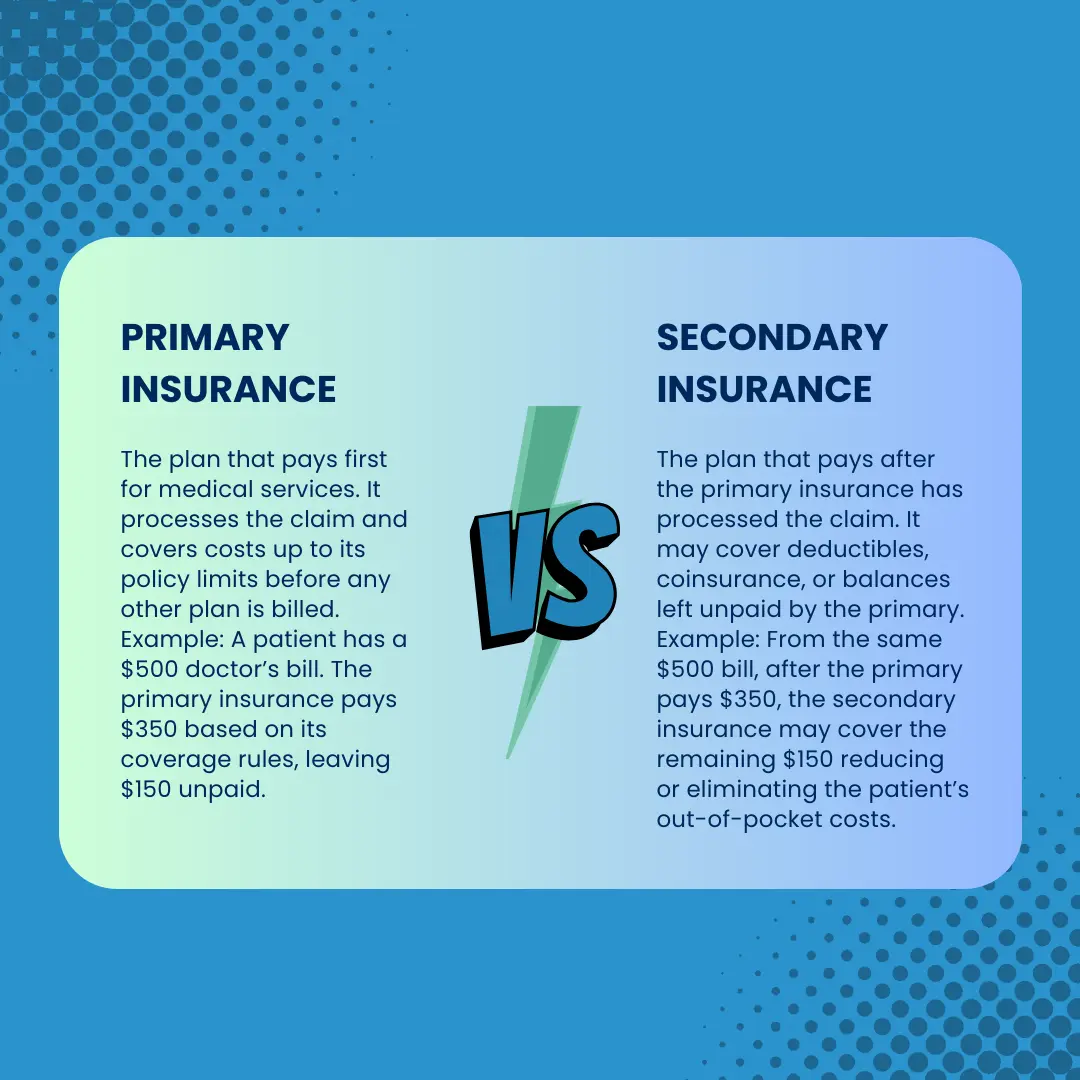

In medical billing, determining which insurance plan is primary and which is secondary is one of the most critical steps in ensuring claims are processed correctly. When a patient is covered by multiple health insurance plans, misidentifying the payer hierarchy can result in denials, payment delays, compliance issues, or even incorrect patient billing.

Primary insurance refers to the plan responsible for paying the claim first, while secondary insurance applies after the primary has adjudicated the claim. The sequence of responsibility is governed by coordination of benefits (COB) rules, which vary depending on factors such as patient age, employment status, and relationship to the policyholder.

What is primary insurance in medical billing?

Primary insurance is the health plan that takes first responsibility for covering medical expenses. It is always billed first, and its decision on payment sets the foundation for how the secondary plan processes the claim.

Examples of Primary Insurance

1- Employee Coverage: If the patient is actively employed, their employer-sponsored health plan is typically primary.

2- Medicare and Employer Coverage: For beneficiaries 65+ who are still working and have employer coverage, the employer plan is primary while Medicare is secondary.

3- Children’s Coverage (Birthday Rule): For children covered under both parents’ plans, the plan of the parent whose birthday (month/day) comes first in the calendar year is primary.

What is secondary insurance and how does it work?

Secondary insurance covers costs not fully paid by the primary plan. It cannot be billed until the primary insurer has processed the claim and provided an EOB.

Examples of Secondary Insurance

1- Spousal Coverage:

A married individual may have their own employer-sponsored plan as primary and their spouse’s plan as secondary.

2- Medicare Secondary:

- Medicare is secondary when a beneficiary is still working and covered under an active employer plan (subject to the 20+ employee rule, or 100+ for disabled beneficiaries).

- Medicare can also be secondary to certain liability or Workers’ Compensation claims, since those pay first for accident- or work-related services.

3- Supplemental Insurance:

Policies like Medigap are considered supplemental rather than full secondary plans. They specifically cover deductibles, coinsurance, or out-of-pocket costs left after Medicare has paid.

Primary vs. Secondary Insurance: Key Differences

At the core, the difference lies in who pays first and who follows. Below is a breakdown:

| Aspect | Primary Insurance | Secondary Insurance |

|---|---|---|

| Payment Order | Pays claims first before any other insurance | Pays only after primary has processed the claim |

| Coverage Responsibility | Responsible for the bulk of claim payment, up to plan limits | Covers remaining balances (deductibles, coinsurance, copays), if eligible |

| Billing Requirement | Provider must always bill this plan first | Provider bills after primary Explanation of Benefits (EOB) |

| Denial Impact | If denied due to eligibility/documentation, secondary usually won’t pay | Secondary requires primary adjudication first |

| Examples | Employer group plan for an employee | Spouse’s plan, supplemental insurance, or Medicare secondary |

| Compliance Risk | High – billing wrong primary leads to denials and compliance flags | Moderate – but still dependent on proper COB reporting |

How do you determine which insurance is primary?

Before you can submit any claim, you must first establish who pays first (primary insurance) and who pays second (secondary insurance). This process is governed by Coordination of Benefits (COB) rules, which every biller must master to prevent denials and keep your practice compliant.

Below is a breakdown of each step in detail

Step 1: Gather Complete Insurance Information During Registration

Before applying any COB rules, you need accurate, up-to-date insurance details. This step should always happen at every patient encounter (not just the first visit).

What to ask patients:

- “Do you currently have more than one health insurance plan?”

- “Who is the policyholder for each plan; yourself, your spouse, or a parent?”

- “Is your coverage from a job, a government program, or a private plan?”

- “Has anything changed recently with your job, marital status, or insurance?”

Why this matters: Many patients don’t volunteer this information. They may not realize that a spouse’s employer plan, a retiree plan, or even COBRA coverage still counts. Missing just one card can derail the entire COB process.

What to record in the system:

- Effective dates for each policy

- Policy and group numbers

- Relationship to subscriber (self, spouse, child, dependent)

- Type of coverage (employer, retiree, COBRA, Medicaid, TRICARE, etc.)

Pro Tip: Always request all insurance cards, even if the patient insists one plan is “the only one that matters.” Patients often forget about secondary or supplemental coverage.

Step 2: What are the rules for employer-sponsored insurance vs. Medicare?

Once you have the insurance cards, the first question is: Does the patient have coverage through an employer?

If the patient has two employer-sponsored plans:

The plan through the patient’s own employer is primary.

The plan through a spouse’s employer is secondary.

Example:

Amanda has coverage from her own employer and is also covered under her husband James’s plan.

- Amanda’s employer plan = Primary

- James’s employer plan = Secondary

If the patient has employer coverage and Medicare:

If the employer has 20 or more employees, the employer plan is primary and Medicare is secondary.

If the employer has fewer than 20 employees, Medicare is primary and the employer plan is secondary.

Example:

Mr. Hill, 67, works for a company with 15 employees. He has employer coverage and Medicare.

- Medicare = Primary

- Employer Plan = Secondary

✅ Pro Tip: Always verify employer size. Medicare Secondary Payer (MSP) audits often focus on this exact detail.

Step 3: What is the birthday rule for dependent children?

If a dependent child is covered under both parents’ insurance, the birthday rule applies:

👉 Standard Rule:

The parent whose birthday (month/day, not year) falls earlier in the calendar year provides the primary plan.

The other parent’s plan is secondary.

Example:

Parent A’s birthday = February 15

Parent B’s birthday = July 9

→ Parent A’s plan = Primary

If the parents are divorced or separated:

If a court order exists, that parent’s plan is primary.

If no court order, the custodial parent’s plan is primary.

If the custodial parent has remarried:

- Custodial parent’s plan = Primary

- Step-parent’s plan = Secondary

- Non-custodial parent’s plan = Tertiary

✅ Pro Tip: Always ask for custody documentation if applicable. Insurance companies will often request proof when determining COB for dependent children.

Step 4: How is COBRA or retiree coverage treated in insurance billing?

COBRA and retiree insurance are two of the most misunderstood areas in COB sequencing. Many patients assume these plans function like regular employer coverage, but in billing, they follow very different rules. Misclassifying them as primary when Medicare or an active employer plan should be billed first will almost always result in denials and rework.

👉 COBRA Coverage

What it is:

COBRA (Consolidated Omnibus Budget Reconciliation Act) allows individuals to temporarily continue their employer health coverage after leaving a job, usually for 18–36 months.

Billing Rule:

If the patient has COBRA and another active plan, COBRA is always secondary.

If COBRA is the only coverage, it must be billed as primary but with caution. COBRA is continuation coverage, not active employer coverage. It can terminate mid-month if premiums are missed, and many payers require ongoing verification to confirm it’s still active.

Example:

- Patient A leaves her job but elects COBRA coverage. She is also covered under her husband’s active employer plan:

- Husband’s employer plan = Primary

- COBRA = Secondary

- Patient B leaves her job, elects COBRA, and has no other insurance:

- COBRA = Primary (but must be reverified frequently to prevent denials).

Why this matters:

COBRA is not treated as “active” coverage under COB rules. If billed incorrectly as primary when another plan exists, the claim will be rejected. When it is the only plan, claims may still be denied if coverage expired, so eligibility verification is critical.

What to verify at registration:

- Ask: “Is your insurance through a current employer or COBRA continuation?”

- Confirm COBRA’s effective date and expiration date.

- Keep a copy of the COBRA election notice or insurance card.

- Always recheck COBRA eligibility before submitting claims, since coverage lapses are common.

👉 Retiree Coverage

What it is:

Retiree plans are health benefits offered by some employers or unions to former employees. They function like supplemental coverage once the patient is no longer actively working.

Billing Rule:

If the patient is retired and has Medicare, Medicare is primary, and the retiree plan is secondary.

Retiree coverage is never primary when Medicare eligibility exists.

Example:

- Mr. Davis, age 72, retired five years ago and has both Medicare Part A/B and retiree coverage from his old employer.

- Medicare = Primary

- Retiree plan = Secondary

Why this matters: Retiree coverage supplements Medicare but does not replace it. Many patients believe their retiree plan is “like job insurance,” but in billing, it is automatically secondary once Medicare is in place.

What to verify at registration:

Ask: “Is this coverage from your current job, or is it a retiree plan?”

Document whether the plan is active employee coverage or retiree coverage. This distinction is critical.

Retiree plan details should always be entered in the EHR as secondary, even if the patient insists otherwise.

Step 5: How do government insurance programs like Medicaid, TRICARE, and Workers’ Compensation determine payer order?

Government insurance programs have strict COB rules that are enforced nationally. Unlike commercial plans, there is very little flexibility: these programs are either always secondary or always primary in certain situations. A single misstep here can lead to compliance violations and large claim rejections.

👉 Medicaid

Always the payer of last resort.

It only pays after all other insurance options have been billed and adjudicated.

Medicaid never pays primary even if the patient insists they “only use Medicaid.”

Example:

Patient has both employer insurance and Medicaid.

- Employer plan = Primary

- Medicaid = Secondary

What to verify at registration:

Always ask: “Do you have Medicaid in addition to any other coverage?”

If yes, flag Medicaid in the system as secondary or tertiary to prevent incorrect billing.

👉 TRICARE

What it is:

TRICARE provides health coverage for active-duty military members, retirees, and their eligible family members.

Billing Rule:

- Active-duty members: TRICARE is always primary, unless the claim is for a work-related injury covered by workers’ compensation or liability insurance.

- Non-active-duty beneficiaries: TRICARE is generally secondary to other active employer-sponsored insurance.

- Exception: If the other plan provides coverage only for dental or vision, TRICARE remains primary for medical care.

If no other health plan exists, TRICARE is billed as primary.

Example:

- Patient is an active-duty service member with TRICARE and employer insurance:

- TRICARE = Primary

- Employer plan = Secondary (only if relevant for dental/vision overlap).

- Patient is a military spouse with employer insurance and TRICARE:

- Employer insurance = Primary

- TRICARE = Secondary

Why this matters:

Many denials occur when TRICARE is incorrectly billed as primary for non-active-duty family members who have employer coverage. Understanding this distinction prevents rejections and ensures compliance with TRICARE coordination of benefits rules.

What to verify at registration:

- Ask: “Are you active-duty military or a dependent/retiree?”

- Confirm if other coverage exists and whether it is medical, dental, or vision only.

- Record active-duty status in the EHR to apply correct COB sequencing.

👉 Liability Insurance (e.g., Auto, Personal Injury)

Always primary for accident-related claims.

This includes auto insurance, homeowners’ policies, or liability carriers covering injury.

Health plans only pay after liability coverage is exhausted or denied.

Example:

Patient is in a car accident and has both auto insurance and employer insurance.

- Auto insurance = Primary

- Employer insurance = Secondary

- Medicaid (if present) = last.

What to verify at registration:

Ask: “Is this visit related to an auto accident or personal injury claim?”

Collect claim number, attorney information, and liability carrier details.

What steps help identify the correct secondary insurance?

Once you’ve established which plan is primary, identifying the secondary insurance becomes the next step. Secondary insurance is not just “what’s left over.” It has specific roles defined by Coordination of Benefits (COB) rules, payer contracts, and federal regulations. The secondary plan only processes claims after the primary has adjudicated them.

Here’s a detailed step-by-step guide:

Step 1: Confirm the Existence of Another Active Plan

Before billing secondary, you need to confirm whether the patient has another active plan in addition to the primary coverage.

What to ask the patient:

“Besides the plan we marked as primary, do you have any other coverage?”

“Are you covered under your spouse’s, parent’s, or retiree insurance?”

“Do you have any supplemental or Medicaid coverage?”

Why this matters: Patients often forget about “secondary” policies like Medigap, COBRA, or Medicaid. If these are missed, balances may be wrongfully billed to the patient, creating compliance issues.

What to record in the system:

- Name of secondary payer

- Subscriber details and relationship

- Policy and group numbers

- Effective dates

Example:

Patient has an employer plan (primary) and is also covered under their spouse’s plan. The spouse’s plan must be recorded as secondary to capture uncovered costs after the primary pays.

Step 2: Review the Explanation of Benefits (EOB) from the Primary Insurance

The secondary insurer will not pay until the primary has issued an EOB or electronic remittance advice (ERA).

Why this matters:

The Explanation of Benefits (EOB) from the primary insurer is essential because it shows exactly what has been paid and what remains the patient’s responsibility, such as deductibles, coinsurance, or non-covered services. Secondary insurers use this as the baseline to decide their share, and if a claim is submitted without the EOB attached, it almost always leads to an automatic denial.

Example:

A $1,000 claim is submitted to the primary insurer. The EOB shows they paid $700, leaving $300 as patient responsibility. That $300 is then billed to the secondary plan, which may cover all or part of it depending on benefits.

What to record in the system:

- EOB denial/approval codes

- Remaining balances by category (deductible, coinsurance, copay, non-covered)

- Attach EOB to the secondary claim submission

If using electronic billing, make sure your practice management system is configured to automatically attach the 835 (remittance advice) from the primary to the secondary submission.

Step 3: Check for Supplemental Coverage

Not all secondary plans work the same way. Some are true secondary insurance, while others are supplemental coverage (like Medigap).

Types to look for:

Medigap (Medicare Supplement Plans): Covers copays, coinsurance, and deductibles left by Medicare.

Secondary Employer Coverage: If the patient is covered under both their own and their spouse’s plan.

Spousal or Dependent Coverage: Common for families.

Example:

Mrs. Allen has Medicare as her primary coverage and Medigap Plan F as secondary. After Medicare pays its share, the Medigap plan automatically picks up the remaining balance.

What to record in the system:

When documenting insurance details, it is important to identify whether the secondary plan is a supplemental policy, such as Medigap, or a true secondary insurer. Supplemental policies usually operate differently from standard commercial plans, often requiring unique claim submission processes and having specific coverage rules. Recognizing this distinction ensures accurate billing and prevents unnecessary denials.

Step 4: Apply the Medicaid Rule

Medicaid follows one of the strictest COB rules in healthcare: it is always the payer of last resort.

Billing Rule:

Medicaid is secondary or tertiary if any other coverage exists.

Medicaid will deny a claim outright if it is billed as primary when another insurance is active.

Example:

- Patient has employer insurance, Medicare, and Medicaid. The order is:

Employer Plan = Primary

Medicare = Secondary

Medicaid = Tertiary (last)

What to record in the system:

Medicaid eligibility must be checked on a monthly basis since coverage can lapse frequently. It is essential to correctly note Medicaid as secondary or tertiary in the system to ensure claims are routed properly. Always run real-time Medicaid eligibility verification before submitting a claim, as many denials occur when Medicaid is mistakenly billed as secondary after a patient’s eligibility has ended.

Step 5: Verify Plan Provisions and Coverage Limits

Not all secondary plans cover everything left by the primary. Some plans will pay deductibles but not coinsurance, or exclude certain services altogether.

Why this matters:

Submitting uncovered balances to secondary can result in repeated denials.

Knowing in advance prevents wasted claim cycles and ensures accurate patient responsibility.

Example:

- Primary plan leaves $500 in deductible and $200 in coinsurance.

- Secondary plan covers only coinsurance, not deductible.

- Secondary pays $200, leaving $500 as patient responsibility.

What to record in the system:

Billers should clearly distinguish which balances can be transferred to the secondary payer and which must be billed directly to the patient. Configuring billing rules within the EHR helps prevent submission of non-covered balances, reducing avoidable denials and ensuring accurate patient responsibility.

What tools can billers use to determine primary vs. secondary insurance?

Insurance coordination is one of the most common causes of claim denials. To avoid errors, billers rely on a mix of eligibility systems, payer portals, clearinghouses, intake tools, and compliance forms. Each tool plays a role in confirming whether a plan is primary or secondary.

1. Eligibility Verification Tools (Real-Time)

Web-based systems that pull live data directly from payer databases to confirm active coverage, COB indicators, and effective dates. These are often the first stop for front-desk and billing staff.

Common Platforms:

- Availity (BCBS, Aetna, Humana, etc.)

- Experian Health

- Office Ally

- Navinet (Independence, AmeriHealth)

- Waystar Eligibility

How it helps:

By instantly checking a patient’s status, these tools reduce guesswork. They display whether a plan is marked active or inactive, provide the exact effective and termination dates, and highlight COB indicators such as “Other coverage exists” or “Secondary to Medicare.” This ensures staff know upfront which payer should be billed first, avoiding the costly mistake of sending claims in the wrong order.

2. Insurance Company Portals (Direct Payer Access)

Provider portals offered by individual insurance companies for checking eligibility, coverage details, and COB status. These are considered the most accurate source since they pull data directly from the payer.

Common Portals:

- UnitedHealthcare Provider Portal

- Cigna for Health Care Professionals

- Aetna Payer Space (via Availity)

- Blue Cross Blue Shield Direct/Availity Portals

- Medicare MAC portals (Noridian, Novitas, Palmetto GBA, etc.)

- State Medicaid portals

How it helps:

Logging in to the payer portal allows billers to see the hierarchy of plans when multiple insurances exist. For example, a patient with both Aetna and Medicare may have Aetna listed as the primary plan in the insurer’s records. Portals also provide past coverage history, COB notes, and sometimes copies of recent COB questionnaires submitted by patients. This gives staff the most reliable confirmation of payer sequencing.

3. Clearinghouses

Intermediary systems that transmit claims and eligibility transactions between providers and payers. Many clearinghouses offer batch COB verification tools.

Common Clearinghouses:

- TriZetto

- Waystar

- Change Healthcare

- Office Ally

- Claim.MD

- Navicure (Waystar)

How it helps:

Clearinghouses go beyond simple claim routing, they also return payer response codes that reveal COB conflicts. For example, a response might state “Plan listed as secondary to another policy,” alerting staff before the claim is rejected. They also allow batch eligibility checks for patients with multiple coverages, making them valuable for larger practices with high patient volumes. Integration with EHRs means COB flags can appear before a claim even leaves the system.

4. Patient Intake & EHR Tools

EHR-integrated eligibility modules and digital intake systems that capture patient insurance details at registration. These combine automation with direct patient input.

Common Tools:

- Epic (insurance sequencing fields, MSP integration)

- Athenahealth

- Kareo / Tebra

- Luma Health

- Mend

- Medifusion

- IntakeQ / SolutionReach

How it helps:

EHRs can be configured to include fields that mark payer order, while intake forms prompt patients to disclose secondary coverage, Medicare status, or recent insurance changes. For example, a self-check-in kiosk may ask if the patient has new coverage from a spouse’s employer. These inputs prevent missed or outdated COB information that automated eligibility checks alone may not catch.

5. Medicare Secondary Payer (MSP) Questionnaire

A CMS-required questionnaire that must be completed for all Medicare beneficiaries at every visit. It establishes whether Medicare is primary or secondary based on federal MSP rules.

Common Versions:

- CMS Standard MSP Form

- Medicare MAC-provided forms (Novitas, Palmetto, Noridian, etc.)

- EHR-embedded MSP forms (Epic, NextGen, AdvancedMD)

- Custom provider registration forms synced with compliance policies

How it helps:

This questionnaire ensures Medicare is billed correctly according to federal MSP rules. For instance, if a patient is still actively employed with group coverage, the form confirms Medicare must be billed as secondary. Completing the MSP form protects providers from denials tied to non-compliance and keeps billing aligned with federal requirements.

6. CAQH (Council for Affordable Quality Healthcare)

A centralized credentialing and data repository used by payers and providers. While mainly used for provider credentialing, some COB and coverage data sync through CAQH.

Common CAQH Tools:

- CAQH ProView

- Linked payer portals synced with CAQH data

- Payer credentialing/eligibility integrations

How it helps:

CAQH ensures provider and practice details are consistent across multiple insurers, which indirectly improves COB accuracy. Some payers also update patient COB data through CAQH synchronization. This alignment reduces the risk of mismatched records that lead to claim rejections, ensuring cleaner claims and fewer delays.

What are common mistakes when determining primary and secondary insurance?

Even experienced billers can make errors when applying Coordination of Benefits (COB) rules. These mistakes often lead to denials, rework, and patient dissatisfaction. Below are the most common pitfalls to watch out for:

1- Assuming Medicare Is Always Primary

Many providers mistakenly bill Medicare first, but in cases where the patient has an active employer group health plan, Medicare is secondary. For example, a 68-year-old patient working full-time with employer coverage has their employer plan as primary not Medicare.

2- Overlooking Dependent Coverage Rules

When children are covered by both parents, the “birthday rule” applies. The plan of the parent whose birthday falls earlier in the calendar year is primary. Ignoring this rule often leads to denials from both payers.

3- Not Collecting Complete Patient Information

Patients may forget to mention supplemental coverage such as Medigap or COBRA. Failing to verify this at registration causes delays, since secondary payers will deny claims until the primary EOB is attached.

4- Confusing Supplemental Plans with Secondary Insurance

Supplemental coverage, like Medigap, is designed only to pick up deductibles and coinsurance left after Medicare not to act as a full secondary payer. Submitting all leftover balances incorrectly results in repeated denials.

5- Ignoring Medicaid’s Payer-of-Last-Resort Rule

Medicaid never pays first if another active plan exists. Billing Medicaid as primary is an automatic denial and can be flagged as a compliance issue.

Conclusion

Determining primary vs. secondary insurance is not just an administrative step, it’s the backbone of clean claim submission and timely reimbursement. Every mistake in payer sequencing can ripple into denials, delayed payments, compliance risks, and frustrated patients. By applying COB rules correctly, confirming details at registration, and leveraging tools like eligibility portals, clearinghouses, and MSP questionnaires, providers can reduce guesswork and secure faster payments.

The key is accuracy and consistency: always gather complete patient insurance information, verify coverage in real time, and document payer hierarchy thoroughly in the EHR. Remember that Medicare is not always primary, Medicaid is always the payer of last resort, and COBRA/retiree plans follow very different rules from active employer coverage.

In practice, the best defense against COB-related denials is a proactive workflow asking the right questions upfront, confirming payer rules before submission, and using integrated billing tools that flag potential conflicts. When providers get this right, patients are protected from balance billing errors, payers receive compliant claims, and practices achieve smoother cash flow with fewer reworks.