Payer offsets and recoupments strategy have quietly become one of the most damaging and least understood sources of cash erosion for many healthcare organizations. According to a 2024 HFMA Revenue Integrity Report, over 32% of hospitals reported unanticipated offsets exceeding $500,000 annually, often discovered months after the payer withdrew funds. These transactions, masked as "routine adjustments," disrupt daily cash flow, distort AR reporting, and erode revenue visibility. The true pain point is that providers frequently have little to no warning, limited appeal windows, and insufficient internal controls to prevent or even detect these silent reversals.

The problem has intensified with post-payment audits and retrospective takebacks that sidestep transparency requirements. CMS Transmittal 12242 (2023) and OIG Advisory Opinion 21-04 both reinforce that payers must provide adequate notice and justification before recovery, yet in practice, enforcement is inconsistent. This blog provides a comprehensive payer offsets and recoupments strategy that helps providers protect their AR, decode payer communications, implement compliant appeal packets, and build KPI dashboards that convert hidden losses into actionable financial intelligence.

Identifying Common Causes of Payer Takebacks

Offsets and recoupments often originate from COB disputes, retrospective audits, or credentialing lapses, and each one represents a preventable cash drain. Understanding these triggers is the first step toward designing a resilient payer offsets and recoupments strategy that protects your AR from silent takebacks and noncompliant recoveries (CMS Transmittal 12242, 2023).

| Trigger | Description | Preventive Control |

|---|---|---|

| Coordination of Benefits (COB) | Payer claims another insurer should have paid first | Enforce real-time eligibility verification |

| Post-Payment Audits | Recovery initiated for "overpayments" | Require audit validation and 30-day notice compliance |

| Medical Necessity Denials | Retrospective denials lead to offsets | Use pre-bill clinical validation reviews |

| Provider Enrollment Errors | Invalid NPI or credentialing issues | Maintain automated NPI registry reconciliation |

Unilateral offsets, though often buried in payer contracts, can violate CMS guidance requiring advance notice and justification (CMS Manual Ch.3, §80.4.1). Building awareness of these triggers within your payer offsets and recoupments strategy empowers teams to respond early and decisively.

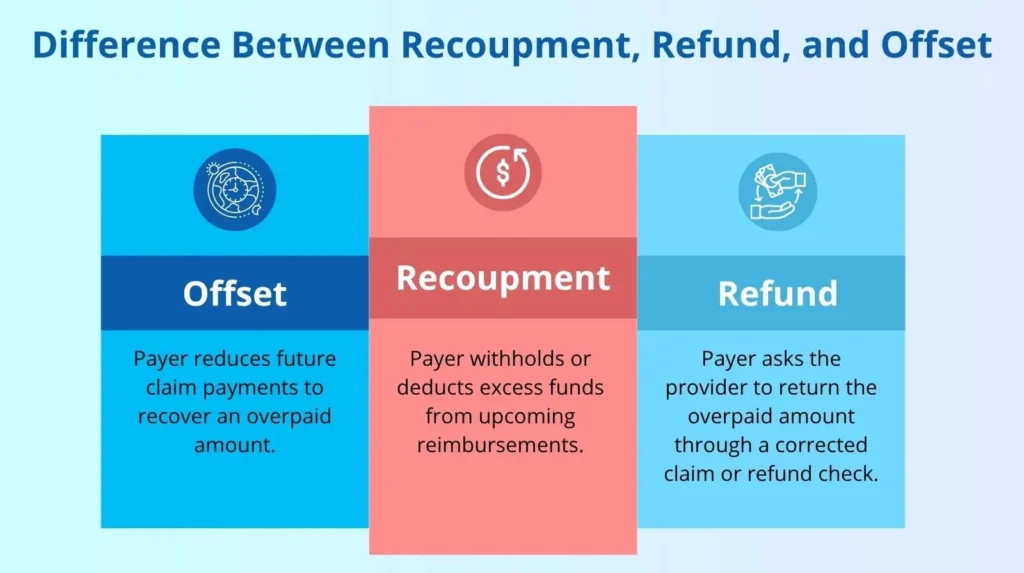

Difference Between Recoupment, Refunds, and Offset

Although the terms recoupment, refund, and offset payment adjustment might sound alike, each one means something different. All three are ways that insurance companies recover or balance overpayments made to healthcare providers.

Because they seem similar, many healthcare providers and even experienced RCM professionals often mix them up or use them as if they mean the same thing. In truth, each process works differently and must be managed in its own way to ensure accuracy and compliance.

How to Read EOB/EOR Data for Early Recoupment Detection?

The earliest signs of offsets or recoupments hide inside the Explanation of Benefits (EOB) or Explanation of Review (EOR). Unfortunately, payers frequently use vague or misleading language, such as "negative balance recovery" or "prior claim adjustment," that obscures their intent. A strong payer offsets and recoupments strategy depends on decoding these documents in real time. Discrepancies between paper EOBs and electronic remittance advice (ERA 835 PLB03-2 segments) often mask offsets spread across unrelated accounts, making reconciliation even harder.

Interpreting EOB/EOR in Payer Offsets Recoupments Strategy

Adjustment codes such as "OA-23" (Provider Payment Adjustments) and "CO-45" (Contractual Obligation) might appear harmless but often represent withdrawn payments. Monthly audits of PLB segments ensure every offset links back to its originating transaction, protecting AR integrity and appeal opportunities.

Legal Safeguards in a Payer Offsets Recoupments Strategy

According to OIG Advisory Opinion 21-04, recoupments without written notice may breach federal prompt-payment regulations. Documenting every payer communication is not just procedural, it is a legal safeguard. Within your payer offsets and recoupments strategy, compliance tracking should be embedded into every denial management workflow.

How to Build an Appeal Packet for Payer Offsets Recoupments Strategy?

Once a recoupment notice lands, time is limited. Most payers require appeals within 30 to 60 days, leaving little room for error. A standardized appeal packet ensures every dispute is documented, supported, and compliant.

Required Elements

Every payer appeal must be complete, compliant, and easy for the reviewer to validate. A well-organized packet does more than contest the recovery; it demonstrates procedural competence and compliance readiness. Each element below plays a critical role in strengthening your payer offsets and recoupments strategy.

Recoupment Notification Letter

This is your proof of payer intent and the foundation of your appeal timeline. It should include the date received, the payer’s reference or control number, the original claim identifiers, and the stated reason for recovery. The notification letter triggers your response clock under 42 CFR §405.379, making prompt documentation critical. Retain both electronic and physical copies and confirm delivery timestamps through payer portals or clearinghouse correspondence logs.

EOB/EOR Copy for a Payer Offsets Recoupments Strategy

Include a clear copy of the payer’s Explanation of Benefits (EOB) or Explanation of Review (EOR), highlighting the specific offset or recoupment transaction. The goal is to show precisely where the payer applied the adjustment, including adjustment reason codes and PLB (Provider-Level Balance) details from the 835 remittance. Annotate the page or attach a short summary table that connects each offset to the corresponding claim number and patient encounter. This step eliminates ambiguity and supports traceability, as required under CMS Manual Ch.3, §80.4.1.

Supporting Documentation

Attach every clinical and administrative record that validates the legitimacy of the original claim. This may include itemized bills, operative reports, treatment authorizations, discharge summaries, and any prior authorization approvals. The documentation should be organized by claim, using bookmarks or separators for efficient payer review. According to OIG Advisory Opinion 21-04, clearly indexed evidence strengthens appeal credibility and reduces denial reversal time.

Financial Summary

Provide a one-page summary that traces payment from issuance to reversal. Include transaction dates, payment identifiers, and total amounts recouped. Where possible, use your remittance or ledger report to reconcile the recouped funds to the specific bank deposit or EFT record. This financial clarity reinforces the audit trail and demonstrates that your organization maintains compliance with HFMA MAP Key RCM-21 (2022) on traceable payment reconciliation.

Regulatory Citations in a Payer Offsets Recoupments Strategy

Did You Know? Each of these components can transform your appeal packet from a reactive submission into a structured compliance instrument. When every document, citation, and financial trace aligns, your appeal becomes a regulatory defense backed by federal standards. According to CMS Transmittal 12242 (2023) and HFMA MAP Key RCM-21 (2022), providers that maintain documented, traceable offset appeals demonstrate higher compliance accuracy and stronger audit outcomes. A complete and well-documented appeal not only safeguards individual payments but also strengthens your overall payer offsets and recoupments strategy, ensuring financial integrity and regulatory readiness across your entire revenue cycle.

How Should You Manage Offsets in the Ledger to Ensure Compliance?

Key Posting Controls

| Control | Purpose | Frequency |

|---|---|---|

| Offset GL Code | Segregates recovery activity for audit tracking | Daily |

| Payment Reversal Log | Matches recouped funds to originating claims | Weekly |

| Suspense Account Validation | Ensures unmatched offsets do not inflate AR | Monthly |

According to HFMA MAP Key RCM-21 (2022), offsets must be separately coded and traceable across accounting periods. Without segregation, organizations risk misrepresenting both payer performance and financial health, a major flaw in AR reporting.

Cross-Department Impact

How Can KPI Dashboards Strengthen Recoupment Oversight?

Core KPIs

Offset Volume Rate: Measures the percentage of total payments impacted by payer offsets over a defined period. A higher rate often signals increased payer audits or internal billing errors that trigger recoveries. Monitoring this KPI helps revenue teams identify payer behavior trends and assess operational weaknesses that cause recurring offsets. According to HFMA MAP Key RCM-21 (2022), maintaining this rate below 2% of total payments supports healthy AR performance and compliance control.

Average Recoupment Lag: Tracks the number of days between a payer’s notice of recoupment and the actual fund withdrawal. This KPI gauges both payer compliance and staff responsiveness. A short lag may indicate premature recoveries that violate CMS Transmittal 12242 (2023), while a long lag can reveal internal posting or tracking delays. The goal is to maintain a lag of 15 to 30 days, giving teams time to validate and appeal recoveries before funds are withdrawn.

Appeal Success Rate: Measures how effectively the organization overturns payer recoupments through the appeals process. A high success rate reflects strong documentation, timely submission, and consistent use of regulatory citations such as 42 CFR §405.379(b). The HFMA 2024 Benchmark Report found that organizations with standardized templates and automated appeal workflows achieve success rates above 60%, making this a vital metric for evaluating appeal process efficiency.

Net Cash Impact: Quantifies the financial outcome of payer offsets by comparing recouped amounts with funds recovered through appeals. This KPI provides a clear picture of how payer actions affect cash flow and bottom-line performance. According to the HFMA 2024 Benchmark Report, organizations that actively track this metric recover up to 28% more contested revenue. For instance, if $400,000 is recouped and $125,000 is reversed through appeals, that 31% recovery rate reflects effective financial and compliance controls.

Dashboards built in Power BI or Tableau connect PLB-level data to payer-specific trends, offering real-time visibility into recoupment activity and financial exposure. These tools merge offset and denial analytics to identify patterns, track payer behavior, and forecast future recoupment risks. For example, Aetna’s Q1 2024 Audit Report showed a 23% rise in retrospective recoupments, reinforcing the need for proactive monitoring. Predictive modeling within these dashboards highlights high-risk areas such as behavioral health, cardiology, and radiology, enabling leaders to allocate resources, strengthen pre-bill validation, and prevent revenue loss before it occurs.

How Can a Structured Framework Safeguard AR Integrity?

Protecting your accounts receivable (AR) from payer recoupments requires more than reactive fixes. It demands a structured, automated, and proactive framework that aligns compliance, revenue integrity, and finance teams. A solid payer offsets and recoupments strategy not only prevents revenue leakage but also strengthens audit readiness and payer accountability.

Steps for Implementation

Automate PLB Monitoring: Automation is the backbone of recoupment prevention. By monitoring Provider-Level Balance (PLB) adjustments in real time, organizations can detect offsets the moment they occur. Tools integrated with the ERA 835 feed help identify unauthorized recoveries instantly. According to HFMA MAP Key RCM-21 (2022), automated PLB monitoring reduces reconciliation errors by over 40% and prevents revenue distortion in financial reports.

Centralize Audit Responses: A single, centralized platform for all payer audits and recoupment notifications eliminates missed deadlines and fragmented communication. Systems such as Epic RCM, Artiva HCx, or SSI Claims allow teams to track appeal status, attach evidence, and manage compliance timelines efficiently. Centralization transforms a scattered response process into a streamlined compliance workflow, a best practice in any payer offsets and recoupments strategy.

Apply Escalation Thresholds: Not every offset requires the same response. Create escalation rules that automatically flag large or high-risk recoveries for compliance review. For example, any offset exceeding $500 should pause posting until management approval is obtained. This ensures due diligence and prevents unauthorized payer adjustments. Following 42 CFR §405.379(b), escalation rules safeguard providers’ rights to dispute improper recoveries.

Standardize Appeal Templates: Consistency drives results. Pre-approved, payer-specific appeal templates ensure every recoupment challenge includes the required documentation, financial summaries, and regulatory citations. Templates should reference CMS Transmittal 12242 (2023) and relevant state insurance codes to strengthen legal validity. Standardized templates reduce appeal turnaround time and increase reversal rates, according to OIG Advisory Opinion 21-04.

Conduct Quarterly Staff Training: Knowledge is protection. Regular training keeps your staff updated on payer behaviors, audit tactics, and code-level changes. Sessions should cover ERA analysis, EOB interpretation, and compliance documentation standards. Consistent training reinforces procedural accuracy and enhances internal readiness for payer reviews or financial audits.

Why Is This Critical for AR Protection?

According to the HFMA 2024 Benchmark Report, hospitals that implemented structured offset controls reduced untracked recoupments by 35% within three months. These improvements not only preserved millions in recoverable revenue but also reduced AR aging and enhanced audit transparency.

Implementing a tactical defense framework makes your payer offsets and recoupments strategy proactive instead of reactive. With automated detection, centralized workflows, and continuous staff readiness, organizations can stop offsets before they impact cash flow, maintain compliance with CMS and OIG standards, and secure the integrity of every earned dollar.

Partner with ProMBS to Strengthen Your Payer Offsets Recoupments Strategy

Managing payer offsets requires more than appeals. It calls for consistent RCM workflows, accurate medical billing and coding, and vigilant denial management. ProMBS works alongside your team to build compliant processes that detect offsets early, standardize appeal packets, and track KPIs for full AR visibility.

We help providers achieve a 98% clean claim rate, drive up to a 30% revenue increase, secure 3× faster payments, and recover 120+ days AR, strengthening their payer offsets recoupments strategy.

With our experience in end-to-end revenue cycle management, we help providers reduce preventable denials, improve claim accuracy, and recover revenue that would otherwise be lost to offsets. Schedule a consultation to see how we can support your practice in turning offset challenges into measurable financial stability.

FAQs

Can a provider dispute an offset in medical billing?

Yes, a provider can dispute an offset if they believe the payer applied it incorrectly or violated contractual or compliance terms. A strong payer offsets and recoupments strategy includes submitting a formal appeal packet with remittance details, EOB copies, and regulatory citations such as CMS Transmittal 12242 or 42 CFR §405.379(b) to challenge improper recoveries.

How is an offset different from a refund?

An offset occurs when a payer recovers overpaid funds by deducting the amount from future reimbursements. A refund, on the other hand, happens when the provider identifies or acknowledges the overpayment and sends the money back to the payer directly, often through a check or electronic transfer.

What is cross-plan offsetting in medical billing?

Cross-plan offsetting happens when a payer recovers an overpayment from one insurance plan by deducting it from payments owed under another plan. This practice is often disputed because it may violate ERISA and CMS rules requiring recoveries to stay within the same plan.

What if you cannot refund the entire overpayment amount at one time?

If your practice is facing a financial challenge, you can request an Extended Repayment Schedule (ERS) as part of your payer offsets and recoupments strategy. This option allows providers to repay the overpayment in monthly installments instead of a single lump-sum payment, helping reduce financial strain while maintaining compliance with CMS recovery guidelines.

What happens if I have multiple overpayment problems?

If your practice experiences multiple overpayment issues, payers may initiate detailed post-payment audits or recoupment reviews. Insurance companies use internal audit teams to detect patterns of delayed refunds or repeated overpayments, which may raise compliance concerns. Ignoring refund requests can lead to payer offsets and recoupments, closer scrutiny, or even legal action. Maintaining a proactive payer offsets and recoupments strategy that includes timely responses, refund tracking, and accurate documentation helps safeguard your revenue and compliance.