In medical billing, entity role codes serve as critical identifiers that tell payers exactly who is involved in a claim whether that’s the rendering provider, a billing company, a hospital, or another organization. Without the right code, even perfectly documented services can face denials, delayed payments, or misdirected reimbursements.

It is typically a short alphanumeric value, often paired with other identifiers like the NPI or Tax ID, to ensure the claim is routed correctly. These codes appear in electronic claim transactions (such as X12 EDI formats) and help distinguish between multiple stakeholders in the billing process. For example, a claim may require separate entity role codes for the provider, the facility, and the payer.

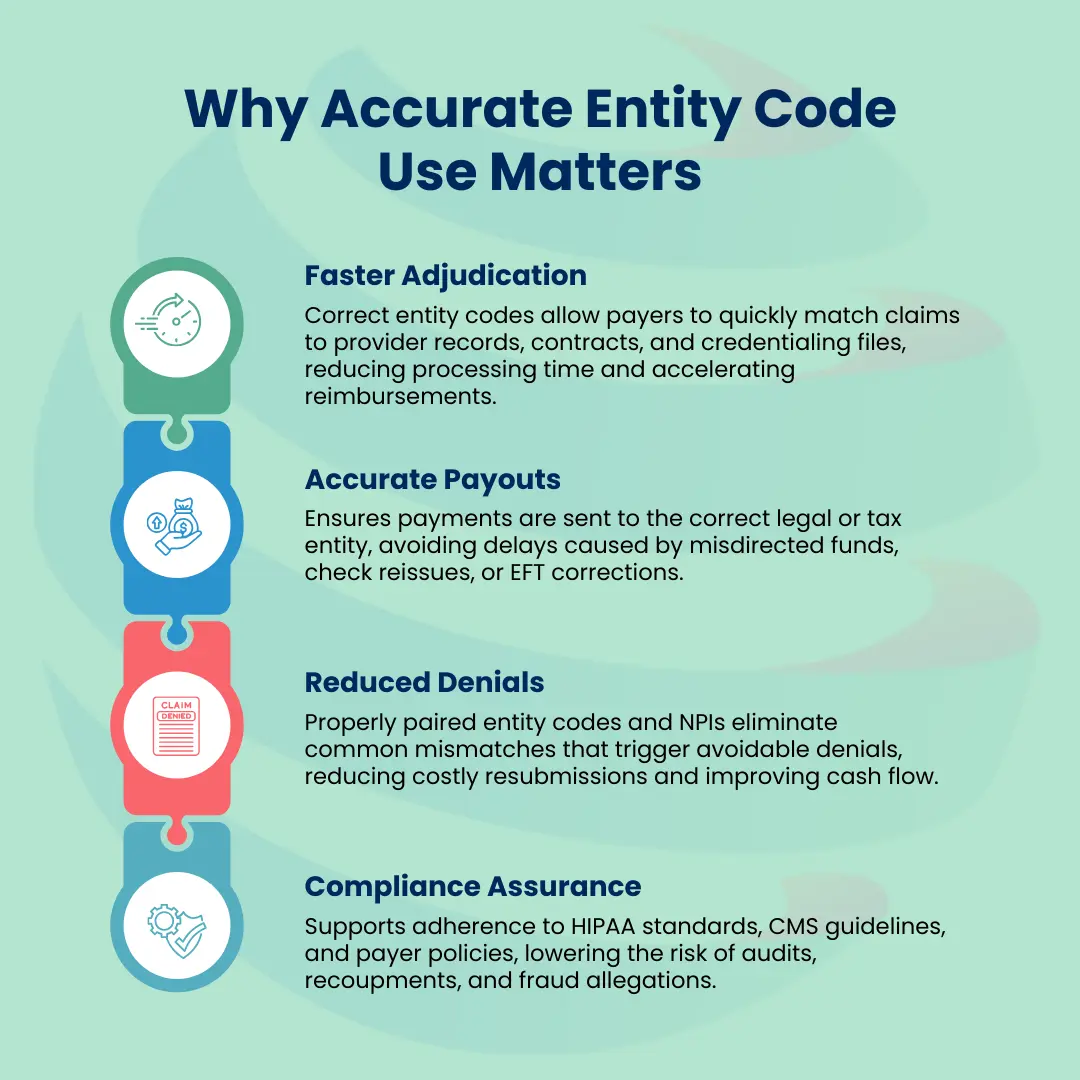

Accurate usage isn’t just a matter of data entry, it’s a compliance and revenue protection strategy. Assigning the wrong code can trigger automatic payer edits, while omitting a code can cause claim rejection before it’s even processed. For billing teams, coders, and healthcare organizations, mastering role identifier means faster adjudication, fewer denials, and a more reliable revenue cycle.

What is an entity code?

An entity code is a standardized, role-specific alphanumeric identifier used in electronic claim transactions to specify the type of entity being referenced. These codes, often two or three characters long (e.g., 1P for Provider, 1O for Hospital, 1I for PPO), are defined in transaction standards such as the HIPAA-mandated ANSI X12 837 format. It works alongside other identifiers like the National Provider Identifier (NPI) or Tax Identification Number (TIN) to ensure the claim is accurately routed and adjudicated.

Role identifiers are embedded within specific claim segments such as the NM1 (Individual or Organizational Name) segment in the X12 EDI format and inform the payer’s system about the role and nature of the party involved. Correct usage ensures that the right party is recognized for payment, prevents claim denials caused by misidentification, and supports compliance with payer and federal billing standards.

Common Types of Entity Identifiers

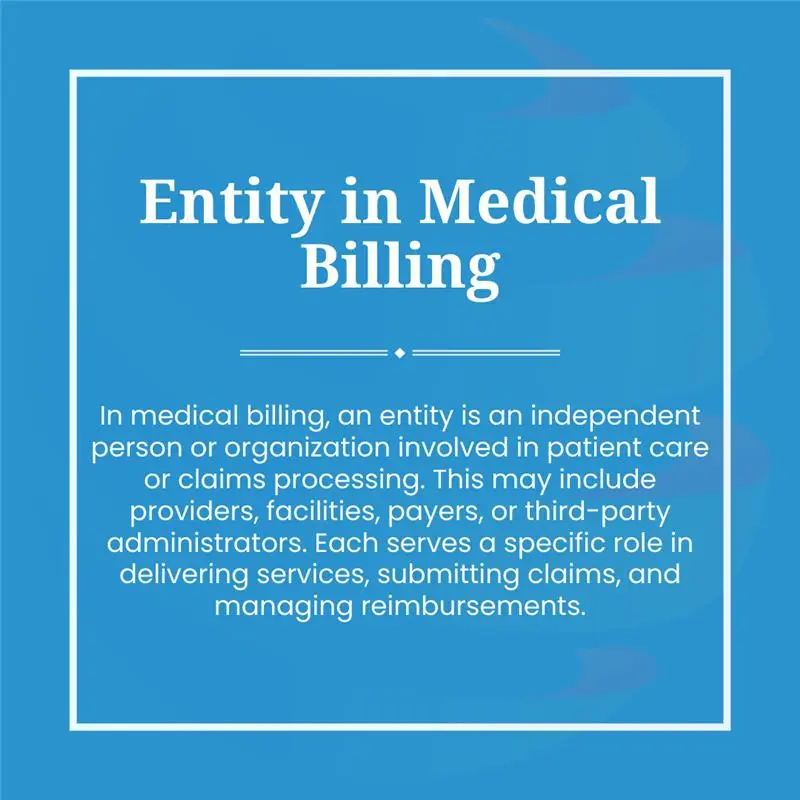

The term “entity identifier” in medical billing refers to any unique code or number used to specify a particular party’s role and identity in the healthcare claim process. These identifiers appear in electronic data interchange (EDI) transactions, most notably in the ANSI X12 837 claim format, which is mandated by HIPAA for standardizing electronic claim submissions. They help payers, clearinghouses, and billing systems distinguish between multiple parties on a claim such as the rendering provider, billing provider, facility, payer, and referring physician.

Here are the most common types:

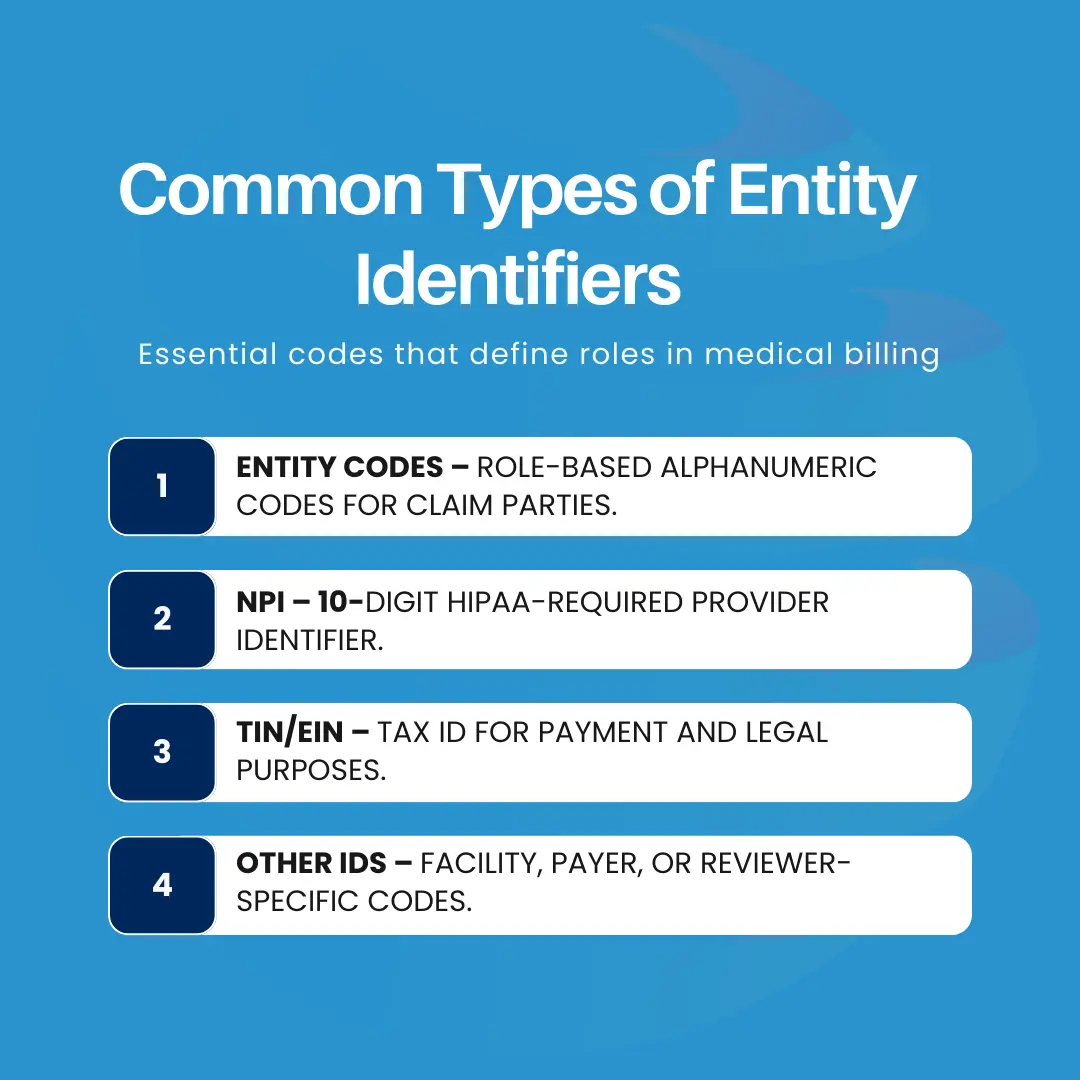

1. Entity Codes

These are role-based, two- or three-character alphanumeric codes that indicate the type of entity involved in the transaction.

Examples:

- 1P – Provider

- 1O – Acute Care Hospital

- 1I – Preferred Provider Organization (PPO)

- 1E – Health Maintenance Organization (HMO)

- Function: These codes are embedded in the NM101 segment of X12 837 files and are critical for ensuring that each party is recognized for its specific function in the claim lifecycle. Without the correct entity code, payer systems may misclassify the role, causing claim rejections or misrouted payments.

- Use Case: If a claim is being submitted by a billing company on behalf of a provider, the claim might include both 1P for the provider and 85 for the billing service.

2. NPI (National Provider Identifier)

The National Provider Identifier (NPI) is a 10-digit unique identifier assigned to healthcare providers in the United States by the Centers for Medicare & Medicaid Services (CMS).

- HIPAA Requirement: HIPAA mandates that all covered healthcare providers use their NPI in standard transactions, replacing legacy identifiers like UPIN and state-specific provider IDs.

- Types of NPIs:

- Type 1 NPI: Assigned to individual providers (e.g., physicians, nurse practitioners, therapists).

- Type 2 NPI: Assigned to organizational entities (e.g., group practices, hospitals, labs).

- Function: The NPI works alongside the entity code to validate the provider’s role and identity. For example, an entity code 1P (Provider) might be paired with a Type 1 NPI in the NM109 segment to confirm the rendering provider’s identity.

3. TIN/EIN (Tax Identification Number / Employer Identification Number)

- Function in Medical Billing:

- Identifies the billing party in financial and tax contexts.

- Required when payments are made to a business entity rather than an individual provider.

- Common Scenarios:

- Solo Practice: TIN may match the provider’s Social Security Number (SSN).

- Group Practice or Billing Company: TIN represents the organization rather than an individual.

4. Other IDs

Beyond these codes, NPIs, and TIN/EINs, various specialized identifiers may be required depending on the payer or healthcare environment.

- Examples:

- Facility Codes: Used to identify specific hospital locations, outpatient centers, or clinics.

- Payer IDs: Unique numeric or alphanumeric identifiers assigned by clearinghouses or insurers to route claims to the correct payer.

- Third-Party Reviewer Codes: Used when an external review organization is involved in prior authorizations or medical necessity determinations.

- Purpose: These IDs help ensure claims are routed correctly within multi-entity systems and can be critical for large integrated health networks or multi-payer environments.

Technical Takeaway:

Every claim often contains multiple entity identifiers working together, an entity code to describe the role, an NPI to specify the provider, a TIN/EIN to define the payment recipient, and possibly facility or payer IDs to handle specialized routing. Correctly pairing these ensures claims pass both syntactic validation (correct data format) and semantic validation (logical accuracy), reducing the risk of payer denials.

Purpose and Key Functions

Provider entity role codes are more than just role indicators, they do not replace other identifiers like the NPI, TIN, or facility IDs, but instead work in tandem with them to ensure accuracy, compliance, and efficiency throughout the revenue cycle. They determine how a claim is interpreted, routed, and ultimately paid. Below are the three primary functions explained in greater detail.

1. Claim Routing and Processing

Facility entity codes serve as precise routing instructions within electronic claim transactions (ANSI X12 837 formats). When a claim passes through a clearinghouse or directly to a payer, the role identifier embedded in the NM101 segment tells the system:

- Who is providing the service (e.g., rendering provider, facility, lab).

- Who is billing for the service (e.g., billing provider, group practice).

- Who should receive payment (e.g., same provider, contracted billing service, or healthcare organization).

If it is correct, the payer’s adjudication system can accurately match the claim to the provider contract, payment arrangement, and benefit plan. Incorrect codes can cause the claim to be misrouted to the wrong department or denied for “entity not recognized.”

2. Avoiding Denials

A mismatched or incorrect entity role code is one of the most preventable causes of claim denials. For example:

- If the referring provider code indicates a hospital (1O) but the NPI provided belongs to an individual provider (Type 1 NPI), the payer’s system flags an inconsistency and may reject the claim outright.

- If the billing provider’s entity code does not match the one on file with the payer’s provider directory, the claim could be denied for “invalid billing provider type.”

By using the correct entity codes, billing teams can prevent denials caused by:

- Role-to-NPI mismatches

- Contract or credentialing inconsistencies

- Payer system misinterpretations

3. Compliance and Auditing

Entity role code accuracy directly supports HIPAA compliance, payer policy adherence, and fraud prevention. In the event of an audit whether by CMS, a commercial payer, or an internal compliance team, role identifiers help establish:

- Who actually delivered the service

- Whether the billing entity was authorized to submit the claim

- Whether the payment was made to the correct legal entity

Accurate coding reduces the risk of being flagged for fraudulent billing practices, such as “upstream” billing (billing under an entity that didn’t perform the service) or “downstream” misrouting (sending payments to an ineligible entity).

Real-World Entity Code Examples

Facility entity codes are not arbitrary, they follow standardized definitions established in EDI transaction guidelines and payer-specific manuals. Systems like Medicaid’s eMedNY and the ANSI X12 837 claim format provide a clear framework for these codes, ensuring consistent interpretation across clearinghouses, payers, and billing systems.

These codes identify the role of each party in a claim, from the rendering provider to the billing organization or payer. Using the correct code is essential for accurate claim routing, preventing denials, and ensuring payments are issued to the appropriate entity. Below is a selection of commonly used codes drawn from eMedNY and other industry-standard references.

| Entity Code | Description |

|---|---|

| 1P | Provider |

| 1O | Acute Care Hospital |

| 1I* | PPO (Preferred Provider Organization) |

| 1E* | HMO (Health Maintenance Organization) |

| 1T | Physician, Clinic, or Group Practice |

| 1U | Long-Term Care Facility |

| 2B* | Third-Party Administrator (confirm with payer) |

| 28* | Subcontractor (confirm with payer) |

Note: Codes marked with an asterisk (*) such as 1I, 1E, 2B, and 28 may be payer-specific and are not part of the universal X12 837 referring provider code set in all implementations. Always confirm with the payer, clearinghouse, or Medicaid program guidelines before using these codes.

Common Errors and Denials

While referring provider codes are designed to streamline claim routing and processing, incorrect usage can cause immediate rejections or denials. Below are the most frequent mistakes encountered in medical billing systems.

Misassigned Entity Role Code

Assigning the wrong role code is a common cause of denials. For example, using 1P (Provider) when the billing entity is actually a 2B (Third-Party Administrator) sends the wrong signal to the payer’s adjudication system. Because the entity role determines how the claim is processed and who gets paid, an incorrect assignment can lead to instant rejection before the claim even reaches review.

In some cases, clearinghouses or practice management systems automatically populate role identifiers during claim generation. While this can speed up data entry, billers must always verify that the auto-populated code matches the provider’s role and NPI type as listed in the payer’s enrollment records to avoid mismatches and denials.

NPI vs. Facility Entity Codes Mismatch

An NPI must align with the designated referring provider code. If a Type 1 NPI (individual provider) is paired with an entity code meant for an organization such as a billing company or group practice, payers will flag the mismatch. This can occur when a rendering provider’s NPI is incorrectly paired with the billing provider’s entity code, resulting in “invalid provider type” errors or payment delays.

Example: A claim lists a referring provider with entity role code DN (Referring Provider) but pairs it with an NPI that belongs to a facility rather than an individual physician. Since most payers require referring providers to have a Type 1 NPI, this mismatch can lead to denials for “invalid referring provider type.”

Duplicate or Missing Codes

Claims with no entity role code or repeated codes fail validation in EDI processing.

- Syntactic validation failures occur when the code is missing in required claim segments (e.g., NM101 in X12 837).

- Semantic validation failures happen when duplicate codes create logical inconsistencies such as listing the same entity as both rendering and referring provider without a valid reason.

Properly assigning, verifying, and maintaining entity codes in claim templates prevents these avoidable rejections and preserves billing efficiency.

Best Practices & Prevention Strategies

Preventing entity role code-related denials requires a combination of system controls, procedural discipline, and ongoing staff training. The following strategies can help ensure consistent accuracy in claim submissions.

Maintain a Centralized Entity Code Registry

Create and maintain a version-controlled master table that links each provider’s or organization’s NPI, assigned entity code, and role type (e.g., rendering, billing, referring). This registry should be accessible to all billing staff and integrated with your practice management or claims software. Where possible, automate entity code population in claim forms to reduce manual entry errors.

Implement Software Validation

Leverage billing software or clearinghouse tools that automatically flag:

- Mismatched NPIs and entity codes

- Missing codes in required segments

- Role assignments that don’t align with payer rules

Running these validations before claim submission allows errors to be corrected proactively, preventing denials and resubmissions.

Conduct Regular Audits

Schedule monthly or quarterly audits to verify that all NPIs on file are paired with the correct entity codes, especially following:

- Staff changes

- Provider credentialing updates

- Organizational restructuring

Audits should include reviewing sample claims for alignment between NPIs, entity codes, and payer contract requirements.

Verify Against Payer Enrollment Records

Before submitting claims, confirm that each entity role code matches the role and NPI type listed in the payer’s provider directory or enrollment file. Mismatches between your system and payer enrollment data can trigger immediate rejections or “invalid provider type” denials. This is especially important after new provider enrollments, contract updates, or payer network changes.

Invest in Training & Documentation

Maintain clear, structured documentation outlining the use case and payer-specific rules for each entity code in your registry. Train all new hires on these standards during onboarding and provide refresher training whenever payer policies or transaction standards change. Well-trained staff are less likely to misassign codes, reducing operational risk.

Conclusion

Facility entity codes are more than simple administrative markers, they are the backbone of accurate claim routing, timely reimbursements, and compliance in medical billing. When applied correctly, they clearly identify every stakeholder in the billing process, from the rendering provider to the billing entity and payer, preventing misclassifications, minimizing denials, and avoiding coordination of benefits (COB) errors that can delay or misdirect payments between primary and secondary payers. This ensures smooth payment flows and preserves revenue integrity.

For billing teams, coders, and healthcare organizations, mastering entity role code usage is essential. It requires understanding each type of entity identifier and applying best practices like maintaining centralized registries, using automated validations, and conducting regular audits to ensure accuracy. In a high-scrutiny payer environment, accurate role identifier assignment safeguards revenue, supports strong payer relationships, and reinforces compliance at every stage of the revenue cycle.