What Are Superbills?

A superbill is a detailed, itemized document used in healthcare billing to capture all the information required for accurate claim submission to insurance payers. It serves as a bridge between the clinical encounter and the medical billing process, ensuring that every service provided is documented with the correct coding for reimbursement.

Superbills are not standard insurance forms; rather, they are internal, provider-generated documents that summarize a patient’s visit. Once completed, the information from the superbill is entered into the practice management or billing system to create a claim (often an electronic CMS-1500 for professional services).

Who Creates Superbills?

Superbills are typically created and completed by healthcare providers such as physicians, nurse practitioners, physician assistants, or therapists immediately after or during the patient encounter. In some cases, clinical staff (e.g., medical assistants or scribes) may assist in populating non-clinical details.

The provider is responsible for ensuring accuracy of diagnosis codes (ICD-10) and procedure codes (CPT/HCPCS) on the superbill, as these directly impact reimbursement and compliance.

Why Are Superbills Needed?

Superbills are essential because they:

- Provide a Complete Record of Services Rendered: Including diagnoses, procedures, and other billable services.

- Ensure Accurate Medical Coding: Minimizing claim rejections or denials caused by incomplete or incorrect documentation.

- Facilitate Faster Claims Submission: Acting as the source document for billers to create payer-compliant claims.

- Support Compliance: Properly documented superbills help meet payer requirements, HIPAA standards, and audit-readiness protocols.

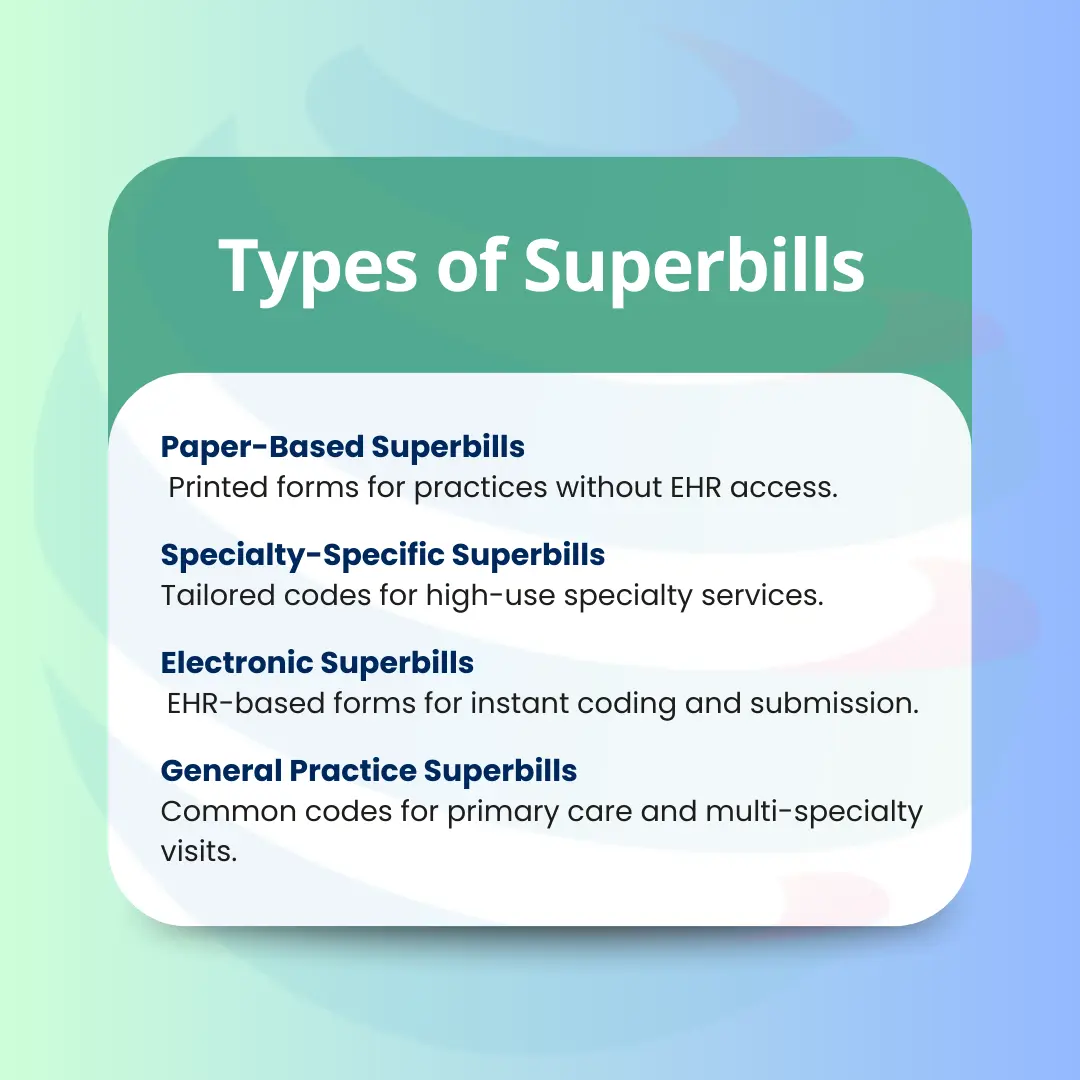

Types of Superbills

1-General Practice Superbills

Used in primary care or multi-specialty practices.

Contains common CPT/HCPCS codes for office visits, preventive exams, and basic procedures.

2- Specialty-Specific Superbills

Customized to reflect high-frequency services in a given specialty (e.g., Cardiology: ECG, stress tests; Gastroenterology: colonoscopy, EGD).

Improves efficiency by reducing the time spent searching for codes.

3- Electronic Superbills

Integrated into an Electronic Health Record (EHR) system.

Allows for real-time coding, drop-down selections, and direct claim submission.

4- Paper-Based Superbills

Physical forms still used in smaller practices or in situations where EHR access is unavailable.

When to Use Superbills

Superbills are most commonly used in outpatient and ambulatory care settings where providers need a quick, structured way to capture charges for services rendered. They are particularly valuable in practices without fully integrated EHR systems or where the clinical documentation process is separate from billing.

They are also used in scenarios where claims need to be submitted to non-contracted insurance payers or for out-of-network patients. In these cases, the patient may submit the superbill directly to their insurance company for possible reimbursement, making accuracy and completeness critical.

Step-by-Step Process of Creating and Using a Superbill

Step 1 – Patient Demographics

The first thing on any superbill is patient identification. This includes:

- Full legal name (as it appears on their insurance card)

- Date of birth (DOB)

- Complete contact information like address, phone, and email

- Insurance details including name of the payer, plan type, group number, policy number, and in some cases, the payer’s contact address for claims

Why it matters:

If even one digit in the policy number is wrong or the name doesn’t match the insurance record, the claim will get rejected before it even reaches processing. This step ensures the billing department starts with accurate, payer-verified patient details.

Step 2 – Provider Information

This section identifies who provided the care and ties the services to the correct rendering and billing provider. It must include:

- Provider’s full name and credentials (e.g., MD, DO, NP)

- NPI (National Provider Identifier) is a unique 10-digit number required by HIPAA for all healthcare providers

- Practice or facility name

- Practice address and contact information

Why it matters:

Insurance companies use the NPI to verify the provider’s credentials, specialty, and network status. If this data is wrong, the payer may deny payment or route funds incorrectly.

Step 3 – Date and Type of Service

Every superbill must clearly state:

- The exact date the service was provided (MM/DD/YYYY)

Type of encounter, for example:

- Office visit

- Telehealth consultation

- Inpatient hospital visit

- Outpatient surgery

- Emergency department visit

Why it matters:

Dates and encounter types determine coverage, claim timelines, and in many cases, the correct CPT/HCPCS coding. Some payers have time-based restrictions (e.g., one annual wellness visit per year), so accuracy here prevents denials.

Step 3 – Date and Type of Service

Every superbill must clearly state:

- The exact date the service was provided (MM/DD/YYYY)

- Type of encounter, for example:

- Office visit

- Telehealth consultation

- Inpatient hospital visit

- Outpatient surgery

- Emergency department visit

Why it matters:

Dates and encounter types determine coverage, claim timelines, and in many cases, the correct CPT/HCPCS coding. Some payers have time-based restrictions (e.g., one annual wellness visit per year), so accuracy here prevents denials.

Step 4 – ICD-10 Diagnosis Codes

This section contains the “why” behind the services rendered.

- ICD-10 codes are diagnosis codes that describe the patient’s condition(s) or reason for the visit.

- Each diagnosis must justify the medical necessity of the procedures performed.

- Example: If you bill for a stress test but list an unrelated ICD-10 code, the payer will likely deny it as “not medically necessary.”

Why it matters:

Diagnosis codes are not just administrative, they are legal documentation of why a patient received care. Using incorrect or non-specific ICD-10 codes can trigger payer denials, recoupments, or even compliance audits.

Step 5 – CPT/HCPCS Procedure Codes

This is the “what” the actual services, tests, and procedures performed during the visit.

- CPT codes (Current Procedural Terminology) describe medical, surgical, and diagnostic services.

- HCPCS Level II codes cover supplies, non-physician services, and equipment.

- Codes must match the services provided and the skill level required to perform them.

Why it matters:

The CPT/HCPCS section drives payment amounts. If you forget to list a service, it won’t be billed, meaning lost revenue. Overcoding or undercoding can lead to compliance issues or payment delays.

Step 6 – Modifiers (if applicable)

Modifiers are two-character codes that provide additional context for CPT/HCPCS codes.

Examples:

- Modifier 25 – Significant, separately identifiable E/M service on the same day

- Modifier 59 – Distinct procedural service

- Modifier 91 – Repeat clinical diagnostic lab test

Why it matters:

Modifiers prevent automatic claim rejections caused by payer edits (like NCCI bundling rules). If you perform multiple related services on the same day, modifiers explain why those services should still be reimbursed separately.

Step 7 – Charges and Units

This section shows:

- Charge amount for each service

- Units like how many times the service was performed

Example:

- CPT 97110 (Therapeutic exercises) – 2 units

- CPT 93000 (ECG) – 1 unit

Why it matters:

Units directly affect reimbursement. Billing for the wrong number of units can cause overpayment (leading to clawbacks) or underpayment (lost revenue).

Step 8 – Provider Signature

A superbill is not valid unless signed by the rendering provider.

- Wet signature – physically signed on paper

- Electronic signature – authorized via EHR

Why it matters:

The signature confirms that the provider reviewed the documentation and attests that the services listed were medically necessary and performed as documented. Missing signatures can delay claims or cause denials.

Step 9 – Submission to Billing Department

Once the superbill is complete, it is forwarded to the medical billing department or billing company. They:

- Verify all codes, modifiers, and charges

- Enter the data into the practice management system

- Submit the claim electronically (via EDI) to the payer

Why it matters:

The billing department relies entirely on the superbill for claim creation. If the superbill is incomplete, the claim will either be delayed or sent out incorrectly, increasing the risk of denials and slowing cash flow.

Process note: EDI (Electronic Data Interchange) is the standard method for transmitting claims to payers; however, some carriers such as certain worker’s compensation programs or smaller insurance companies may still require paper claim submissions.

Advantages of Superbills

1) Efficiency

Superbills centralize all billing-related data including patient demographics, provider details, diagnoses, and procedures into one ready-to-use form. This eliminates back-and-forth between providers and billing teams for missing information.

When integrated into an EHR, electronic superbills streamline coding through preloaded code lists and templates, enabling same-day charge submission and reducing administrative bottlenecks in the revenue cycle.

2) Accuracy

By linking the “why” (ICD-10 codes) and the “what” (CPT/HCPCS codes) in one place, superbills minimize coding errors that lead to denials. They also include modifier prompts to ensure correct claims submission.

Accurate superbills improve the clean-claim rate, prevent mismatched code denials (like CO-11), and ensure compliance with payer-specific rules for medical necessity. Accurate superbills also reduce rework time for billing staff, directly improving the practice’s cash flow cycle.

3) Compliance

A completed superbill creates a verifiable audit trail, documenting who rendered the service, the exact date, procedures performed, and diagnoses justifying medical necessity. This makes it easier to meet HIPAA and payer compliance requirements.

It also serves as a safeguard against compliance risks such as upcoding, undercoding, and post-payment recoupments, especially during payer or OIG audits.

4) Customizability

5) Supports Revenue Cycle

A well-structured superbill ensures every billable service, supply, and procedure is documented, preventing missed charges and improving overall revenue capture.

Better charge capture leads to fewer write-offs, faster reimbursements, lower denial rates, and healthier key revenue metrics such as days in A/R and net collection rate.

Disadvantages of Superbills

1) Risk of Outdated Codes

2) Human Error

3) Specialty Limitations

4) Paper-Based Delays

Physical superbills require manual handoff from the provider to the billing team, which introduces delays especially if the forms are misplaced, damaged, or left incomplete.

In contrast, electronic superbills within an EHR system can be transmitted instantly, reducing lag time and improving claim turnaround speed.