Any person holding a health insurance plan would have surely heard about EOB in Medical Billing. There are several crucial reasons both from the perspective of providers and patients to thoroughly know about EOB.

- And how is it related to Medical Billing

- What does EOB stand for in medical terms?

- What is EOB in healthcare?

As a Medical term, it stands for Explanation of Benefits. EOB in Medical Billing serves as a bridge between patients, insurers, and providers. For an insurer, it serves as a document detailing services and goods covered for a patient under a specific health insurance plan. It takes the patient into confidence by sharing details of the services covered by their health insurance policies. It helps providers by identifying billing errors in claims and enables them to fix these discrepancies to avoid claim denials.

What is EOB in Medical Billing?

EOB is a document that an insurance company sends to a covered patient, sharing details of the medical treatment and the services paid on his behalf. It explains the services’ costs, how much was covered by the insurance, what the patient is responsible for paying, and any discounts applied.

Is An EOB a Bill? Should I pay for it?

Not at all, Explanation of Benefits (EOB) is a tool not a bill. You need not pay anything for it. Based on the care you received; it is a report informing of health plan benefits for that care and what your insurance plan is going to cover. If there is an amount mentioned in the EOB that you owe, your doctor will share a separate bill for the portion you need to pay. It creates transparent financial transactions between the patient and insurer informing the latter if the doctor charging more than EOB or what he deserves.

Why Is EOB Essential for Healthcare Providers?

EOB in health insurance has a significant role. It is an essential document provided by insurance companies that outlines the services delivered to a patient, how much the patient has to pay to the provider, and how much the insurance company pays.

Here Are the Major Reasons Why EOB is Essential for Healthcare Providers

Ensures the accuracy of the services provided

EOBs detail all the services a patient receives from the provider. Reviewing this document ensures accuracy that all the services the healthcare provider provided to the patient are noted and there is no error, such as no services were included that the doctor did not provide. In this way, EOB ensures double-edged benefits both for patients to avoid fraudulent claims and for providers to avoid overcharges, resulting in higher patient satisfaction.

Identifies Mistakes in Billing and Insurance

EOB helps healthcare providers draw comparisons between the actual payment a patient pays and the medical bill issued by an insurance company. Providers can cross-check the insurance details and billing information. If there is any mismatch or inconsistency between these two, healthcare providers can address the issues. So, EOBs help providers fix insurance and billing errors.

Facilitates Financial Options and Payment Plans

In case of unexpected extra charges, healthcare providers, by using EOBs can review the cost. If the bills are too high for immediate payment, it helps providers easily discuss and negotiate multiple payment options such as setting up payment plans or exploring other financial options.

Records Documentation for Appeals and Disputes

When a patient appeals to a decision made by the insurance company, he clarifies tax deductions or disputes a charge from the provider related to medical expenses. In such cases, EOBs help providers in sorting out the confusion of the patient. EOB in healthcare contains a complete record of the charges and services necessary to help in appeals and disputes.

Complies with Tax Regulations

EOBs can be used for tax-related purposes to verify medical expenses, especially when patients itemize deductions for healthcare costs on their tax returns. It can be important to ensure providers comply with tax regulations and claim the correct amounts regarding medical expenses.

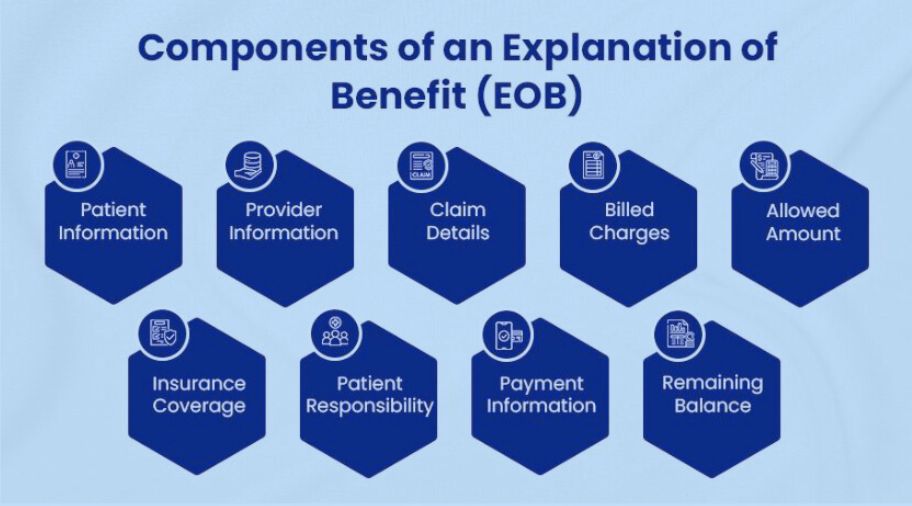

Components of an Explanation of Benefits (EOB)

There are several components of the Explanation of Benefits (EOB). Each contains a comprehensive overview of the claim and its financial effect.

Patient Information: This section includes the policyholder’s name or insured individual, address, policy number, and other relevant details.

Provider Information: This section consists of the name, address, and contact number of the healthcare provider who provided the services.

Claim Details: This consists of the services provided and claim denials, such as the service date, the description of the treatment or procedure, the claim, and the billing codes.

Billed Charges: The EOB shows details of the total charges billed by a healthcare provider for the services provided. This amount includes the insurance coverage and, the initial cost of the medical care before any adjustment.

Allowed Amount: The insurer aims to cover the highest possible amount for the services provided. This amount is negotiated between the healthcare provider and the insurance company or based on the fee schedule of the provider.

Insurance Coverage: The bill charges that an insurance company covers include coinsurance, deductibles, copayment amounts, and applicable limitations or exclusions.

Patient Responsibility: This is the amount that the patient has to pay out-of-pocket. This may include deductibles, copayments, coinsurance, or any remaining balance after the insurance company’s payment.

Payment Information: This section includes the information on the payment made by the insurance company to the provider. It includes the payment date, the amount paid, and any adjustments or write-offs applied.

Remaining Balance: This shows the remaining amount that the patient has to pay. This includes the patient’s share of the allowed amount, non-covered services, or other outstanding charges.

The Workflow of an EOB

Patient Visit

- EOB workflow starts the movement you visit the clinic for a doctor’s appointment and receive any service like a diagnostic test, routine checkup, etc.

- The provider documents the patient’s details including the reason for the visit, diagnosis made, or treatment provided.

Services Rendered

- Based on the patient’s health needs, the provider performs necessary medical services.

- The providers ensure that all the services provided are medically necessary and correctly documented in the patient’s medical records.

Claim Submission

- The healthcare provider or billing office compiles a detailed bill for the services provided and sends it to the insurance company of the patient via a clearinghouse.

- The provider submits all the essential service codes, patient details, and required documentation accurately.

Processing by Insurance

- Once the insurance company receives the claim, it processes it to assess the coverage and the amount payable.

- The healthcare provider may need to provide additional information to the insurance company or respond to queries if required.

EOB and Payment Issued

- The insurance company, after processing the claim, issues an insurance EOB to the provider, which shares details of what has been covered, any deductions, and the final amount paid. Payment is typically made by electronic funds transfer (EFT) or check.

- Review insurance EOB for accuracy, ensure EOB details match the payment, and fix any discrepancies with the insurance company.

Why I Get Multiple Insurance EOBs?

It can be confusing but it isn’t something unusual. Sometimes members might have a single medical procedure but receive multiple EOBs.

When you use insurance for something involving more complications than just an office visit, there can be many providers or doctors involved in your care. Some of these healthcare providers are behind the scenes. The medical procedures they provide you may be sent to insurance and individual payment requests.

EOB example: if you have surgery, it is a complex procedure that involves many healthcare providers for your care. The doctor, anesthesiologist, the lab that administers your bloodwork, and the outpatient center or hospital where your care was received are all part of your care team.

Some aspects of the care may be grouped. Other payment requests may be sent separately. This results in multiple insurance EOBs.

However, it is important to make sure that the total amount of your insurance EOBs should match the doctor’s bill.

Understanding EOB in Medical Billing for Financial Reasons

It is important to understand the role of EOB in Medical Billing as misunderstanding can lead to confusion over insurance coverage and bill payment, resulting in financial implications and stress for patient stress. Understanding EOB avoids complications and ensures financial clarity.

What If I Don’t Get an EOB?

If you have an insurance plan and the doctor’s office you visited for medical treatment has your insurance information, they generally submit the insurance claim for you. But if they don’t have that accessibility or you visit an out-of-network provider, you will need to submit the claim yourself. In that case, you may get a bill from your healthcare provider or doctor before you get an Explanation of Benefits (EOB).

There are also other situations where you may not receive an EOB. For instance, many HealthPartners plans don’t send an EOB if they know a member does not need to pay anything.

Either way, it is important to avoid paying your hospital or clinic bill until you receive an EOB for that service. In this way, you feel confident that you are paying what you owe.

Of course, if you have any questions regarding EOB or you feel the doctor charging more than EOB, call Member Services at your insurance company. They are happy to help you figure out what you owe.

What is the Difference Between EOB and ERA and how do we receive it from Insurance?

There is no denying the fact that Medical Billing is a complex process involving numerous steps and documents. Among these complications, two terms that are often interchangeably used are ERA and EOB. However, healthcare providers must understand the difference between them.

Difference between EOB and ERA

EOB and ERA are both related Medical Billing terms and contain information about payments and claims, there are significant differences between the two.

Purpose: The basic purpose of the EOB is to provide patients with details about the amount they owe for medical treatment and to explain how insurance benefits were applied. The ERA is a document that is sent to healthcare providers, and its basic purpose is to provide detailed information about claim status and payment processing.

Recipient: ERA is sent to the provider, while EOB is sent to patients.

Format: usually, the EOB is a paper document that is sent to patients via email, while ERA is a digital document that is electronically sent to healthcare providers.

Content: The EOB provides details about the services provided, the amount paid by the insurance company, the amount charged, and any amounts owed by the patient. The ERA provides information about the payment amount, the reason for any denials or adjustments, and the date of payment.

Timing: Typically, EOB is sent after the claim has been processed, while the ERA is sent to providers in near real-time after a claim has been processed.

How does Understanding the Difference Between EOB and ERA Make a Difference?

It makes a huge difference for healthcare providers, insurance companies, and patients to understand the difference between EOB and ERA. Healthcare providers need to track the status of their claims and reconcile their accounts receivable, which is done through the ERA. On the other hand, patients need to understand the costs related to their medical treatment and how their insurance benefits are applied, which they can do through EOB.

Final Thought

There is no denying the reality that the explanation of benefits (EOB in Medical Billing) has a crucial role. It provides healthcare providers with a roadmap to effectively navigate billing issues such as claim errors, inaccurate insurance details, etc. For patients, it is important to save and review it until they get the final bill from the provider. After receiving it, match the amount with both documents, if they match proceed with payment. If there is any inconsistency, contact the billing department to fix it.

Partnering with an industry-leading and reliable organization like Pro Medical Billing Solutions is the most productive choice to streamline your payment posting process.

In a nutshell, the explanation of benefits (EOB in Medical Billing) makes financial transaction procedures more convenient and transparent, enabling you to focus only on providing exceptional patient care, which is the top priority of every healthcare provider.

FAQs

What is an Explanation of Benefits (EOB) in Medical Billing?

An Explanation of Benefits (EOB) is a statement provided by your health insurance company after a medical claim is processed. It outlines the services you received, the amount the insurance paid, any amounts you owe, and whether there are any adjustments or denials. It helps you understand how your claim was handled and what you’re responsible for paying.

Why did I receive an EOB when I didn’t pay for anything?

You receive an EOB regardless of whether you paid for the service or not. The EOB is for informational purposes and is sent to show how the insurer processed the medical claim. It details the payment made by the insurance company and outlines what, if any, remaining balance you need to pay (like co-pays, deductibles, or co-insurance).

How do I read my EOB?

Reading an EOB involves understanding several key sections:

- Service Description: Lists the medical services you received.

- Amount Billed: The total amount the healthcare provider billed for services.

- Amount Covered by Insurance: The amount the insurer will pay.

- Your Responsibility: This shows any remaining balance you owe, such as deductibles, co-pays, or co-insurance.

- Adjustments or Denials: Details if any portion of the claim was denied or adjusted.

What does it mean if a service was denied on my EOB?

If a service was denied on your EOB, it means the insurer did not approve payment for that particular service. Denials can occur for several reasons, such as the service being outside of the plan’s coverage, missing information, or the service being deemed medically unnecessary. You can contact your insurance provider to appeal the denial or clarify why it was rejected.

How can I dispute an EOB or medical bill?

If you believe an EOB or medical bill contains errors, you can take the following steps:

- Review the EOB carefully to check for mistakes like incorrect dates or charges.

- Contact your insurance company to ask about discrepancies or ask for clarification.

- Reach out to the healthcare provider if you believe they billed you incorrectly.

- If the issue is unresolved, you can file an appeal with your insurer or request a review of the claim.

How does Pro Medical Billing Solutions Manage EOB for you? Pro Medical Billing Solutions is one of the most prominent billing companies in the U.S. Our extensively experienced and qualified staff saves a great deal of healthcare providers’ time by timely identifying denials and errors, reconciling EOBs with practice’s billing system, improving overall revenue cycle management, and enhancing patient satisfaction.