Unified claim templates are transforming how hospitals, clinics, and billing teams manage claims. If your organization still uses different templates for each payer, you’re likely wasting time and losing revenue. Multiple formats mean more rework, denials, and compliance risks.

These templates fix that problem by creating one clear and consistent format for claim submission across all payers, specialties, and practice locations. Instead of switching between multiple forms, your billing team can use a single structure that includes every important detail such as patient information, provider identifiers, diagnosis codes, and payer specific requirements. This consistency helps reduce data entry mistakes, improves communication between billing and coding teams, and keeps every claim aligned with CMS and HIPAA guidelines. In this guide, you will learn how to design unified claim templates that reduce errors, improve accuracy, and help your organization submit cleaner claims on the first try.

The Importance of Unified Claim Templates

Why are unified claim templates so important for healthcare billing teams?

These templates act as a single, standardized structure for medical claim submission. They ensure that every required field, from patient demographics to provider identifiers, follows a consistent format that meets CMS and HIPAA requirements. When healthcare organizations use fragmented templates, small inconsistencies lead to big problems. Missing taxonomy codes, invalid modifiers, or incomplete provider data can cause claim denials and slow reimbursement.

According to HFMA, healthcare organizations that use standardized claim templates see up to 28 percent fewer rework cases compared to those using multiple formats. This improvement happens because data is entered consistently across every claim, reducing the need for manual corrections and follow-ups. With fewer errors to fix, billing teams spend less time reprocessing claims and more time on timely reimbursements, which leads to faster payments and a smoother revenue cycle overall.

Key benefits of unified claim templates include:

- Consistent data across all payers and specialties

- Fewer denials and rejections

- Better compliance with CMS and HIPAA standards

- Faster payment cycles and improved accuracy

By creating one standardized framework for claim submission, you make it easier for every team member to follow the same process. Each claim includes the right information in the right place, no matter who prepares it. This consistency ensures claims are accurate and complete before they ever reach the payer.

Problems with Non-Standardized Claim Templates

What happens when claim templates aren’t aligned across your organization?

When hospitals or clinics rely on different templates for each department or payer, billing quickly becomes disorganized. Staff have to switch between formats, remember separate data rules, and manually adjust information to fit each payer’s requirements. These small inconsistencies pile up, creating confusion, delays, and a higher chance of costly claim errors.

Common issues include:

- Payer-specific field variations that cause submission mismatches

- Missing NPI or taxonomy codes not aligned with CMS rules

- Incorrect modifiers or place-of-service codes that violate AMA CPT guidelines

- Duplicate data entry across EHR and billing systems

- Conflicts between CMS-1500 and UB-04 formats

According to MGMA, inconsistent or nonstandard claim data is one of the main reasons behind payment delays and revenue loss in healthcare billing. When claim information isn’t formatted the same way across payers, even small differences can cause denials or hold up payments. Each inconsistent template adds extra work for billers, slows down processing, and increases the risk of claims being rejected for reasons that could have been avoided.

How to Create a Unified Claim Template

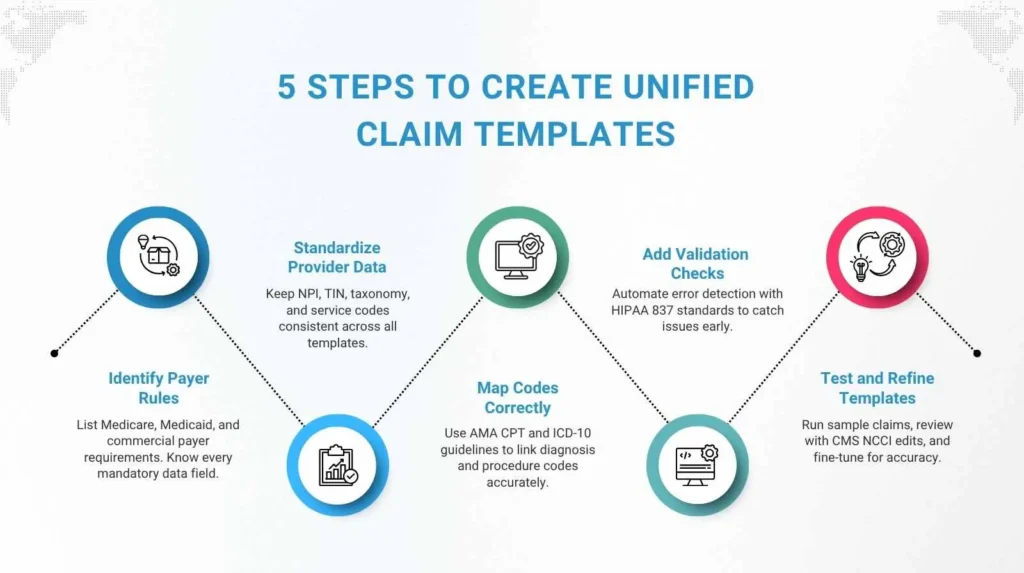

Step 1: Identify payer-specific requirements

Start by listing every field rule from Medicare, Medicaid, and commercial payers. Reference the CMS Internet-Only Manual (IOM 100-04) to confirm mandatory data elements for Medicare claims. Take time to understand how each payer formats data, as even small differences in field structure or code validation can lead to denials later.

Step 2: Standardize provider and location data

Ensure all identifiers such as NPI, TIN, taxonomy, and place of service codes are consistent across every template. Validate these details using NPPES, the official provider registry maintained by CMS. This step ensures that provider details remain accurate and uniform, reducing errors that come from inconsistent data entry.

Step 3: Map CPT and ICD-10 codes accurately

Use the official AMA CPT and CDC ICD-10-CM guidelines to align diagnosis and procedure codes properly. This prevents invalid code pairings that often lead to denials. When these mappings are standardized, your billing team spends less time correcting coding issues and more time ensuring timely submissions.

Step 4: Add validation logic

Include automated checks for missing, invalid, or incomplete data before a claim is sent. Follow HIPAA 837 electronic transaction standards to ensure your templates meet compliance. Setting up these automated rules helps your system flag issues early, saving time and avoiding unnecessary rejections.

Step 4: Add validation logic

Include automated checks for missing, invalid, or incomplete data before a claim is sent. Follow HIPAA 837 electronic transaction standards to ensure your templates meet compliance. Setting up these automated rules helps your system flag issues early, saving time and avoiding unnecessary rejections.

Step 5: Test and refine using real claims

Sample Unified Claim Template Layout

| Field Name | Required Format | Source System | Validation Rule |

|---|---|---|---|

| Patient Name | Last, First | EHR | Mandatory |

| Provider NPI | 10-digit numeric | Provider Master | Must match taxonomy |

| ICD-10 Code | A00.0–Z99.9 | Coding Module | Valid combination with CPT |

| CPT Code | 5-digit numeric | Billing System | Required for each service |

| Payer ID | 5-character alphanumeric | Payer Table | Auto-filled via API |

Using Technology to Streamline Template Creation

Can technology really simplify claim template design? Yes, and it’s often the missing link between manual chaos and automated accuracy. Modern RCM platforms and clearinghouses now offer tools that make it easy to build and maintain unified templates. Automation allows billing systems and EHRs to stay synchronized. APIs can pull provider data directly into claim forms, reducing manual work and human error.

Technology-driven benefits include:

- Real-time data syncing between EHR and billing platforms

- Automatic field validation for payer IDs and NPIs

- Centralized version control for template management

- Seamless compliance with CMS and HIPAA standards

Platforms such as Availity, Office Ally, and Change Healthcare help healthcare practices create unified billing claim templates that reduce manual re-entry and ensure clean, compliant claims every time.

Maintaining Accuracy and Compliance

How can you make sure your templates stay accurate and compliant?

Creating unified claim templates is only the first step toward a truly efficient billing system. Payer rules, CMS updates, and state Medicaid policies are constantly changing, and those shifts can quickly make existing templates outdated. To stay compliant and prevent denials, your templates need to evolve alongside regulatory and payer updates, ensuring that every claim you send meets the latest standards.

To stay compliant and up to date:

- Audit templates quarterly using CMS Program Integrity Manual guidelines

- Track updates from Medicare Administrative Contractors (MACs)

- Offer staff training through AAPC and AHIMA programs

- Keep detailed change logs to document revisions

According to the HIPAA Journal, healthcare organizations that perform regular audits see claim rejection rates drop by more than 20 percent. These reviews help identify gaps, outdated fields, or missing compliance elements before they become costly errors. Consistent governance, combined with ongoing staff training, ensures that your templates always reflect current payer rules and regulatory requirements, keeping your claims accurate and compliant year-round.

Key Benefits of Unified Claim Templates

Hospitals and clinics that move to a single unified billing claim form template see clear, measurable improvements across their entire revenue cycle. What real improvements can your organization expect after implementation? Standardizing the claim format not only streamlines submission but also enhances accuracy, reduces administrative workload, and accelerates payment processing.

Typical outcomes include:

- 99% clean claim rate, as reported by HFMA

- 30% fewer resubmissions due to validation rules

- Shorter AR cycles and faster payments, according to MGMA

- Easier onboarding for new billing staff

- Improved reporting and analytics using standardized claim data

When claim data follows a consistent structure, every department can work with greater efficiency and confidence. Billing teams spend less time correcting errors, coders have the right information upfront, and administrators gain clearer visibility into financial performance. This consistency leads to higher accuracy, faster reimbursements, and stronger overall revenue results.

Why Every Practice Should Adopt Unified Claim Templates

Unified templates bring consistency and reliability to a process that often feels chaotic. Unified claim templates eliminate confusion, reduce compliance risk, and streamline the entire billing cycle. By aligning your claim forms with CMS, AMA, and HIPAA standards, your organization gains better control over data accuracy and payment timelines. It’s a simple operational change that produces long-lasting financial and compliance benefits.

Pro-MBS can help you design and implement unified claim templates tailored to your organization’s needs. Our experts specialize in reducing denials, improving compliance, and streamlining workflows for hospitals, clinics, and multi-specialty practices. Take the next step toward cleaner and faster claim submissions.

FAQs

What is a unified claim template in medical billing?

A unified claim template is a standardized format used in medical billing to submit claims to all payers. It ensures consistency, improves billing accuracy, and keeps every claim compliant with CMS and HIPAA standards.

Why do hospitals and clinics need standardized claim templates?

Hospitals and clinics need standardized claim templates to eliminate confusion and reduce claim errors. Using unified claim templates keeps data consistent across payers, increases the clean claim rate, and speeds up reimbursements.

How do unified claim templates reduce claim errors and denials?

Unified claim templates reduce errors by organizing key details like patient data, provider identifiers, and payer requirements into one structure. This improves billing accuracy and supports smoother RCM workflows with fewer denials.

What information should be included in a unified claim template?

A complete unified claim template includes patient demographics, provider NPI, taxonomy codes, CPT and ICD-10 codes, payer ID, and validation rules. These fields help maintain CMS compliance and accurate claim submissions.

How often should claim templates be reviewed and updated?

Claim templates should be reviewed every quarter to stay up to date with CMS compliance guidelines, payer requirement changes, and HIPAA standards. Regular updates prevent claim denials and keep billing efficient.

What are the main payer requirements to consider when creating templates?

The main payer requirements for unified claim templates include accurate NPI and taxonomy codes, correct CPT and ICD-10 mapping, and adherence to HIPAA 837 standards. Following these ensures complete CMS compliance.

Can unified claim templates work across multiple EHR and billing systems?

Yes, unified claim templates can integrate across multiple EHR and billing systems. Automation tools and APIs make it easy to sync data, maintain consistency, and ensure clean claim submissions across all payers.

How does automation improve the claim template creation process?

Automation simplifies unified claim template creation by validating data, syncing payer information, and catching missing details before submission. This increases billing accuracy and helps achieve higher clean claim rates.

What compliance standards must unified claim templates meet?

Unified claim templates must comply with CMS billing rules, AMA coding guidelines, and HIPAA privacy standards. Meeting these compliance requirements ensures accurate, secure, and fully approved claim submissions.