Introduction

Opening a medical bill can make you feel anxious.

The healthcare system involves many complications and is hard to understand. You may want to ignore the doctor bills that keep coming to you.

But you don’t need to be scared!

It is a fact that not paying medical bills can negatively impact your credit score and money situation later on.

In this article, we will discuss with facts what happens if you don’t pay medical bills.

I will share with you the real stories of the people who have also gone through this.

Rest assured, you are not alone. By the end of the article, you get tips on how to dispute a medical bill and how unpaid medical bills can affect your credit score and money. But above all, we will talk about the most convenient and efficient ways to effectively deal with it, so you don’t feel too worried. There is no such thing in a situation to lose hope – there are multiple ways to handle it.

Let’s delve deep together to find out the most relevant solution to it. I want you to be confident, not afraid. We can do this! We will discuss step by step the method of how to dispute a doctor’s bill and much more.

What is Medical Debt?

Medical debt means owing money for hospital and doctor bills you have not paid for the services you received. Such situations emerge in the circumstances when your medical expenses are more than you can pay out of your pocket. Unpaid medical bills can create medical debt and pile up fast.

Why People Get Medical Debt

There are several reasons behind people getting into medical debt. Health insurance plans with high deductibles and high medical costs make it hard to pay for medical care. It becomes worse for those with long-term health issues or emergencies. Besides, losing income or a job can also make it tough to pay medical bills. Getting bills, all of sudden and unexpected from out-of-network doctors or for uncovered services can also create unexpected debt. At the same time, it is also equally important to learn how to dispute medical charges that will help you navigate complex billing challenges.

How Medical Debt Hurts

Medical debt can negatively impact finances and life. Unpaid bills can hurt credit scores which makes it harder for one to rent an apartment, get a loan, or find a job. In extreme cases, it can lead to property liens, wage garnishment, or even bankruptcy. Debt-related stress can also harm physical and mental health. Ahead, we will talk about how you can dispute medical bill issues.

The Shocking Reality of Medical Debt in the U.S

Medical debt is increasingly becoming a serious dilemma for the millions of Americans who face it each day. According to the Kaiser Family Foundation report, American citizens are currently carrying more than $220 billion in medical debt. Between no or inadequate insurance and the steadily increasing healthcare cost, medical debts reach the point where many feel like they are drowning in it. It has been observed that people facing debt cut spending on medications, clothing, food, and other necessities while simultaneously borrowing money from friends or draining their savings. If you are currently struggling with medical debt, understand that you are not the only one, millions of Americans are facing it. It is more common than you can think. Over $140 billion in unpaid medical debt is affecting millions of U.S., citizens. What is more important is that medical debt is the number one source of outpacing credit cards, debt collections, utilities, and auto loans.

Do Hospitals in the U.S. Deny Medical Care to Patients Who Lack Insurance or Are Unable to Pay Their Medical Bills?

No, it is not true that if you can not pay for your medical bills, hospitals in the U.S. will leave you to die. Even if you cannot pay, there is a law that says hospitals must provide emergency medical care to everyone who needs it. This is called the Emergency Medical Treatment and Labor Act (EMTALA).

If you go to the emergency room, under this law, the hospitals must treat you and make you stable, even if you cannot pay for the treatment or don’t have insurance. The hospitals cannot refuse to treat you and let your condition deteriorate just because you cannot afford treatment. Law obligates hospitals to provide emergency treatment which is also the right thing to do.

However, later on, you may have to face problems will bills later on. The hospital will send you bills to pay but at the same time, many hospitals understand that medical expenses are hard for some people to pay. That’s why they have special financial assistance programs such as the Pfizer Patient Assistance Program and the Affordable Care Act (ACA), to help make the bills easier to pay.

Eligibility Verification Factor

The most important thing for a patient is to talk to the hospital about your situation. Avoid ignoring the bills. Have a discussion with them to find out if you qualify for any help or relaxation, and try to make a plan to pay what you can afford. Bear in mind that unpaid bills can hurt your credit score. But the hospitals have no legal option denying you treatment just because you cannot pay.

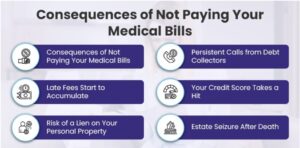

Consequences of Not Paying Your Medical Bills

Unpaid medical bills can cause lots of problems. If you decide to choose the path of not paying medical bills that are due, it means you are setting yourself on the path that takes you to money troubles. However, it is crucial to get help to manage your bills to prevent yourself from long-lasting consequences.

If you don’t pay your medical bills, here are some things that can happen to you:

Higher Interest Rate

As we earlier said, there are economic pitfalls for those not paying medical bills. If you don’t pay, the medical debt that you owe keeps growing bigger. The doctor or hospital will send your unpaid medical bills to a collection company or medical bill dispute agency. Once your bills reach to collections company, they will add interest charges and extra fees, making your debt much larger. Surrounded by financial burdens, many patients are seen looking for ways to find out how to fight a hospital bill.

For instance, the yearly interest rate of some collection companies on unpaid medical bills is 25%. That means originally you owed $1,000 but did not pay for one year, you would then owe $1,250! The $250 is extra they added from 25% yearly interest. The bill that was easy to manage quickly became too much to handle.

Many hospitals work with credit card companies to medical bills. If miss payment or forget to pay on one of those cards, they charge you over 20% of the full amount you owe. In this way, your debt soon ends up out of your control.

So, it is important to prioritize paying medical bills on time. The extra fees and interest can turn a small debt into a huge debt that spirals out of control. You can prevent yourself from these extra costs by paying bills right away.

Persistent Calls from Debt Collectors

If miss your hospital bill payment, you will get lots of calls from debt collectors. These are the companies that want you to pay the money you owe. You can dispute medical bills if you think there is some error otherwise, they will keep calling you multiple times, which will make you feel stressed every time.

The debt collector will keep reminding you through many channels such as he will send you emails, messages, and letters. They will try to reach you through different ways. There are certain rules under the Fair Debt Collection Practices Act about how they can communicate to you but they will keep trying all options available to get the money.

If you ignore their messages and calls, things will become worse. They can take you to court and then you may have to pay even more money. Some debt collectors like Medial Data Systems and Convergent Healthcare, are known for never easily giving up.

The main thing you need to be concerned over is that if you don’t pay your medical bills, the debt collectors will keep disturbing you till you pay the bill. If you think, something was mistakenly added to your medical bills then you can dispute the medical bill. The most viable option is to talk to them and plan to pay what you owe, even in installments. That way, you will be stress-free, and nobody will call you all the time or take you to court.

Penalty Charges Are Now in Effect

Not paying your medical bills on time can quickly lead to untold financial sorrow as the amount you owe gets big. Collection agencies and doctors start to add late fees every time you miss a payment. This makes the total amount grow very fast. These late fees don’t just create anxiety and stress for you but strain your relations with your healthcare provider. If you don’t pay your bills doctors may not want to see you anymore which could jeopardize your health.

The best way to avoid medical bill disputes is to pay your bills at the right time and the right time is when you get them. If you can’t afford to pay the full amount, right away call the billing office to set up smaller payments you can handle. The key to stopping late fees from making your debt too big is to have a proactive conversation with the Medical Billing staff.

Ignoring medical bills leads to more debt, more fees, and more problems. By prioritizing those payments, you will save money and have access to good healthcare. A little effort ahead of time makes a great difference. It makes you stress and hassle-free without creating billing disputes.

Act Now to Safeguard Your Credit Score

Often people strive to learn how to dispute hospital bills particularly when they are confronted with a huge medical bill. If you avoid paying medical bills, the hospital may send it to a collection agency. It is important to prevent it from ending up in collections as the bill will appear in your credit report. It leaves negative impacts on your credit score.

A low credit score creates financial problems in your life. You may have to pay higher interest rates on mortgages, credit cards, and loans. When you rent, landlords may charge you more money. Some organizations may be interested to know about your financial track record through your credit score before they hire you.

Unpaid medical bills not only negatively impact your credit score but make your life expensive.

It creates a big financial problem if you don’t pay your medical bills. Paying your medical bills keeps your credit score good which is very important. If you have any reservations about medical bills, you should learn how to dispute doctor bills. On the other hand, if you face an affordability issue and can’t pay bills all at once, call the hospital and make a payment plan that you can afford. If you pay bills on time, it will keep your credit score good.

Safeguard Your Assets from a Lien

Your primary priority should be to pay the bills promptly when you receive services from a hospital or healthcare provider. If you fail to pay, the hospital or doctor may have the legal right to pursue legal action against you, including filing a lawsuit. You should also learn how to argue a medical bill to minimize the consequences of unpaid medical bills. But try to resolve the issue before it gets to that extreme point.

But one bad thing that should be avoided at all costs is ‘lien’. They can put a ‘lien’ on your things.

If you don’t pay the money to hospitals or doctors that you owe, they have the legal right to take your stuff.

If they put a lien on your car, house, or other valuable things, they can compel you to sell things to pay back the money you owe.

It has been rightly said, ‘no crack in the building is considered small’. It perfectly sits well with medical bills. Even if the bill is small, it can grow into a big problem. Collection companies apply largely tough means to get their money back. They will get permission from the court to take your stuff.

In the U.S., when people don’t pay their medical bills, companies such as Credence Resource Management often sue and levy their property.

Once there is a lien, limited options are left with you to borrow money or do other money things until pay your medical debt.

Ensure Your Assets Stay Protected After Your Death

Unpaid medical bills last longer, create big economic problems and don’t spare you even after you are dead. Unpaid bills don’t go away when pass away. Law authorizes your creditors to get paid for the things you leave behind. It means you leave less behind to give to your family and loved ones.

Paying off those old medical bills is a long process. Executors don’t give away what’s left of your assets until they pay off all your bills people ask for. Your family is already sad about losing you, they have to wait longer to get their share. Disputing a medical bill is one of the options, you can use if you identify any error in the procedure.

Some companies such as ARS National Services and Nationwide Recovery Systems are really efficient at asking for money to cover medical bills. This reflects the sensitivity and importance of paying your medical bills when you are still alive. If you don’t, you put your legacy at stake, a big part of your assets that you want to leave for your loved ones as a legacy might have to be given away to pay off your old unpaid bills instead.

How Do You Dispute a Medical Bill?

A dispute meaning in Medical Billing is a disagreement between a healthcare professional or hospital and a patient or their family about the outcome of healthcare services. Do you have any idea as to how to dispute a medical bill or how to dispute hospital billing?

If you receive a balance bill or believe you were overcharged on a medical bill, follow the steps below for contesting medical bills:

Secure an itemized medical bill to spot and dispute potential errors:

Ask the hospital or healthcare provider for an itemized bill with all billing codes listed. Because 80% of medical bills contain mistakes, you may find incorrect or duplicate charges.

Ask To See the Contract:

You have no legal obligation to pay if there is no written agreement. If debt collectors are asking for payment for an unfair bill, ask them to provide you with the contractual agreement, obligating you to pay.

Check the Accuracy of the Hospital’s Posted Prices

Use our hospital price files finder to confirm if you were correctly charged. If you find that you were not correctly charged, write or call your hospital and dispute the bill.

Compare Prices to Negotiate

Save screenshots of the prices of nearby hospitals, and compare prices at Clear Health Costs and Healthcare Bluebooks.

For surgical procedures, you can also make a comparison of prices at Texas Free Market Surgery and the Surgery Center of Oklahoma. You can use these prices for negotiations.

FAQs

How do I dispute a medical bill?

To dispute a medical bill, request an itemized breakdown to identify errors or overcharges. Contact the provider or your insurance company to challenge the charges and seek a resolution.

What can you do about unethical Medical Billing practices?

Report unethical Medical Billing practices to your provider, dispute inaccuracies on your medical bill, and file a complaint with your state’s health department or insurance commissioner.

How can I dispute a hospital bill?

Request an itemized hospital bill, review it for errors, and contact the billing department or your insurance provider to dispute incorrect charges.

How do you argue medical bills?

Request an itemized hospital bill, review it for errors, and contact the billing department or your insurance provider to dispute incorrect charges.

How to Contest a Medical Bill?

To contest a medical bill, request an itemized statement, review for errors, and contact the billing department or insurer to dispute inaccuracies.

How does Pro Medical Billing Solutions simplify the process of addressing and settling unpaid medical bills?

Pro Medical Billing Solutions simplifies the process by identifying billing errors, negotiating with providers, and assisting with payment plans or claim disputes to resolve unpaid medical bills efficiently.