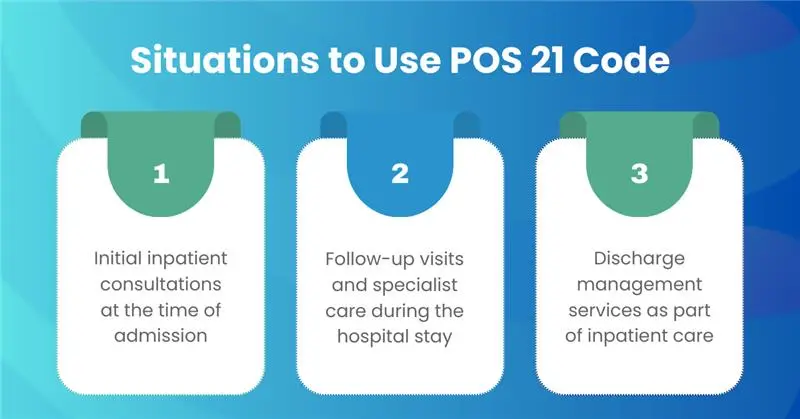

Inpatient hospital billing requires precision, and one of the most critical elements is the correct use of Place of Service 21. This code designates that services were provided to a patient formally admitted to a hospital for diagnosis, treatment, or rehabilitation.

While it may look like a simple two-digit entry on a claim form, POS 21 carries significant weight in determining how a service is reimbursed, how it is audited, and how compliant the claim will be under payer and CMS guidelines.

For providers and billing teams, understanding Place of Service 21 is not just about coding correctly, it’s about protecting revenue and ensuring claims move smoothly through the reimbursement cycle. In 2025, with payers applying more scrutiny and Medicare expanding the gap between facility and non-facility rates, accurate use of POS 21 has become an essential safeguard against denials, recoupments, and unnecessary delays in payment.

Why POS 21 Matters More Than Ever in 2025

In today’s billing landscape, a two-digit code like POS 21 can determine whether a claim is paid correctly or flagged for audit. With new reimbursement policies and stricter payer oversight, accuracy in POS reporting is directly tied to a practice’s revenue integrity.

- Rising payer scrutiny: Payers are tightening edits around inpatient claims, flagging POS errors as potential fraud or overpayment risks.

- Reimbursement shifts: Medicare’s 2025 updates have widened the gap between facility and non-facility rates making POS accuracy essential to protect margins.

- Audit environment: MACs and commercial payers now prioritize POS errors in audit selections, especially when CPT codes and POS don’t align.

- Cash flow impact: A single POS 21 mistake can cause rejections, underpayments, or lengthy delays, compounding AR management challenges.

Why is POS 21 Important for Providers?

POS 21 directly influences how payers process and reimburse claims. Because it determines whether a service is paid at the facility rate or non-facility rate, even a single coding error can mean significant revenue loss or overpayment. For inpatient services, the facility rate always applies, making correct POS selection essential for accurate compensation.

Beyond reimbursement, Place of Service 21 also acts as a compliance safeguard. Reporting it correctly shows payers that services match the patient’s admission status, reducing the risk of denials, audits, or recoupments. Since many payers automatically reject claims when POS doesn’t align with CPT codes or documentation, getting POS 21 right is key to protecting both revenue and compliance.

How Does POS 21 Differ from Other Hospital POS Codes?

| POS | Setting | When to Use | Don’t Use For |

|---|---|---|---|

| 21 | Inpatient Hospital | Patient is admitted and you deliver a professional service tied to that admission | ER-only care; observation/outpatient |

| 22 | On-Campus Outpatient Hospital | Hospital-based outpatient services, clinic/department on campus | Inpatient admits; ER |

| 19 | Off-Campus Outpatient Hospital | Hospital-owned off-campus clinics/departments | Inpatient admits; ER |

| 23 | Emergency Room—Hospital | ER encounters | Inpatient days after formal admission (then use 21) |

Impact of POS 21 on Claim Submission

Pricing Logic

The choice of POS 21 directly determines how Medicare and commercial payers price the service. Under the Medicare Physician Fee Schedule (MPFS), Place of Service 21 applies the facility rate, which assumes the hospital bears the overhead. Selecting the wrong POS can either undercut reimbursement or trigger overpayments that lead to recoupments.

E/M Family Selection

Evaluation and Management (E/M) coding is closely tied to POS reporting. For inpatient encounters, only the inpatient E/M family (99221–99239) aligns correctly with POS 21. If an office or outpatient E/M code is submitted with an inpatient POS, the claim will almost always be denied, creating unnecessary rework.

Audit Risk

Downstream A/R

Errors in POS selection frequently cascade into broader revenue cycle problems. A rejected claim delays payment, lengthens accounts receivable (AR) days, and burdens staff with resubmissions or appeals. Over time, recurring POS errors can significantly erode cash flow and strain practice operations.

Challenges Providers Face with POS 21

POS/CPT Incompatibility

ER vs. Inpatient Confusion

Another frequent challenge occurs when patients transition from the emergency room to inpatient status. Coders sometimes fail to update the POS from ER (POS 23) to Inpatient Hospital (POS 21) after admission. This oversight often leads to duplicate or conflicting claims and complicates reimbursement.

Remote Interpretations

In diagnostic services such as radiology or cardiology, coders occasionally report the provider’s physical location instead of the patient’s setting. For inpatient tests, the correct POS is the hospital inpatient environment not the physician’s office or remote workstation. This mistake leads to mispriced claims and payer rejections.

Documentation Gaps

Incomplete or unclear documentation is a persistent obstacle. If the patient’s admission status is not explicitly noted in the chart, payers may assume outpatient care and deny claims billed with Place of Service 21. Missing details such as admission date, unit, or discharge orders also raise red flags during audits.

Team-Based Care Complexities

Inpatient care often involves multiple providers hospitalists, surgeons, and specialists. Without clear documentation of each provider’s role, duplicate E/M billing can occur. Payers quickly flag two inpatient visits billed for the same day and patient, especially when both claims report POS 21 without distinct justification.

How to Avoid Common POS 21 Errors

Link to ADT Feeds

The most reliable safeguard is integrating Admission, Discharge, and Transfer (ADT) feeds directly from the hospital into your billing system. This ensures that patient admission status is automatically updated, preventing coders from mistakenly assigning outpatient or ER POS codes when the patient is already admitted.

Build Pre-Edits in Claim Scrubbers

Claim scrubbers should be programmed with POS/CPT compatibility rules to stop errors before submission. For example, the system should reject attempts to bill office-only CPT codes with POS 21. Automated edits like these dramatically reduce denials and keep claims clean on the first pass.

Continuous Coder Training

Because payer rules and CMS guidance evolve, coders need regular refreshers on inpatient E/M coding, POS rules, and payer-specific requirements. Quarterly training sessions keep staff updated, reduce knowledge gaps, and minimize repeated errors across the team.

Clear and Explicit Documentation

Providers should always document the admission status, hospital location, and their role in the patient’s care (attending, consulting, or specialist). These details not only justify the use of POS 21 but also provide evidence for compliance in the event of an audit.

Maintain a Payer Matrix

Every payer has nuances in how they handle inpatient claims. Keeping a live payer matrix that outlines inpatient billing rules, ER-to-admit scenarios, and documentation requirements ensures that coders and billers apply the right standards for each insurer.

Establish a Strong Audit Loop

Regular spot audits are critical to catching trends before they escalate. Reviewing inpatient claims for ER-to-admit transitions, duplicate consults, or improper CPT/POS combinations provides valuable feedback for process improvement and reduces future denial risk.

Conclusion

Correctly applying Place of Service 21 (Inpatient Hospital) is far more than a coding detail; it is a cornerstone of accurate reimbursement, compliance, and cash flow stability in 2025. With payers tightening edits and audits targeting POS errors, providers must ensure that every inpatient claim reflects the right setting, the right E/M family, and clear documentation of admission status.

By integrating ADT feeds, deploying scrubber edits, training coding staff, and maintaining payer-specific guidance, practices can eliminate costly mistakes and reduce denial risk. Ultimately, mastering POS 21 safeguards revenue integrity, strengthens audit resilience, and ensures that providers get paid accurately and on time for the care they deliver.