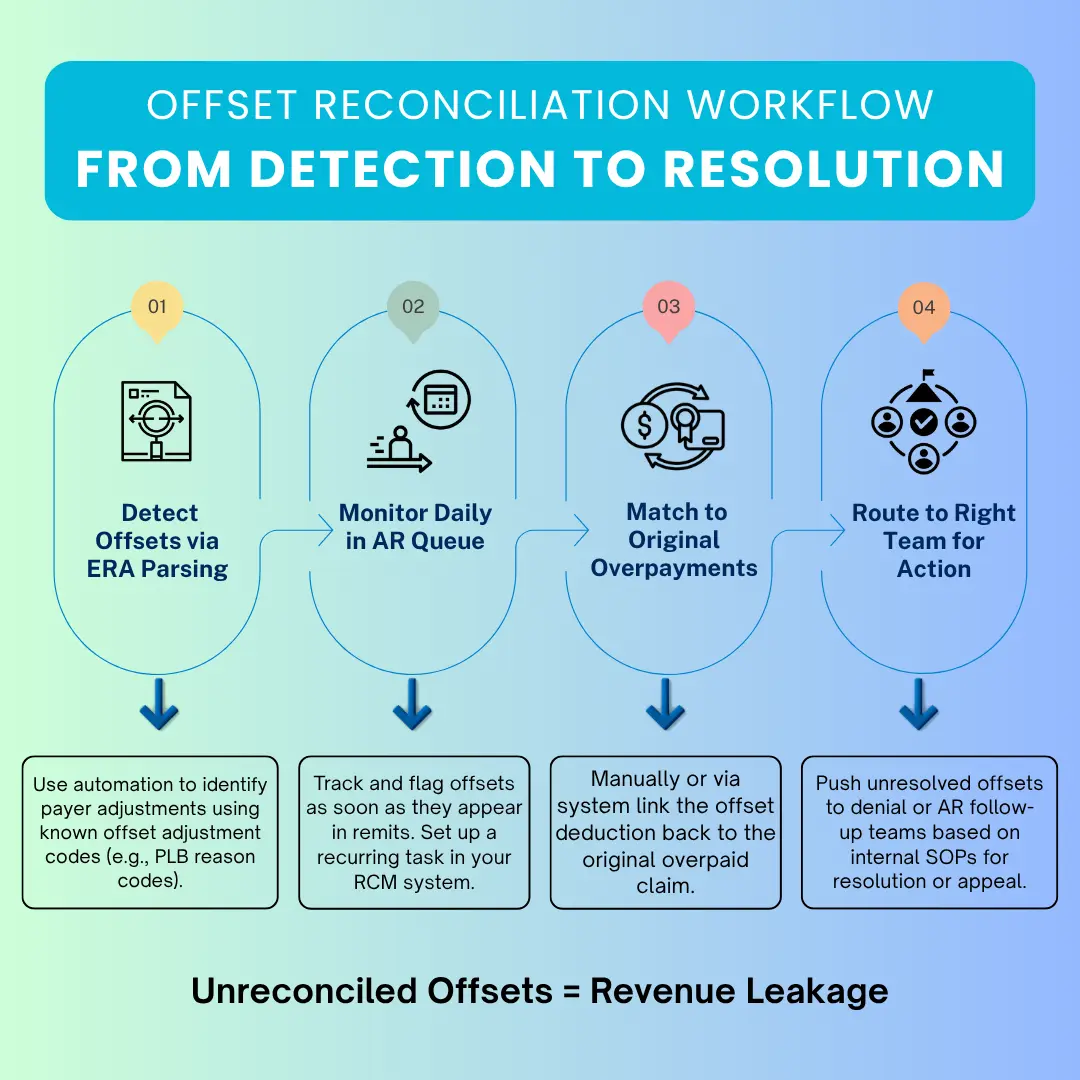

How to Reconcile Offsets Effectively

How Pro-MBS Helps Practices Manage Offset Risk

Our Pro-MBS team uses payer-specific offset trackers, automated posting logic, and smart denial routing workflows to ensure that offsets are reconciled before they damage your AR health. Whether you’re dealing with Medicare offsets or commercial payer deductions, we apply our deep payer knowledge and compliance systems to close the loop on every unpaid claim.

By integrating offset management directly into our denial and AR dashboards, we help providers reduce aging balances, minimize rework, and maintain audit-proof records.